Should You Be Adding iA Financial (TSE:IAG) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like iA Financial (TSE:IAG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for iA Financial

How Fast Is iA Financial Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, iA Financial has grown EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of iA Financial's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. iA Financial's EBIT margins have actually improved by 2.1 percentage points in the last year, to reach 7.6%, but, on the flip side, revenue was down 6.6%. That falls short of ideal.

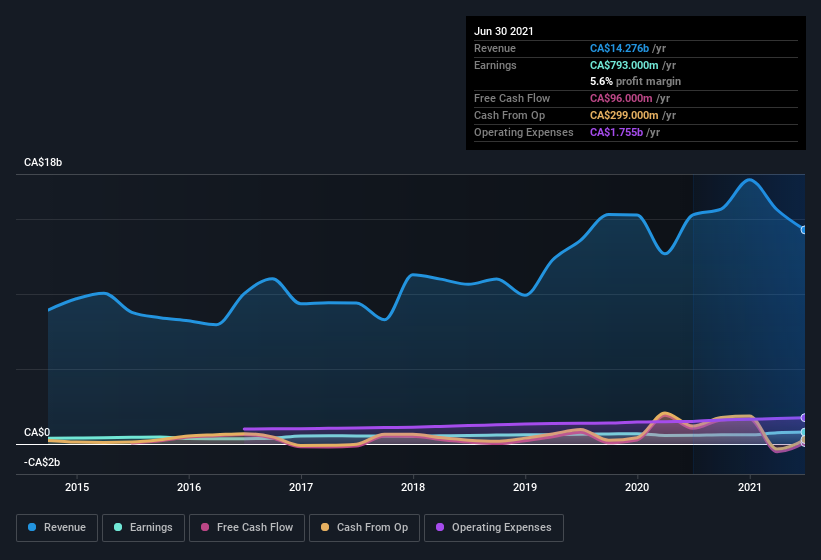

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future iA Financial EPS 100% free.

Are iA Financial Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While iA Financial insiders did net -CA$178k selling stock over the last year, they invested CA$704k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Executive VP & Chief Growth Officer, Michael Stickney, who made the biggest single acquisition, paying CA$352k for shares at about CA$68.96 each.

Is iA Financial Worth Keeping An Eye On?

One important encouraging feature of iA Financial is that it is growing profits. Not every business can grow its EPS, but iA Financial certainly can. The gravy on the mushroom pie is the insider buying, which has me tasting potential opportunity; one for the watchlist, I'd posit. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if iA Financial is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But iA Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:IAG

iA Financial

Provides insurance and wealth management services in Canada and the United States.

Established dividend payer with proven track record.