How Power Corporation of Canada’s CA$200 Million Wealthsimple Investment Could Shape Its Fintech Strategy (TSX:POW)

Reviewed by Sasha Jovanovic

- Wealthsimple revealed it has closed a new equity round of up to CA$750 million at a post-money valuation of CA$10 billion, with investors including Power Corporation of Canada and its subsidiaries contributing a combined CA$200 million through preferred shares.

- This investment highlights Power Corporation's growing emphasis on digital finance, reflecting a push to strengthen its presence in high-growth fintech platforms.

- We will explore how Power Corporation’s expanded investment in Wealthsimple could influence its long-term fintech exposure and growth outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Power Corporation of Canada Investment Narrative Recap

To be a shareholder in Power Corporation of Canada, you need to believe in the resilience of its core insurance and wealth management businesses, while trusting that investments in digital platforms like Wealthsimple can deliver incremental growth. The recent news of CA$200 million in preferred share funding for Wealthsimple supports Power’s fintech exposure, but does not materially alter the central short-term catalyst: stable, recurring earnings from core subsidiaries. The biggest risk remains the potential volatility triggered by regulatory changes or weaker performance in insurance and wealth management.

Among the latest announcements, Power Corporation’s addition to the S&P/TSX Preferred Share Index is closely linked to this financing event, as it validates the company’s growing weight in the Canadian preferred share market. This heightened profile may help broaden its investor base in the short term, even as investors continue to watch for consistency in alternative asset earnings and successful management of fee pressures in high-growth areas.

Yet even with more digital investments like Wealthsimple, investors should be aware of the continued earnings reliance on Great-West Lifeco and IGM Financial if...

Read the full narrative on Power Corporation of Canada (it's free!)

Power Corporation of Canada's outlook anticipates CA$47.0 billion in revenue and CA$3.5 billion in earnings by 2028. Achieving this would require 8.1% annual revenue growth and a CA$0.7 billion increase in earnings from the current CA$2.8 billion.

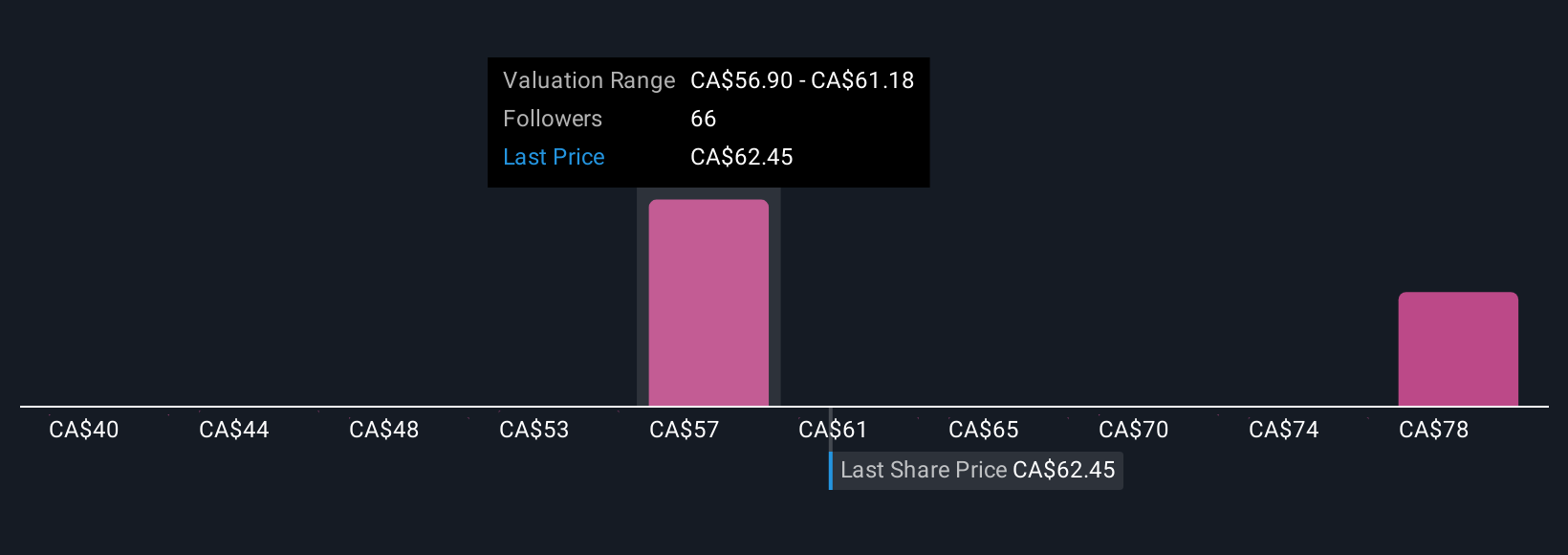

Uncover how Power Corporation of Canada's forecasts yield a CA$59.75 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members place fair value between CA$54.77 and CA$83.07 per share, highlighting strong differences in outlook. Some expect the company’s digital expansion to help offset risks from sector disruption affecting its major subsidiaries, making it essential to weigh multiple viewpoints before deciding.

Explore 5 other fair value estimates on Power Corporation of Canada - why the stock might be worth 16% less than the current price!

Build Your Own Power Corporation of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Corporation of Canada research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Power Corporation of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Corporation of Canada's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives