- Canada

- /

- Metals and Mining

- /

- TSX:AG

Does First Majestic Silver’s (TSX:AG) Record Output Reveal Limits of Beating Analyst Expectations?

Reviewed by Sasha Jovanovic

- First Majestic Silver Corp. recently announced record third-quarter results, reporting a very large year-over-year surge in both silver production and revenue, largely attributed to the Los Gatos Mine acquisition and operational gains across its portfolio.

- An interesting observation is that despite these quarter records in production and sales, the company missed analyst expectations for both earnings and revenue, underscoring the high bar set by market forecasts.

- We'll explore how missing financial forecasts amid record production shapes the outlook for First Majestic Silver’s investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

First Majestic Silver Investment Narrative Recap

For investors in First Majestic Silver, the core thesis centers on sustained growth in silver production, operational scale, and the ability to convert new capacity, such as the Los Gatos Mine, into higher revenues and cash flow. The recent record-setting quarter confirms the company's progress toward these goals but does not materially shift the short-term catalyst, which remains the pursuit of margin expansion through production efficiency. The biggest risk, persistent cost escalation at key Mexican assets, is still relevant as cost controls will be continually tested.

Amid several company updates, the most relevant recent announcement is the major increase in the quarterly dividend, now at US$0.0052 per share. While modest in size, the increased payout does highlight the company’s confidence in cash generation, which closely ties back to its core production and operational catalysts.

In contrast, investors should be alert to ongoing region-specific risks in Mexico, including regulatory and cost pressures that could...

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's narrative projects $1.2 billion revenue and $94.0 million earnings by 2028. This requires 12.2% yearly revenue growth and a $79.3 million increase in earnings from $14.7 million today.

Uncover how First Majestic Silver's forecasts yield a CA$22.50 fair value, a 40% upside to its current price.

Exploring Other Perspectives

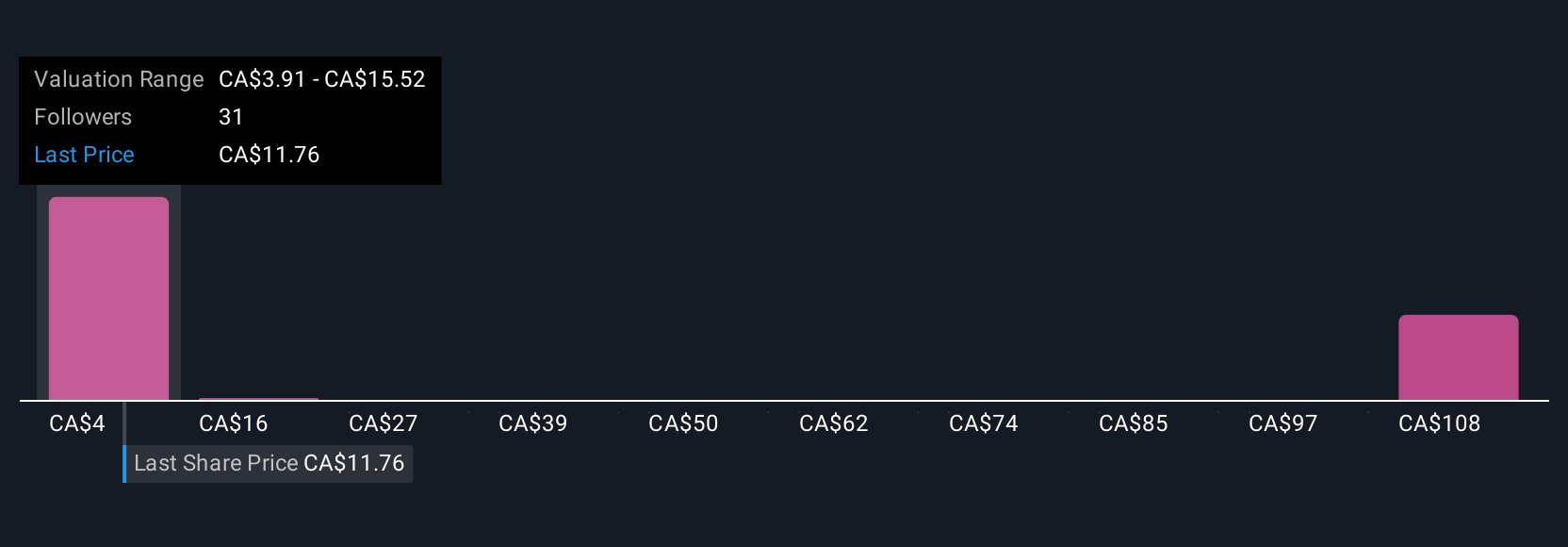

Simply Wall St Community members provided 10 fair value estimates for First Majestic Silver between US$3.91 and US$43.55 per share. While production surged last quarter, the company’s exposure to rising operational expenses continues to shape debates on future earnings and cash flow strength.

Explore 10 other fair value estimates on First Majestic Silver - why the stock might be worth over 2x more than the current price!

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives