With inflation moving closer to target and central banks considering easing measures, the Canadian market is experiencing a phase of cautious optimism. Amidst this backdrop, dividend stocks offer an attractive option for investors seeking stability and income in a potentially volatile environment.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.77% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.39% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.48% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.58% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.53% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.02% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.55% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.84% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.05% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

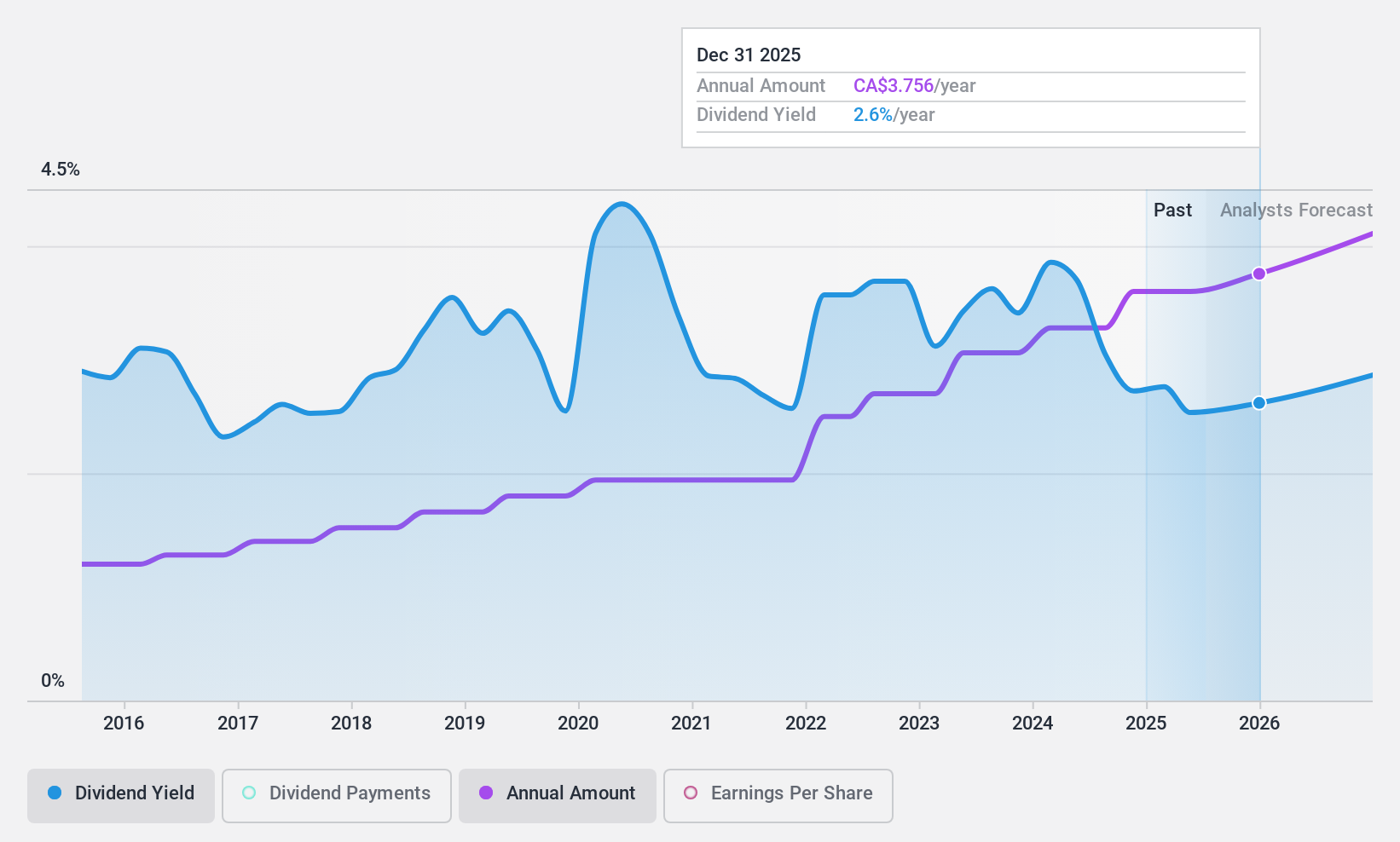

iA Financial (TSX:IAG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: iA Financial Corporation Inc. provides insurance and wealth management services in Canada and the United States, with a market cap of CA$8.36 billion.

Operations: iA Financial Corporation Inc. generates revenue from individual insurance (CA$4.23 billion), group insurance (CA$2.27 billion), individual wealth management (CA$1.68 billion), and group savings and retirement (CA$1.25 billion).

Dividend Yield: 3.5%

iA Financial's dividend payments have been stable and growing over the past 10 years, with a current yield of 3.53%. The dividends are well-covered by both earnings (payout ratio: 21.2%) and cash flows (cash payout ratio: 18%). Recent news includes the affirmation of a quarterly dividend of C$0.82 per share payable on September 16, 2024, and the completion of a C$350 million fixed-income offering to support corporate purposes.

- Unlock comprehensive insights into our analysis of iA Financial stock in this dividend report.

- The valuation report we've compiled suggests that iA Financial's current price could be quite moderate.

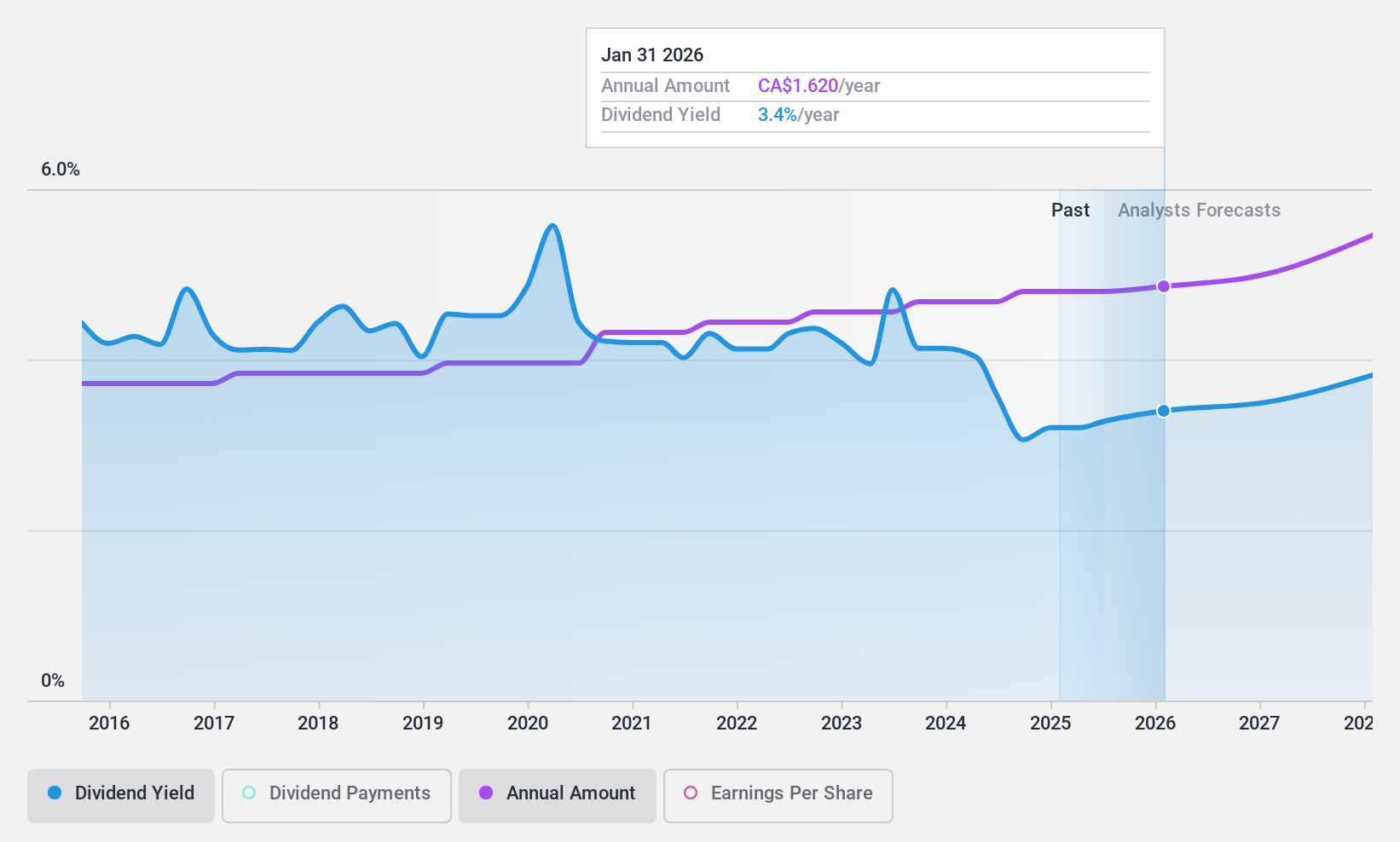

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. (TSX:NWC) operates retail stores offering food and everyday products in rural and urban markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.11 billion.

Operations: The North West Company Inc. generates CA$2.50 billion from retailing food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3.6%

North West Company Inc. has consistently provided reliable and growing dividends over the past decade, with a current yield of 3.61%. Recent earnings for Q1 2024 showed an increase in sales to C$617.52 million and net income to C$25.53 million, supporting a quarterly dividend of C$0.39 per share declared for July 15, 2024. Dividends are well-covered by both earnings (payout ratio: 55.2%) and cash flows (cash payout ratio: 59.8%).

- Get an in-depth perspective on North West's performance by reading our dividend report here.

- According our valuation report, there's an indication that North West's share price might be on the cheaper side.

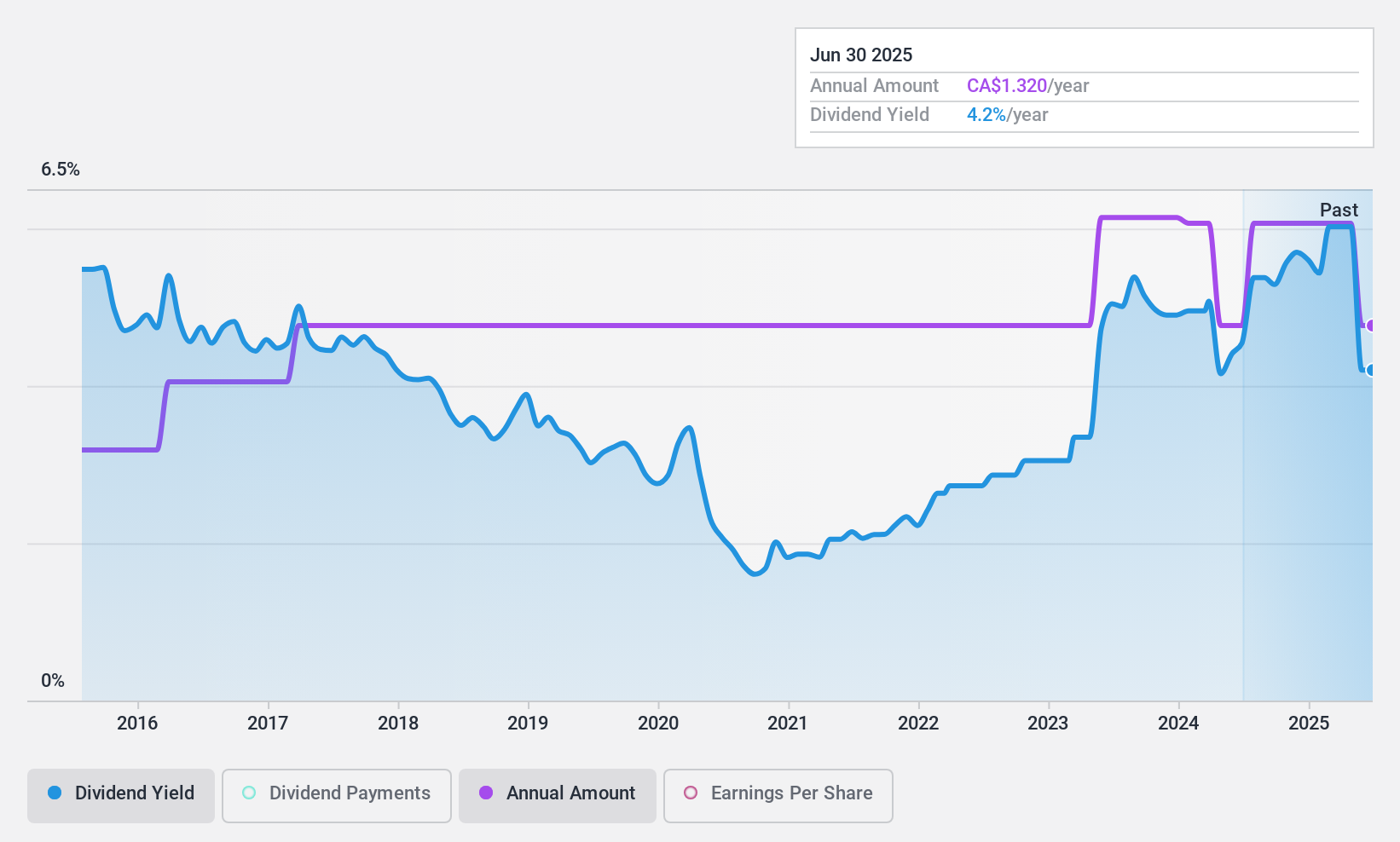

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, with a market cap of CA$348.92 million, designs, manufactures, and distributes packaging containers and healthcare supplies in North America.

Operations: Richards Packaging Income Fund generates revenue primarily from its wholesale miscellaneous segment, which amounts to CA$415.52 million.

Dividend Yield: 4.1%

Richards Packaging Income Fund has consistently paid and increased its dividends over the past decade, with a current monthly distribution of C$0.11 per unit. Recent Q2 2024 earnings showed stable performance, with net income rising to C$11.8 million from C$10.91 million a year ago, supporting the dividend payout. The dividends are well-covered by both earnings (payout ratio: 56.4%) and cash flows (cash payout ratio: 20.6%), although the yield of 4.06% is lower than top-tier Canadian dividend payers.

- Click here to discover the nuances of Richards Packaging Income Fund with our detailed analytical dividend report.

- Our valuation report unveils the possibility Richards Packaging Income Fund's shares may be trading at a discount.

Taking Advantage

- Click through to start exploring the rest of the 33 Top TSX Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet established dividend payer.