- Canada

- /

- Metals and Mining

- /

- TSX:AG

A Look at First Majestic Silver (TSX:AG) Valuation Following Record Production and Analyst Forecast Misses

Reviewed by Simply Wall St

First Majestic Silver (TSX:AG) just posted record silver production for the third quarter, nearly doubling its revenue compared to last year. This growth was driven by the Los Gatos Silver Mine and higher realized silver prices.

See our latest analysis for First Majestic Silver.

Even with headline-grabbing record production and revenue for the quarter, First Majestic Silver’s shares have seen sharp swings lately, reflecting a tug-of-war between optimism over operational success and caution after missing earnings forecasts. After soaring more than 86% year-to-date, the stock quickly gave back ground with a 13.7% one-month price drop, though its 90-day share price return remains a robust 30%. Over the longer run, total shareholder returns have generally kept pace, painting a picture of building momentum while still suggesting plenty of volatility as investors react to both the gains and persistent uncertainties around court disputes and future outlook.

If strong mining results have you searching for your next opportunity, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

Yet with analysts split on the future, investors are left to weigh whether First Majestic Silver’s recent pullback signals a bargain in an undervalued stock, or if the market is already factoring in the company’s future growth potential.

Most Popular Narrative: 28.8% Undervalued

First Majestic Silver's most followed narrative highlights a sizeable gap between its fair value and the latest closing price, suggesting that current optimism in the market may not fully reflect all value drivers. With the market price falling well below the narrative fair value, there is a clear debate unfolding about the company's potential.

Substantial ongoing investment in exploration (for example, 255,000 meters drilled, addition of drilling rigs, and development of large new ore bodies like Navidad and Santo Niño) is expected to extend reserve life, increase production capacity, and drive long-term revenue and cash flow growth.

Want to know what’s fueling this valuation call? The key factors are aggressive expansion bets, bold profit margin projections, and analyst models that reach well beyond today’s numbers. Which pivotal factors tip the scales for this price target, and do they align with your view of the future? Explore the narrative for the financial roadmap behind the headline fair value.

Result: Fair Value of $22.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or setbacks at key mines could quickly undermine these bullish growth projections. This highlights the need for caution.

Find out about the key risks to this First Majestic Silver narrative.

Another Perspective: Market Multiples Paint a Different Picture

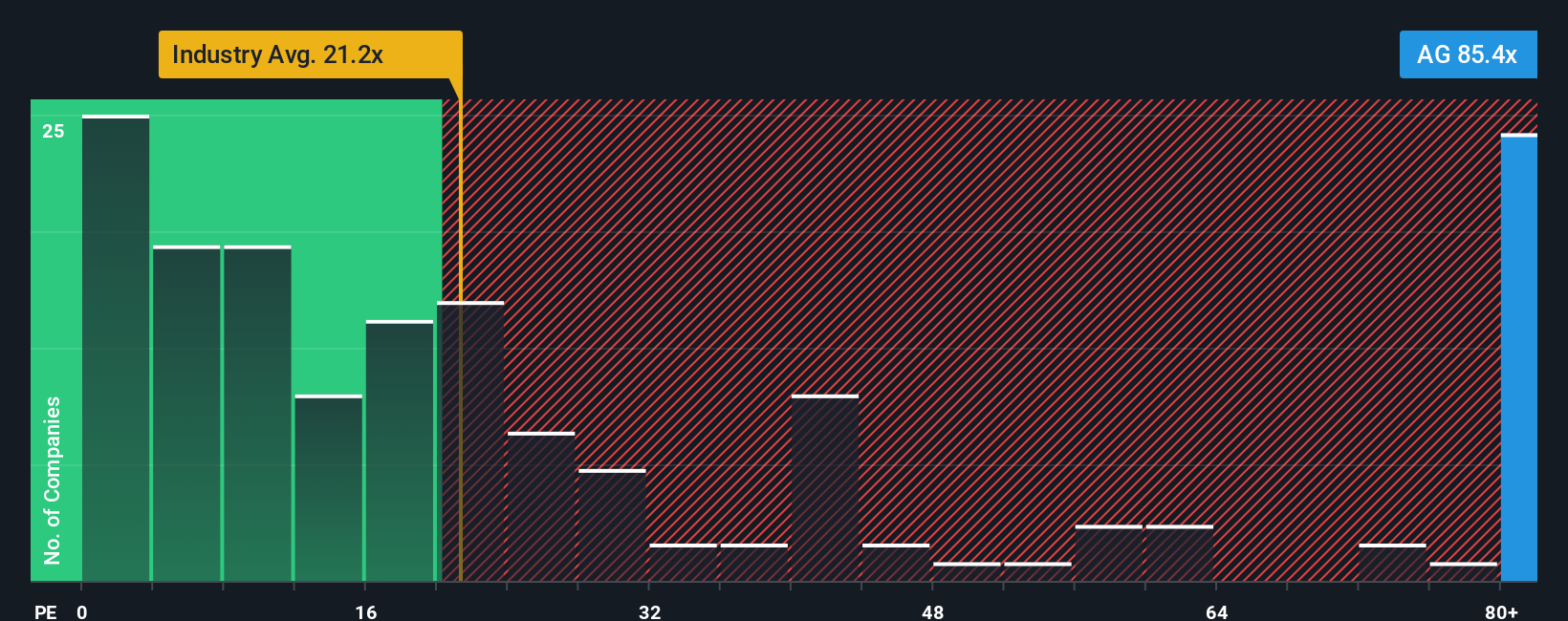

Looking through the lens of earnings ratios, First Majestic Silver trades at a steep 82.1x earnings, which is far above both the Canadian Metals and Mining industry average of 20.7x and the peer average of 36.9x. Its fair ratio is calculated to be just 27.6x, suggesting the market is assigning a premium that could signal risk if future growth does not meet high expectations. Does the current price tag reflect real value or is optimism running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Majestic Silver Narrative

If you see things differently or want to chart your own course, you can easily assemble and share your own view in just a few minutes. Do it your way

A great starting point for your First Majestic Silver research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The smartest investors constantly hunt for new themes and winning companies before the crowd catches on. Let Simply Wall Street's screener help you spot tomorrow’s leaders today, tailored to exactly what matters to you.

- Start earning more from your portfolio with these 16 dividend stocks with yields > 3% which offers attractive yields and stable payouts.

- Uncover hidden gems seizing massive market opportunities with these 25 AI penny stocks that power the next technology breakthroughs in artificial intelligence.

- Get ahead of the curve by tapping into these 883 undervalued stocks based on cash flows stocks that are poised for long-term growth based on solid fundamentals and strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives