- Canada

- /

- Construction

- /

- TSX:BDT

Top TSX Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

With the Canadian market facing uncertainties due to potential tariffs and political shifts, investors are increasingly adopting a defensive stance. In this environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate these turbulent times.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 8.64% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 4.34% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.29% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.83% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.77% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.15% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.67% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.57% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.00% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.67% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bird Construction (TSX:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bird Construction Inc. is a Canadian company that offers construction services, with a market cap of CA$1.17 billion.

Operations: Bird Construction Inc. generates revenue primarily from its General Contracting Sector of the construction industry, amounting to CA$3.40 billion.

Dividend Yield: 4.1%

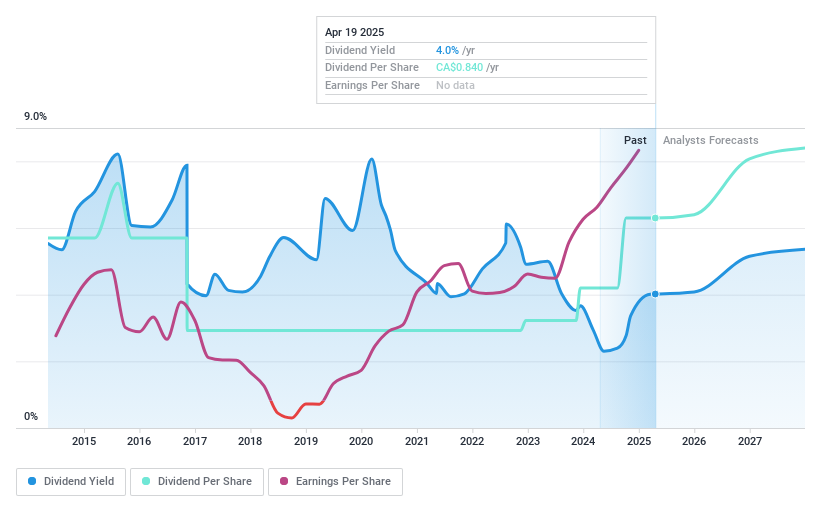

Bird Construction's dividend payments are well-covered by earnings and cash flows, with payout ratios of 31.9% and 57.8%, respectively. However, its dividend history has been volatile over the past decade, despite recent growth in payments. The company reported strong financial performance for 2024, with sales reaching C$3.40 billion and net income at C$100.1 million, supporting its current dividend policy of C$0.07 per share for March and April 2025 amidst significant project wins across Canada.

- Dive into the specifics of Bird Construction here with our thorough dividend report.

- According our valuation report, there's an indication that Bird Construction's share price might be on the cheaper side.

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. operates in the asset management sector in Canada with a market cap of approximately CA$10.32 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from its Wealth Management segment, contributing CA$2.45 billion, and its Asset Management segment, generating CA$1.26 billion.

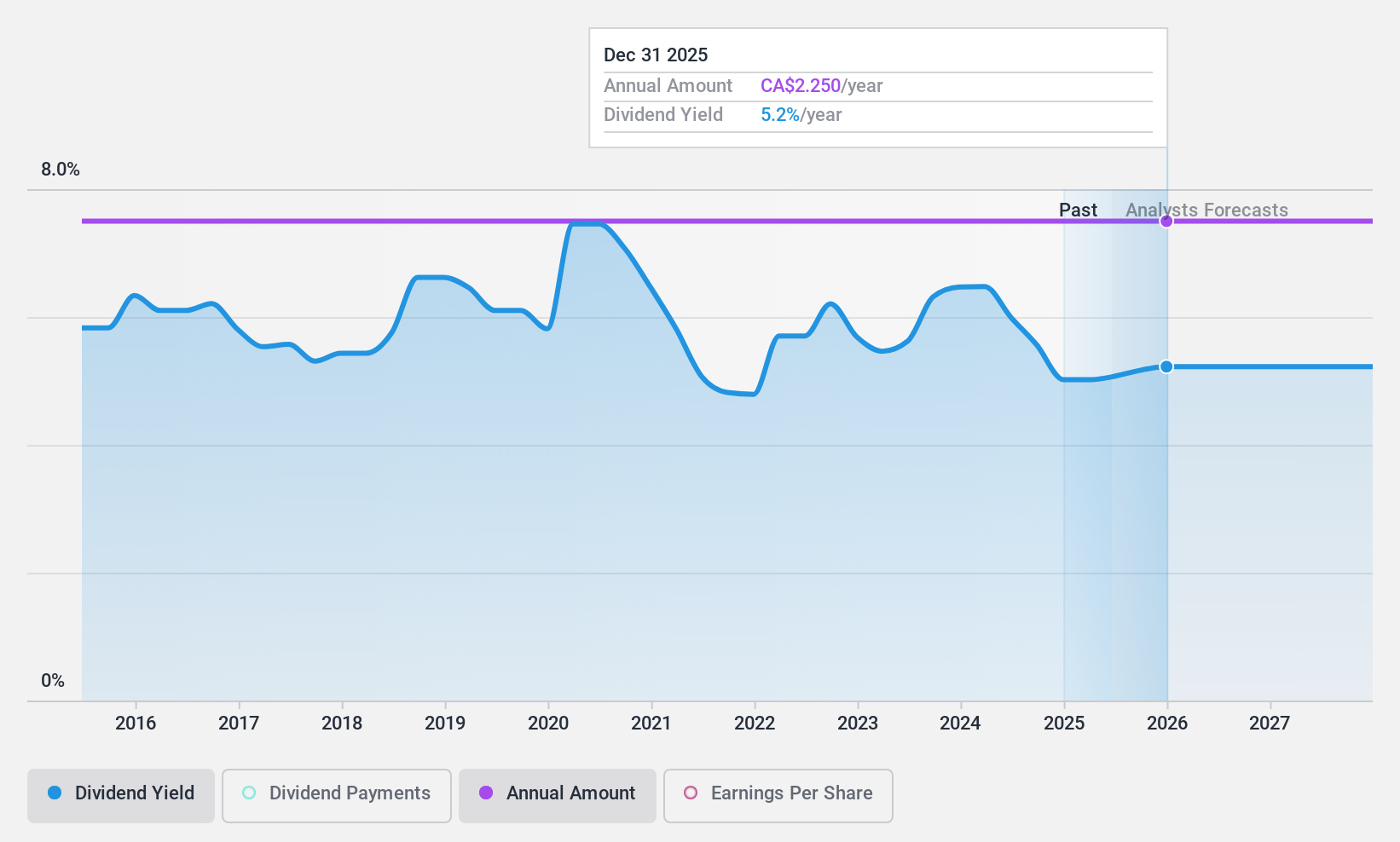

Dividend Yield: 5.2%

IGM Financial's dividends are well-covered by earnings and cash flows, with payout ratios of 57.2% and 51.6%, respectively, ensuring sustainability. Despite a decline in net income to C$933.51 million for 2024, dividends remain stable and have grown over the past decade. The company declared a dividend of C$0.5625 per share payable in April 2025. Trading at a discount to its estimated fair value, IGM offers an attractive yield of 5.15%.

- Click here to discover the nuances of IGM Financial with our detailed analytical dividend report.

- The valuation report we've compiled suggests that IGM Financial's current price could be quite moderate.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company that provides financial services across North America, Europe, and Asia, with a market cap of CA$30.86 billion.

Operations: Power Corporation of Canada's revenue segments include Lifeco at CA$39.10 billion, Power Financial - IGM at CA$3.64 billion, and Holding Company at CA$56 million.

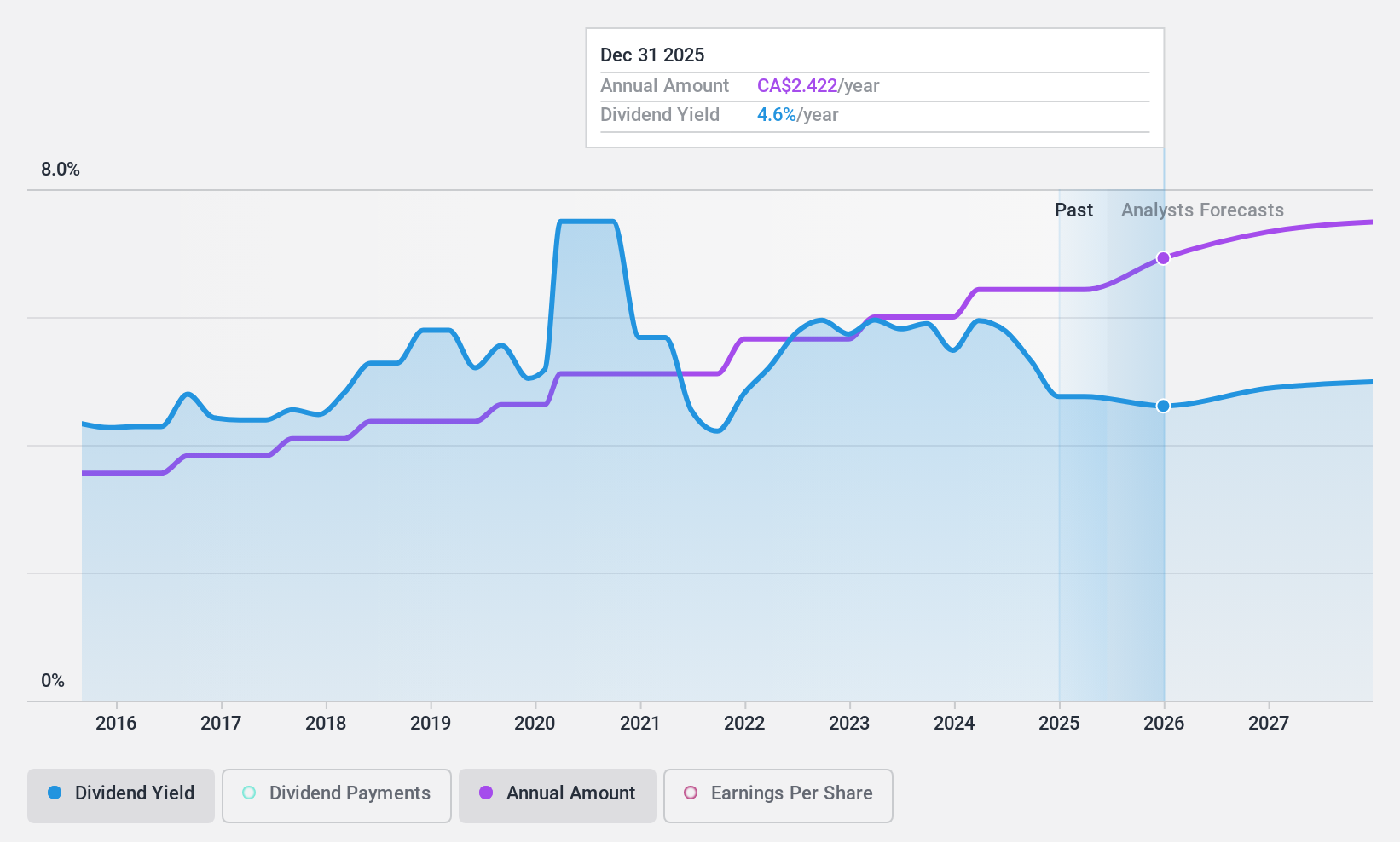

Dividend Yield: 4.7%

Power Corporation of Canada's dividends are well-supported by earnings and cash flows, with payout ratios of 61.8% and 29.4%, respectively, indicating sustainability. The company has consistently increased its dividend over the past decade, though its yield of 4.67% is below the top tier in Canada. A recent share buyback plan reflects confidence in its financial position, potentially enhancing shareholder value as it trades at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Power Corporation of Canada stock in this dividend report.

- Our valuation report here indicates Power Corporation of Canada may be undervalued.

Taking Advantage

- Embark on your investment journey to our 26 Top TSX Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDT

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives