Preferred Share Offering Might Change The Case For Investing In Power Corporation of Canada (TSX:POW)

Reviewed by Sasha Jovanovic

- Power Corporation of Canada recently completed a fixed-income offering, raising CA$200 million through the issuance of 8,000,000 5.65% non-cumulative preferred shares, with proceeds to be used for general corporate purposes and the shares set to list on the Toronto Stock Exchange.

- This fundraising follows the release of robust third-quarter earnings and a continued dividend affirmation, underscoring the company’s efforts to maintain financial flexibility and support growth initiatives.

- Next, we’ll explore how this successful preferred share issuance could influence Power Corporation of Canada’s investment narrative and outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Power Corporation of Canada Investment Narrative Recap

To be a shareholder in Power Corporation of Canada, you largely need to believe in the resilience and growth of its core holdings, particularly Great-West Lifeco and IGM Financial, which anchor long-term earnings. The recent CA$200 million preferred share offering, while positive for financial flexibility, is unlikely to materially shift the most important short-term catalyst, continued robust asset inflows into these subsidiaries, nor does it directly address the key risk of regulatory or sector pressure affecting their performance.

Among recent announcements, the affirmation of a quarterly dividend of CA$0.6125 per share stands out. This underscores the company's commitment to reliable income distributions, which is meaningful in the context of recent capital raising activities, reinforcing investor confidence in both near-term stability and ongoing capital stewardship.

However, investors should also be mindful that if regulatory or sector turmoil hits core holdings, the group's earnings could face sudden volatility and...

Read the full narrative on Power Corporation of Canada (it's free!)

Power Corporation of Canada’s narrative projects CA$47.0 billion revenue and CA$3.5 billion earnings by 2028. This requires 8.1% yearly revenue growth and a CA$0.7 billion earnings increase from CA$2.8 billion.

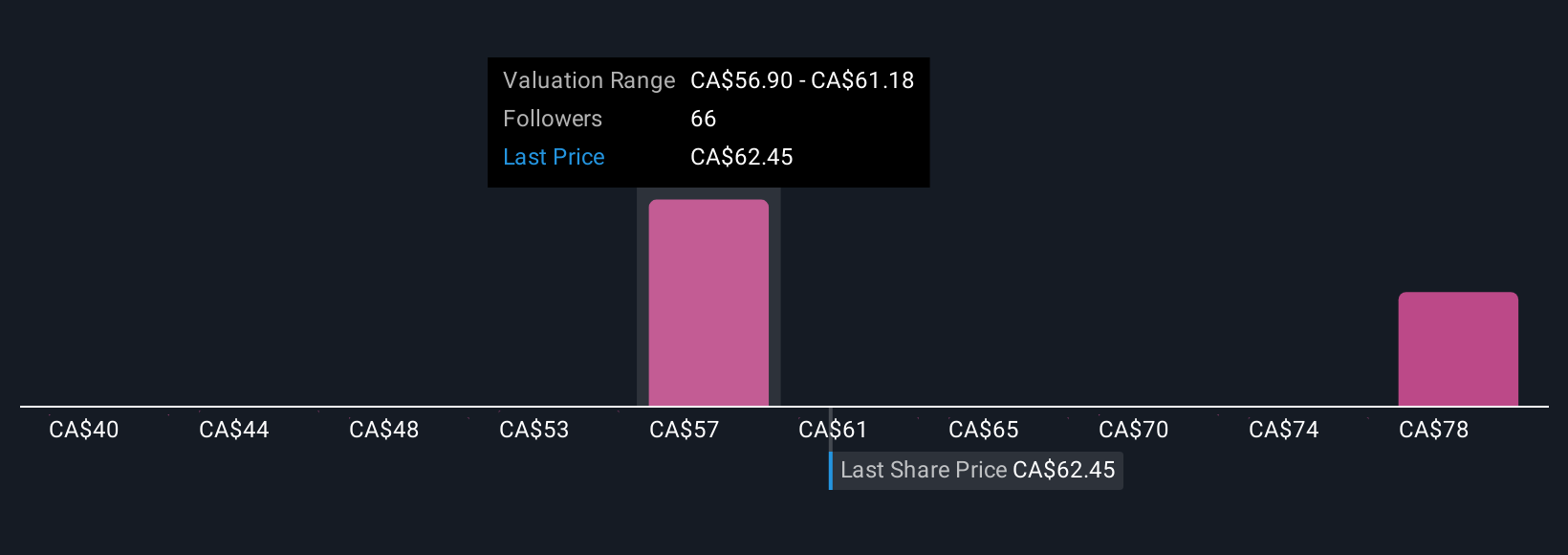

Uncover how Power Corporation of Canada's forecasts yield a CA$62.50 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Five unique fair value estimates from the Simply Wall St Community range from CA$54.77 to CA$88.69 per share. While perspectives differ, many are watching whether Power's core subsidiaries maintain strong asset flows amid evolving risks and sector shifts.

Explore 5 other fair value estimates on Power Corporation of Canada - why the stock might be worth as much as 26% more than the current price!

Build Your Own Power Corporation of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Power Corporation of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Corporation of Canada's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives