Do Manulife Financial's (TSE:MFC) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Manulife Financial (TSE:MFC). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Manulife Financial

How Quickly Is Manulife Financial Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Manulife Financial's EPS has grown 31% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Manulife Financial's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Manulife Financial's EBIT margins have actually improved by 64.2 percentage points in the last year, to reach 74%, but, on the flip side, revenue was down 72%. That falls short of ideal.

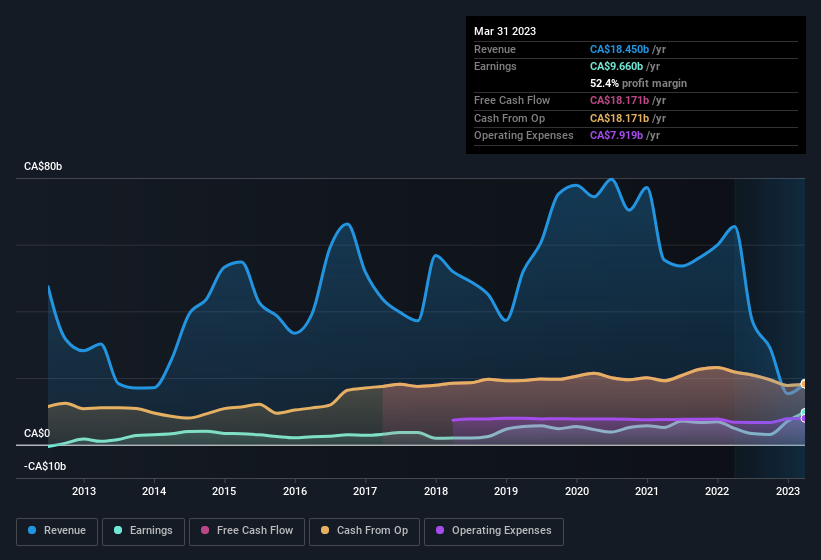

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Manulife Financial's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Manulife Financial Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though there was some insider selling over the last year, that was outweighed by Independent Chairman of the Board Donald Lindsay's huge outlay of CA$2.7m, spent buying shares. The average price of which was CA$26.81 per share. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

On top of the insider buying, it's good to see that Manulife Financial insiders have a valuable investment in the business. Indeed, they hold CA$35m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.07% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Manulife Financial Worth Keeping An Eye On?

For growth investors, Manulife Financial's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. It is worth noting though that we have found 1 warning sign for Manulife Financial that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Manulife Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives