- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Barrick Gold (TSX:ABX): Exploring the Latest Valuation After Strong Share Price Gains

Reviewed by Simply Wall St

Barrick Mining (TSX:ABX) shares have alternated between modest gains and declines over the past month, but recent investor interest suggests shifting sentiment. The company’s combination of steady earnings growth and exposure to commodity prices continues to draw attention.

See our latest analysis for Barrick Mining.

Barrick Mining’s share price momentum has picked up notably, with a strong 44.1% share price return in the past 90 days and an impressive 101.8% gain year-to-date. In addition, investors have enjoyed an 84.4% total shareholder return over the last year, building on substantial medium and long-term outperformance. The stock’s recent uptick seems driven by optimism around earnings growth and renewed confidence in the sector rather than short-term speculation.

If Barrick’s run has you rethinking your portfolio, this might be the perfect opportunity to broaden your radar and discover fast growing stocks with high insider ownership

Given Barrick Mining’s stellar run this year and ongoing earnings growth, the key question now is whether the current price reflects all the good news or if there is still a buying opportunity for investors.

Most Popular Narrative: 22.6% Undervalued

At CA$46.44, Barrick Mining’s share price stands noticeably below what the narrative sees as fair value. The current setup hints at more upside, especially as investors weigh global macro risks and gold’s safe-haven appeal.

With its shares trading at CAD 48.07, the company appears undervalued relative to fair value estimates, offering a potential buffer in volatile weeks ahead.

Curious what’s driving this significantly higher valuation? The narrative’s fair value is built on expectations of steady earnings momentum and a unique mix of commodity upside, along with a surprising twist on industry profit margins. Can Barrick keep this pace up and match the projections? Unpack the extraordinary logic and numbers behind this estimate inside the full narrative.

Result: Fair Value of $60.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a swift U.S. fiscal resolution or a sudden drop in gold prices could quickly undermine Barrick’s perceived undervaluation.

Find out about the key risks to this Barrick Mining narrative.

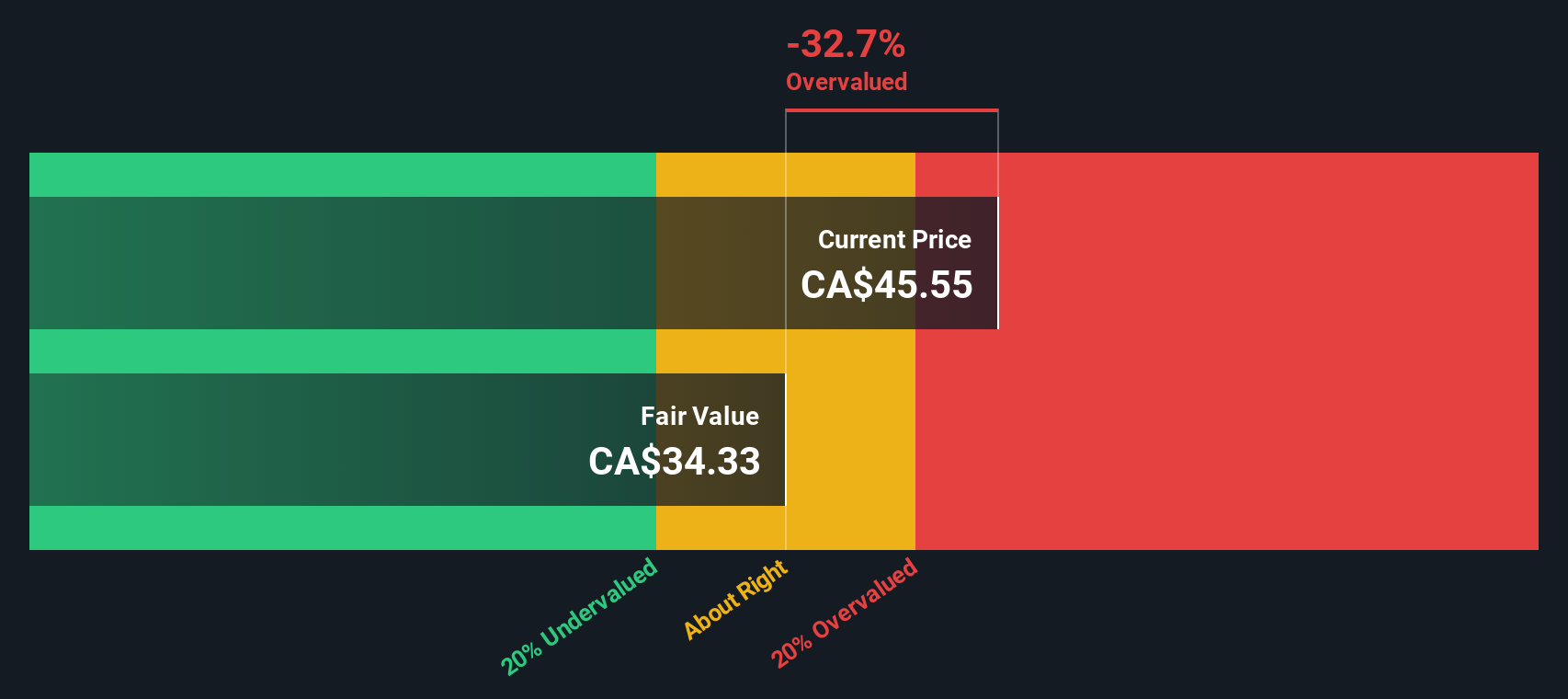

Another View: Discounted Cash Flow Perspective

While the narrative points to Barrick Mining being undervalued, our DCF model offers a more conservative check of fair value. According to this approach, Barrick may actually be trading above its estimated intrinsic value. This challenges the current upbeat outlook and raises questions about whether the narrative is too optimistic or if the market is overlooking hidden potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barrick Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barrick Mining Narrative

If the analysis above doesn’t sit right with you or you prefer to chart your own path, you can use our platform to build and share your unique story in just a few minutes. Do it your way

A great starting point for your Barrick Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The market is full of exciting opportunities, so don’t limit yourself to just one stock. Unlock smarter possibilities that could transform your portfolio today.

- Tap into the strongest cash flow opportunities and target significant value by checking out these 870 undervalued stocks based on cash flows poised for potential upside.

- Benefit from recurring income and financial resilience by starting with these 16 dividend stocks with yields > 3% offering attractive yields and healthy fundamentals.

- Stay ahead of technology trends by focusing on these 24 AI penny stocks set to shape tomorrow’s innovation landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives