Intact Financial (TSX:IFC) Valuation in Focus After Strong Q3 Earnings Beat and Dividend Update

Reviewed by Simply Wall St

Intact Financial (TSX:IFC) caught investors’ attention this week after posting third-quarter results that topped expectations. Both earnings and revenue rose sharply from last year. Dividend announcements added to the positive momentum for shareholders.

See our latest analysis for Intact Financial.

After a sharp earnings beat, Intact Financial’s recent 1-week share price gain of 7.1% stands out. Total shareholder returns for the past year are up 7.2% and have more than doubled over five years. Momentum is building as investors respond to strong performance, attractive dividends, and the latest CAD 150 million fixed-income offering featured in the headlines.

If Intact’s latest run-up has you scanning for other investing ideas, now's a smart moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares climbing after this earnings beat and analysts still seeing upside, investors have to ask if Intact is currently undervalued or if the market has already factored in all the growth ahead. Is this a buying opportunity, or has future potential already been priced in?

Most Popular Narrative: 12.3% Undervalued

Compared to the last close of CA$280.17, the narrative sets Intact Financial’s fair value at CA$319.62, indicating a significant valuation gap. The stage is set for a closer look at the assumptions driving this bold estimate.

Significant premium growth in personal auto and property, driven by both rate actions and increased units, combined with persistent hard market conditions fueled by more frequent climate-related weather events, position Intact to sustain strong top-line growth and market share gains. This directly benefits future revenue. Acceleration in technology adoption such as AI underwriting, advanced pricing models, and digital customer platforms is expected to further improve pricing accuracy, risk selection, and operational efficiency. These advancements could enable lower combined ratios and higher net margins over time.

Curious which unexpected metric could be the secret engine behind this premium valuation? The narrative is betting big on profit margin expansion and a powerful transformation in where future growth comes from. Is there a game-changing assumption hiding in plain sight? Don’t miss what could make or break the analyst consensus—the numbers might surprise you.

Result: Fair Value of $319.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating claims from climate events or rising competition in large commercial lines could quickly challenge optimism regarding Intact’s future profit margins.

Find out about the key risks to this Intact Financial narrative.

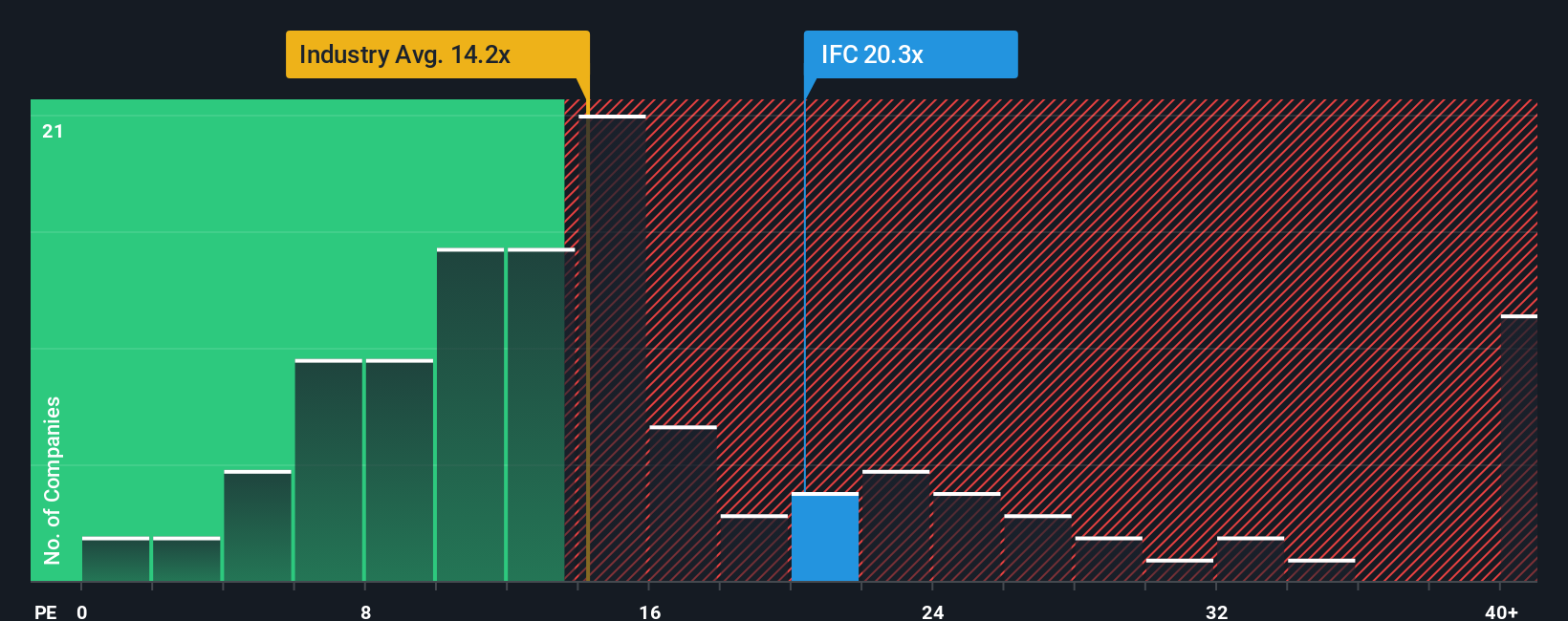

Another View: Price Ratios Raise a Red Flag

Taking a different angle, the company's current price-to-earnings ratio stands at 16.7x. This is well above both the Canadian insurance industry average of 13.8x and the fair ratio of 11.3x. As a result, investors are paying a notable premium compared to peers and what the market might ultimately consider reasonable. Does this pricing risk signal a hidden vulnerability, or is it justified by Intact’s outperformance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intact Financial Narrative

If this perspective doesn't quite fit your outlook, or you want to test the numbers firsthand, you can craft your own take on Intact Financial in just a few minutes. Do it your way

A great starting point for your Intact Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Why stop at just one great stock? Give your portfolio an edge by putting bold new companies on your radar. These eye-opening ideas are just a click away.

- Unlock steady income potential by zeroing in on strong yields with these 16 dividend stocks with yields > 3%, offering above-average payouts and solid fundamentals.

- Tap into tomorrow’s breakthroughs by targeting these 24 AI penny stocks. These companies are transforming entire industries through artificial intelligence innovation.

- Supercharge your hunt for long-term value and spot the market’s hidden gems using these 870 undervalued stocks based on cash flows, where quality meets under-the-radar pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives