A Look at Power Corporation (TSX:POW) Valuation Following Strong Earnings and New Preferred Share Offering

Reviewed by Simply Wall St

Power Corporation of Canada (TSX:POW) just posted a strong jump in earnings for the third quarter and year to date. Alongside those results, the company completed a CAD 150 million preferred share offering and affirmed its dividend.

See our latest analysis for Power Corporation of Canada.

After a run of strong news, including robust earnings, a sizeable buyback, and a fresh preferred share issue, Power Corporation of Canada has caught the market’s attention. The stock’s 55.9% share price return year-to-date and impressive 140% three-year total shareholder return show that momentum is firmly on its side, suggesting investors are growing more optimistic about both its growth prospects and financial position.

If you’re curious to see other companies with surging momentum and strong insider support, this is a great opportunity to explore fast growing stocks with high insider ownership.

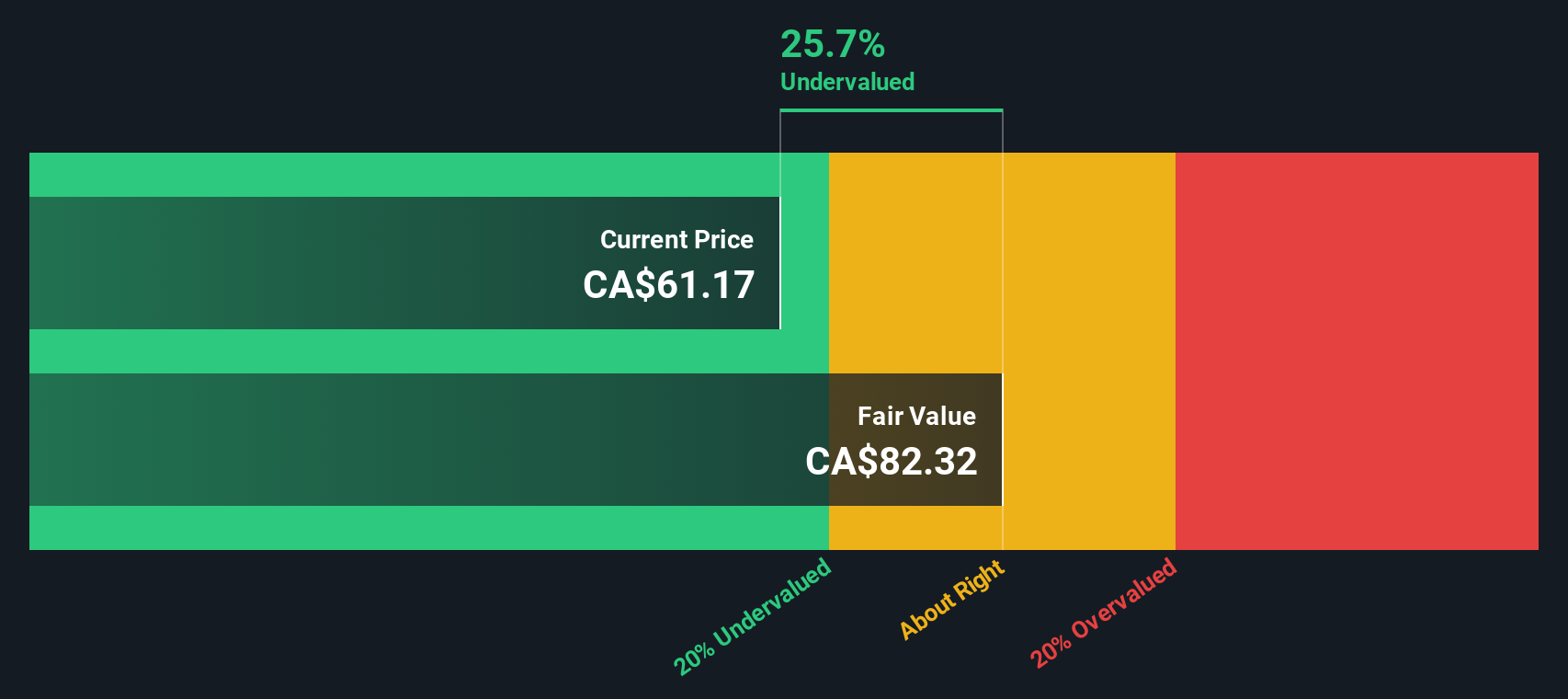

With shares soaring over 55% this year and record earnings in the books, the key question for investors now is whether Power Corporation remains undervalued, or if the market has already priced in its future growth potential.

Most Popular Narrative: 9.9% Overvalued

Power Corporation of Canada’s most widely followed narrative sees its fair value at $62.50, which is nearly 10% below the recent closing price of $68.71. This sets the stage for a major debate around whether strong recent growth is now fully priced in.

Ongoing cost containment and operational efficiency initiatives, propelled by digital transformation across key subsidiaries, are expected to drive a lower expense ratio and higher operating leverage. This could lead to improving net margins over time.

Want to know what’s fueling the bold price target? The narrative hints at profit margins rising and aggressive digital innovation changing the game. What is the pivotal factor that makes this growth story so compelling? Read on to find out what assumptions truly drive this valuation forecast.

Result: Fair Value of $62.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or underperformance from key subsidiaries could quickly reverse sentiment and potentially derail Power Corporation of Canada’s current growth narrative.

Find out about the key risks to this Power Corporation of Canada narrative.

Another View: What Does Our SWS DCF Model Say?

Looking beyond multiples, our SWS DCF model paints a different picture. It estimates Power Corporation of Canada’s fair value at CA$88.26 per share. This suggests the stock is actually undervalued by a significant margin. Does the market’s focus on recent momentum risk overlooking longer-term fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Power Corporation of Canada Narrative

If this outlook doesn’t align with your own or you’d rather rely on your own analysis, it only takes a few minutes to build your own perspective. Do it your way.

A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take a smarter approach to building your portfolio with these handpicked opportunities. Don’t wait and risk missing out on trends driving sharp gains right now.

- Capture impressive income and steady growth by evaluating these 16 dividend stocks with yields > 3%, which offer high yields and reliable payouts.

- Ride the momentum of rapid innovation by targeting these 25 AI penny stocks, shaping the artificial intelligence revolution.

- Strengthen your portfolio’s resilience by seeking out these 923 undervalued stocks based on cash flows that show solid fundamentals at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives