Is iA Financial (TSX:IAG) Trading Above Fair Value? A Fresh Look at Its Recent Share Price Momentum

Reviewed by Simply Wall St

iA Financial (TSX:IAG) shares have edged higher recently, drawing attention from investors curious about what is driving this insurance company’s solid performance. There has not been a single headline event; however, the stock is quietly gaining ground.

See our latest analysis for iA Financial.

iA Financial’s latest share price of $167.52 reflects steady momentum, with a 4.5% gain in the past month and a robust 27.3% price return so far this year. Long-term holders have benefited from a remarkable 50.1% total shareholder return over the past year. This demonstrates consistent growth, even as the broader sector has faced uncertainty.

Curious what else the market has to offer? If you want to see how other fast-growing, high-ownership companies are performing, discover fast growing stocks with high insider ownership

But with shares outperforming expectations and now trading just above analyst price targets, investors face a key question: Is iA Financial undervalued, or is all of its future momentum already priced in?

Price-to-Earnings of 15.3x: Is it justified?

iA Financial trades at a price-to-earnings (P/E) ratio of 15.3x, which positions the stock at a premium relative to both industry and peer benchmarks. The last close price of CA$167.52 is slightly higher than many analysts’ targets, suggesting the market is putting a higher value on iA Financial’s current and future earnings power compared to its competition.

The price-to-earnings multiple compares a company's current share price to its per-share earnings and provides a quick metric for gauging how highly the market is valuing each dollar of profit. This ratio is a cornerstone valuation metric for the insurance sector, where steady earnings and profitability are critical factors for investors.

For iA Financial, the P/E of 15.3x stands out. It is notably higher than the North American insurance industry average of 13.7x and above the peer group average of 14.8x, indicating the market is pricing in superior growth or quality. However, regression-based fair value methods suggest a P/E of 13.5x may be more appropriate. This raises questions about whether investors may be overpaying for the company's growth prospects. If the market corrects toward this fair ratio, there could be a meaningful shift in valuation.

Explore the SWS fair ratio for iA Financial

Result: Price-to-Earnings of 15.3x (OVERVALUED)

However, if earnings growth slows or the broader sector faces headwinds, iA Financial’s premium valuation could quickly come under pressure.

Find out about the key risks to this iA Financial narrative.

Another View: Is iA Financial Actually Undervalued?

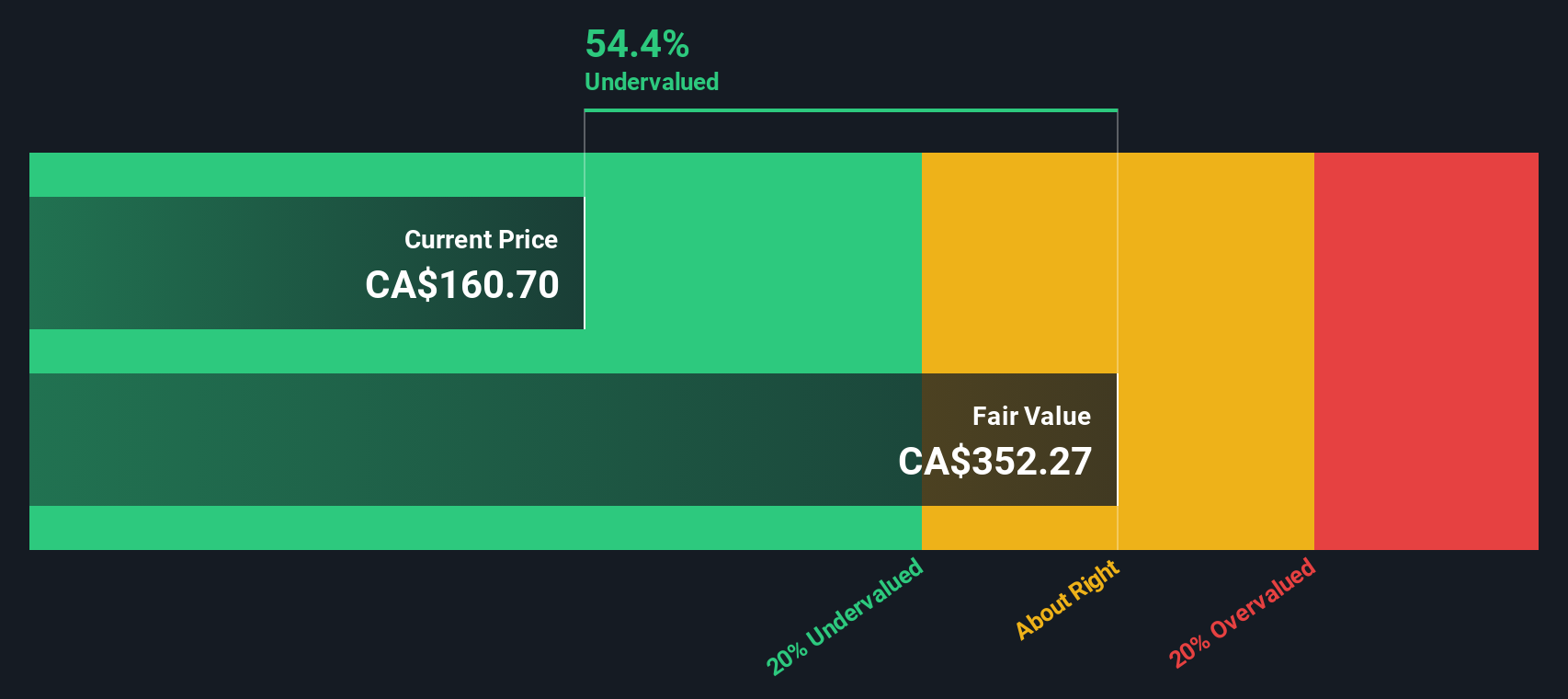

While conventional ratios suggest iA Financial is trading at a premium, a different story emerges from our DCF model. According to this approach, the current share price is a significant 54% below what we estimate to be its fair value. Is the market overlooking a major opportunity, or is there more to the picture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iA Financial Narrative

If you would rather reach your own conclusions or want to check the numbers for yourself, you can easily build your own perspective in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding iA Financial.

Looking for More Investment Ideas?

Seize the momentum and supercharge your portfolio with fresh opportunities handpicked for your goals. Don’t let these powerful investing themes pass you by.

- Unlock the potential of tomorrow’s market leaders by targeting these 843 undervalued stocks based on cash flows with strong fundamentals and room for growth.

- Capitalize on breakthrough innovations fueling the healthcare sector by starting your search with these 33 healthcare AI stocks that are transforming patient care and technology.

- Access high-yielding options by choosing these 18 dividend stocks with yields > 3% that offer robust income streams above 3 percent, aiming for steady returns in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives