Sun Life (TSX:SLF) Expands Family Leave Coverage—How Does Its Valuation Stack Up After the Latest Move?

Reviewed by Simply Wall St

Sun Life Financial (TSX:SLF) is taking another step forward in the U.S. group benefits market by expanding its Family Leave Insurance to seven more states. With this move, Sun Life’s coverage now reaches 24 states and gives more employers access to flexible leave solutions.

See our latest analysis for Sun Life Financial.

The latest expansion of Sun Life’s Family Leave Insurance comes at a time when momentum in the stock has been gradually building. While the past week’s share price dipped by just under half a percent, Sun Life’s three-month share price return is in positive territory, and the 12.8% total shareholder return over the past year signals that investors are rewarding its steady progress and product innovation.

If Sun Life’s latest move has you thinking about what other companies are breaking new ground, now is an ideal moment to broaden your lens and explore fast growing stocks with high insider ownership

With Sun Life's latest expansion and strong momentum, investors may wonder if the stock is still trading at an attractive valuation or if the market has already fully factored in future growth potential. Could this be a buying opportunity?

Most Popular Narrative: 4% Undervalued

With Sun Life Financial trading at CA$86.50 against a narrative fair value of CA$90.14, the story suggests shares remain below the level analysts collectively view as justified. Momentum and optimism are building, but the details reveal the true engine behind this valuation.

Ongoing investment in digital initiatives, such as generative AI tools, straight-through processing, and real-time underwriting, is improving operational efficiency and customer experience. This supports margin expansion and enables scalable future growth.

What’s really powering analyst confidence? Hint: big expectations for digital efficiency, operating margins, and a bold new profit projection. Ready to see what bold financial leaps underpin this call? Dive into the surprising details inside the full narrative.

Result: Fair Value of $90.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds in the U.S. Dental business and ongoing challenges in asset management could temper Sun Life’s growth story if these issues are left unresolved.

Find out about the key risks to this Sun Life Financial narrative.

Another View: What Does the Market Multiple Say?

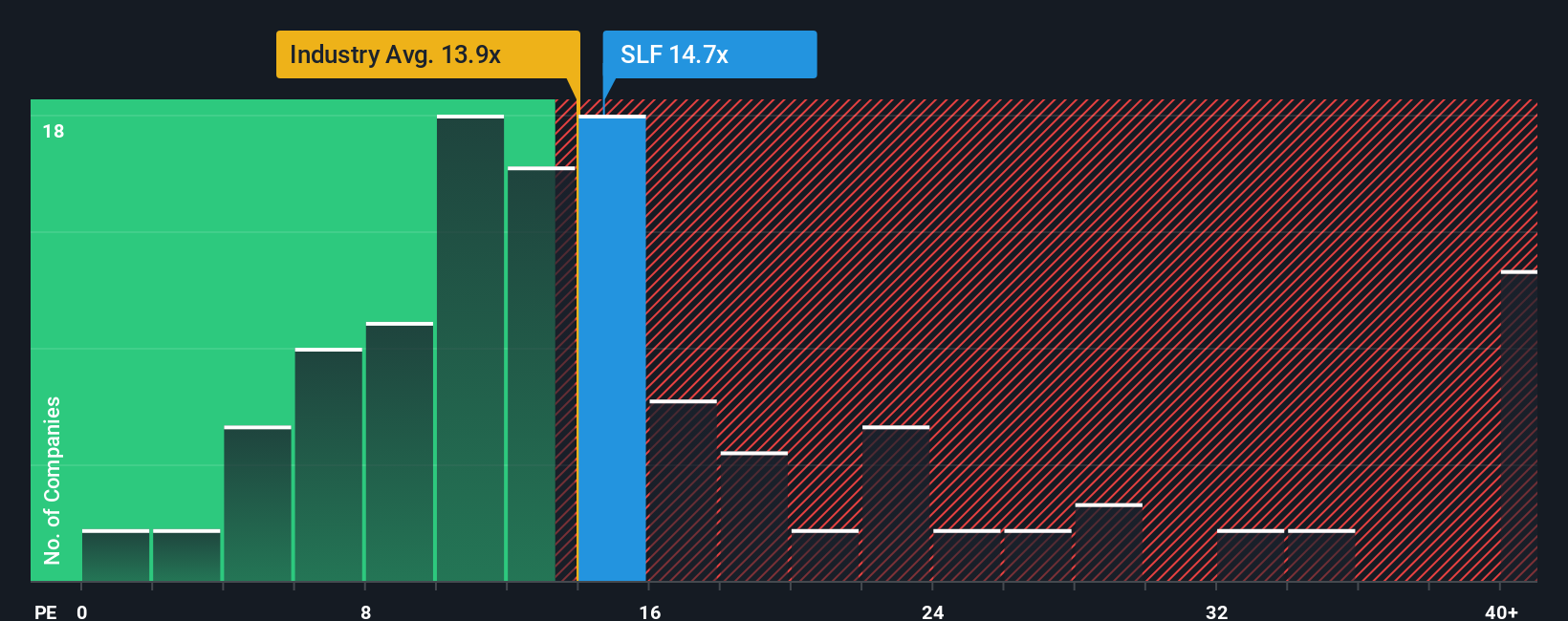

Taking a look through the lens of the price-to-earnings ratio reveals a different perspective. Sun Life is trading at 15 times earnings, which is higher than both its North American insurance peers (13.4x) and the fair ratio of 15.4x. This slim gap suggests the stock may be priced close to where the market believes it should be, with limited valuation risk or upside from re-rating. But are investors right to accept such a tight margin?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Life Financial Narrative

You don’t have to settle for consensus if you want to see the numbers for yourself. Uncover your own insights and build a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sun Life Financial.

Looking for More Investment Opportunities?

Don’t let promising investment ideas slip through your fingers. The right screener can help you spot opportunities you might otherwise miss. Move ahead of the crowd and make smarter choices today.

- Tap into rapid growth potential by accessing these 27 AI penny stocks to harness artificial intelligence, disrupt traditional industries, and unlock new revenue streams.

- Secure reliable income streams by checking out these 20 dividend stocks with yields > 3% for companies with generous yields above 3% and a track record of steady payouts.

- Get an edge on value investing by investigating these 844 undervalued stocks based on cash flows, which is packed with stocks currently trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives