Sun Life (TSX:SLF) Valuation: Is There More Upside After Recent Modest Share Price Move?

Reviewed by Simply Wall St

Sun Life Financial (TSX:SLF) shares have edged up slightly this week, moving about 0.4%. Investors are weighing the company’s performance and recent momentum as they try to assess what might lie ahead for the stock’s valuation.

See our latest analysis for Sun Life Financial.

While Sun Life Financial’s share price saw only a mild uptick recently, momentum has generally softened since the start of the year. Still, long-term total shareholder returns tell a different story. There has been a 50% gain over three years and an impressive 72% over five. This suggests that patient investors have been rewarded even through short-term dips.

If you’re curious to expand your search and spot fresh opportunities, this is a perfect moment to discover fast growing stocks with high insider ownership

With shares treading water recently but analysts seeing potential upside, the key question now is whether Sun Life Financial’s stock is undervalued or if the market already reflects the company’s future earnings power.

Most Popular Narrative: 9% Undervalued

Sun Life Financial's most followed narrative suggests a fair value that is notably higher than its recent closing price of CA$82.77. This sets the stage for a fresh debate on where shares could be headed next.

Ongoing investment in digital initiatives, such as generative AI tools, straight-through processing, and real-time underwriting, is improving operational efficiency and customer experience, supporting margin expansion and enabling scalable future growth.

Want to know what’s fueling this bullish outlook? Key hidden levers, like bold revenue and profit margin assumptions, drive the narrative’s higher fair value. What surprises are baked into their forecast? Unlock the real numbers behind these projections and explore why the market may not be seeing the full story.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing U.S. Dental challenges and persistent outflows in asset management could threaten Sun Life’s future earnings momentum and put pressure on its margin outlook.

Find out about the key risks to this Sun Life Financial narrative.

Another Perspective: Market Ratios Paint a Different Story

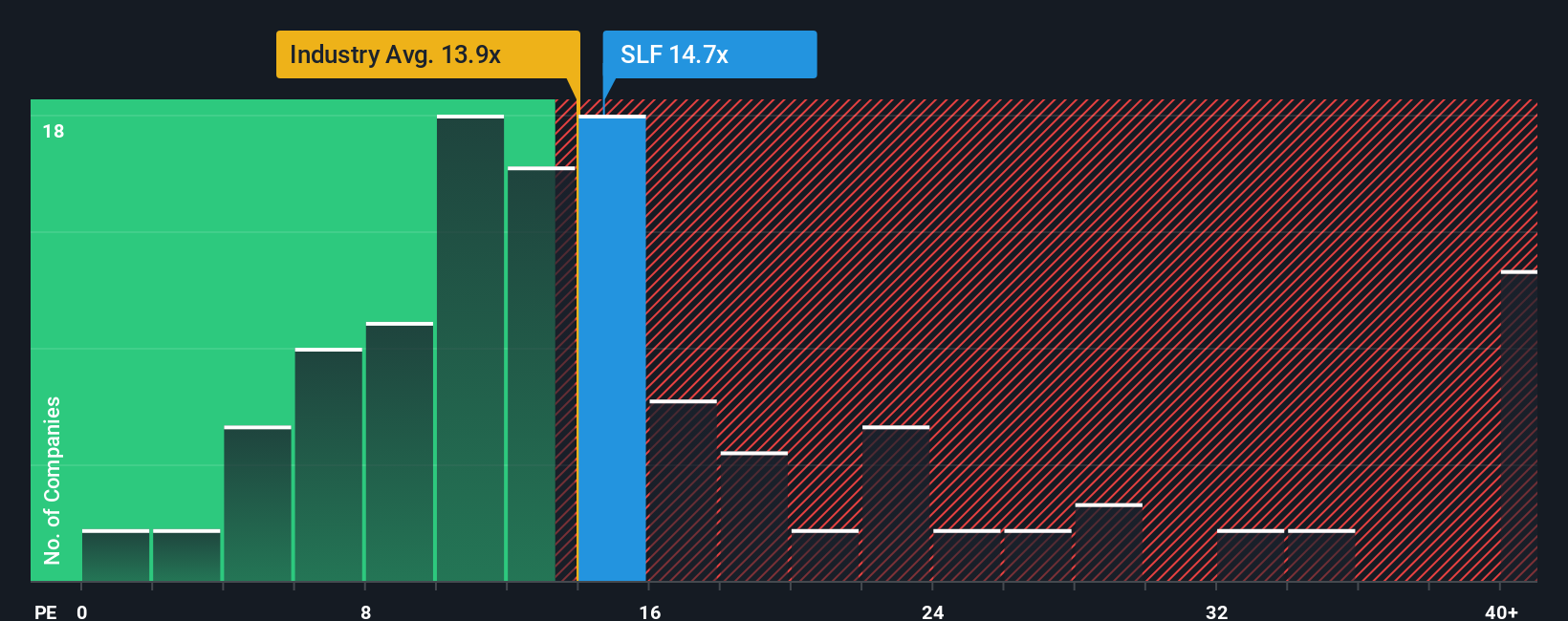

Looking at market valuation ratios, Sun Life Financial’s price-to-earnings sits at 15.4x, which is above the North American insurance industry’s average of 13.2x and higher than its peer group at 14.3x. Meanwhile, the market’s fair ratio for Sun Life is estimated at 15.9x. This means the current price is on the more expensive side, but investors are not paying a significant premium. Does this add risk, or is the market simply betting on Sun Life’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Life Financial Narrative

Keep in mind, if you see things differently or want a deeper dive into the numbers, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Sun Life Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity. Make smarter moves by using our unique screeners that surface hidden gems, high-yield opportunities, and future-focused leaders.

- Uncover income potential and tap into steady cash flow with these 16 dividend stocks with yields > 3% paying yields above 3%.

- Join the tech transformation and pursue growth alongside the innovators powering tomorrow’s breakthroughs by checking out these 26 AI penny stocks.

- Get ahead of the crowd and spot undervalued companies others may be missing by seizing your chance with these 917 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives