Is Sun Life Financial Fairly Priced After Flat Performance and Recent Market Expansion News?

Reviewed by Bailey Pemberton

- Wondering if Sun Life Financial is as good a value as it seems? You are not alone, and now is a great time to take a closer look at what’s behind the current price.

- The stock price has been mostly flat over the last week and is down 3.5% in the past month. It has returned 1.5% in the last year and 50.8% over three years, which hints at both resilience and potential growth.

- Recent headlines highlight ongoing strategic investments by Sun Life Financial, including its expansion into new markets and partnerships aimed at boosting long-term growth. These moves have attracted fresh attention from analysts and investors, offering important context for the recent price action.

- The company currently scores 3 out of 6 on our valuation checks, suggesting some areas of potential undervaluation. Let’s break down how this compares across different valuation approaches, and stay tuned for a deeper perspective on what “fair value” really means for Sun Life Financial.

Find out why Sun Life Financial's 1.5% return over the last year is lagging behind its peers.

Approach 1: Sun Life Financial Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company can generate returns above its cost of equity from every dollar invested. This method highlights a firm’s ability to produce profits that go beyond what shareholders require as compensation for risk, making it especially relevant for evaluating financial institutions like Sun Life Financial.

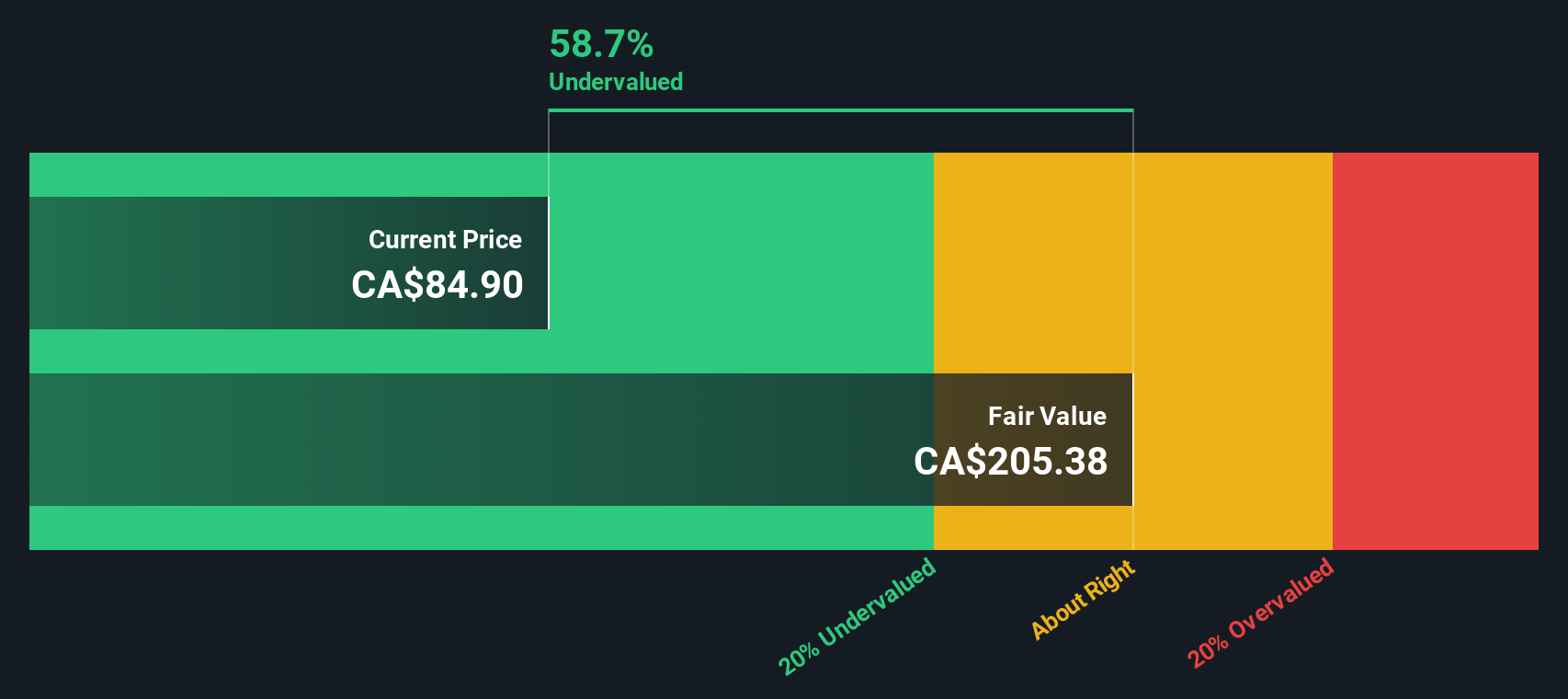

For Sun Life Financial, the average Return on Equity is a strong 17.83%, underscoring strong efficiency in using shareholder capital. The company’s Book Value is CA$42.01 per share, while its stable Earnings Per Share is estimated at CA$8.21. Analysts expect the company to deliver a stable Book Value of CA$46.04 per share in the future, and the Cost of Equity stands at CA$2.82 per share. This results in an Excess Return of CA$5.39 per share, suggesting consistent value creation well above the cost of capital.

The resulting Excess Returns valuation estimates Sun Life Financial’s intrinsic value to be significantly higher than the current market price. This implies the stock is 59.8% undervalued. If this analysis holds true, there may be meaningful upside for investors who buy at today’s prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Sun Life Financial is undervalued by 59.8%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: Sun Life Financial Price vs Earnings

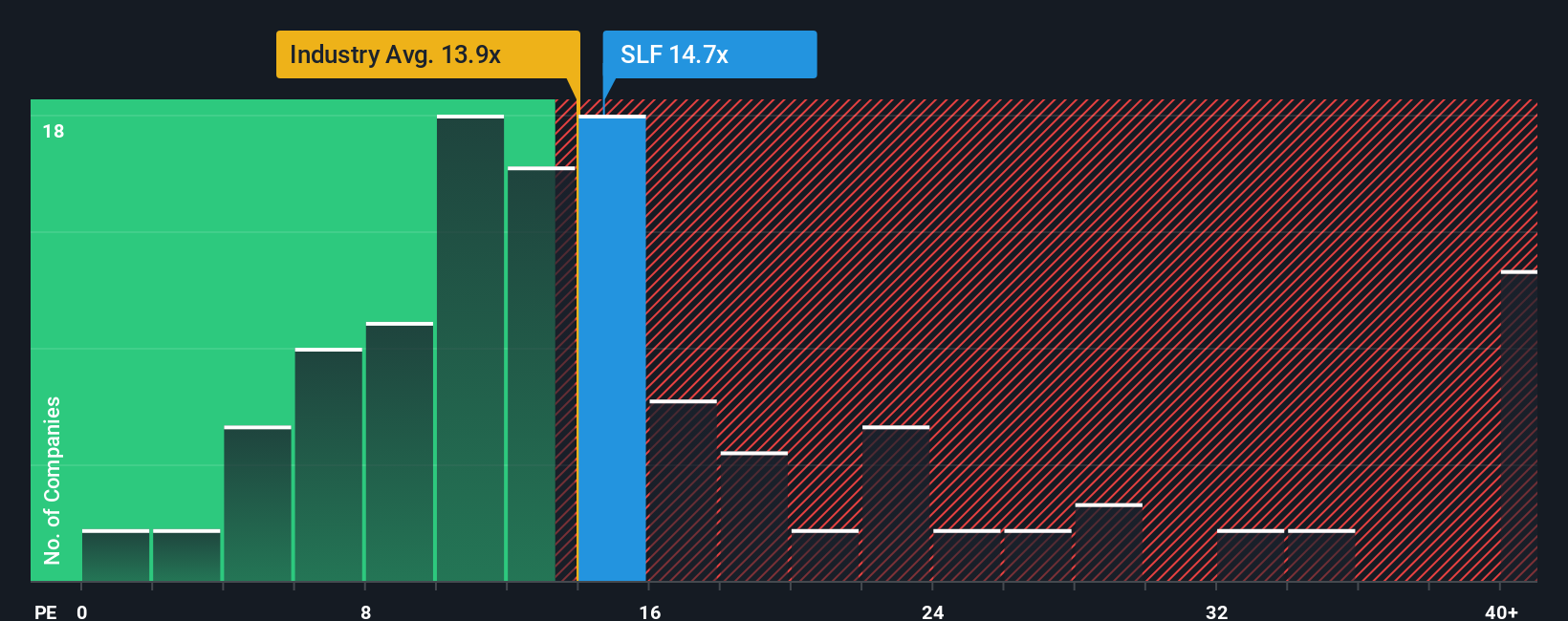

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it shows how much investors are willing to pay for each dollar of a company’s earnings. For stable and established firms like Sun Life Financial, a PE ratio gives a practical snapshot of market expectations around future growth and risk.

While PE ratios are handy, what counts as a “fair” PE depends on factors such as expected earnings growth and how risky the business is compared to its peers. Rapid growers and less risky businesses often command higher PE ratios, while mature or riskier firms tend to trade at lower multiples. Comparing Sun Life Financial’s current PE ratio of 15.4x to the insurance industry average of 11.6x and the peer average of 14.2x, Sun Life sits above its industry but close to its peer group.

Simply Wall St’s “Fair Ratio” takes things a step further. It suggests a PE of 15.9x for Sun Life Financial, after factoring in the company’s earnings growth outlook, profit margin, industry characteristics, risks, and market cap. This makes it a more informed benchmark than just stacking up numbers against industry or peers. With the fair ratio nearly matching the company’s market PE, Sun Life Financial’s stock appears valued about right based on current fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

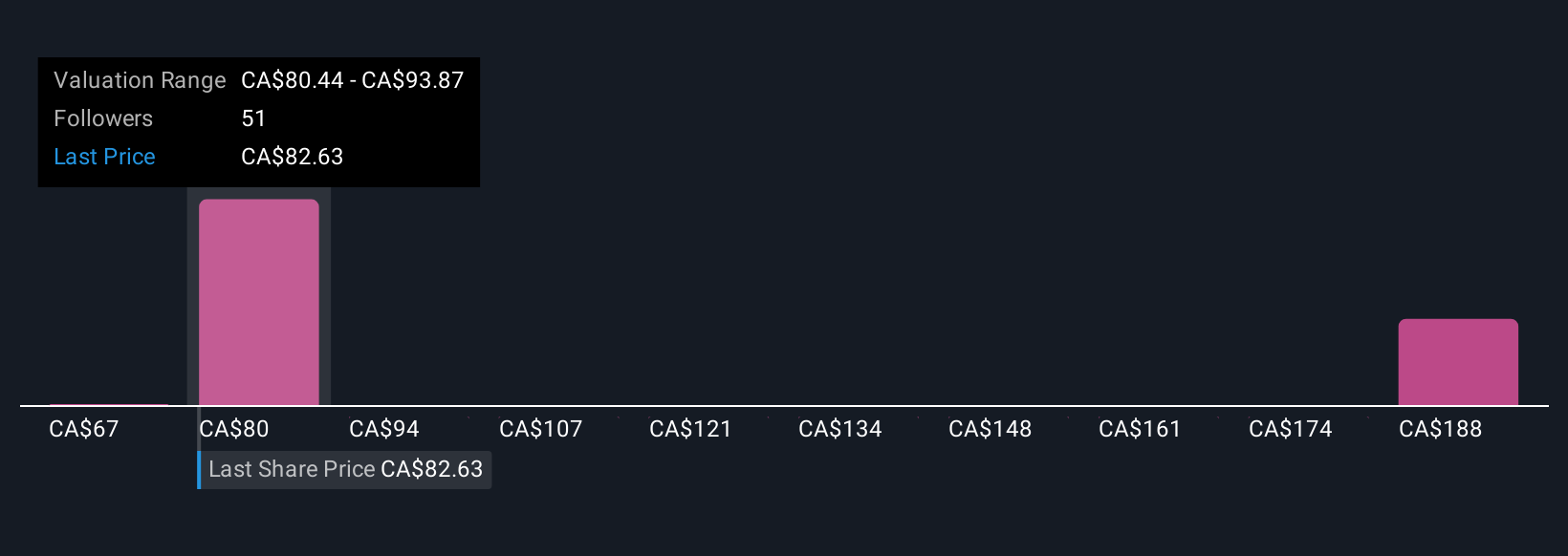

Upgrade Your Decision Making: Choose your Sun Life Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, accessible way to connect a company’s story to the numbers. You build your own perspective on Sun Life Financial by pairing what you believe about its future (like revenue, earnings, and profit margins) with your estimate of its fair value. Narratives link the bigger picture, such as the company’s business developments, risks, and outlook, directly to dynamic financial forecasts and a fair value, so you can see the “why” behind the numbers.

Available on the Simply Wall St Community page, Narratives are used by millions of investors to make smarter buy or sell decisions by comparing their own fair value with the current share price. Since Narratives update automatically whenever new news or earnings are announced, you’re always acting on the latest information. For example, one Sun Life investor may focus on strong Asian growth and cost efficiency programs and set a higher fair value, while another may be concerned with U.S. Dental risks or margin pressures and set a lower one. Whichever view you adopt, Narratives help you personalize your outlook and time your investment decisions confidently.

Do you think there's more to the story for Sun Life Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives