iA Financial (TSX:IAG) Margin Expansion Challenges Bearish Narratives Despite Slower Forward Growth

Reviewed by Simply Wall St

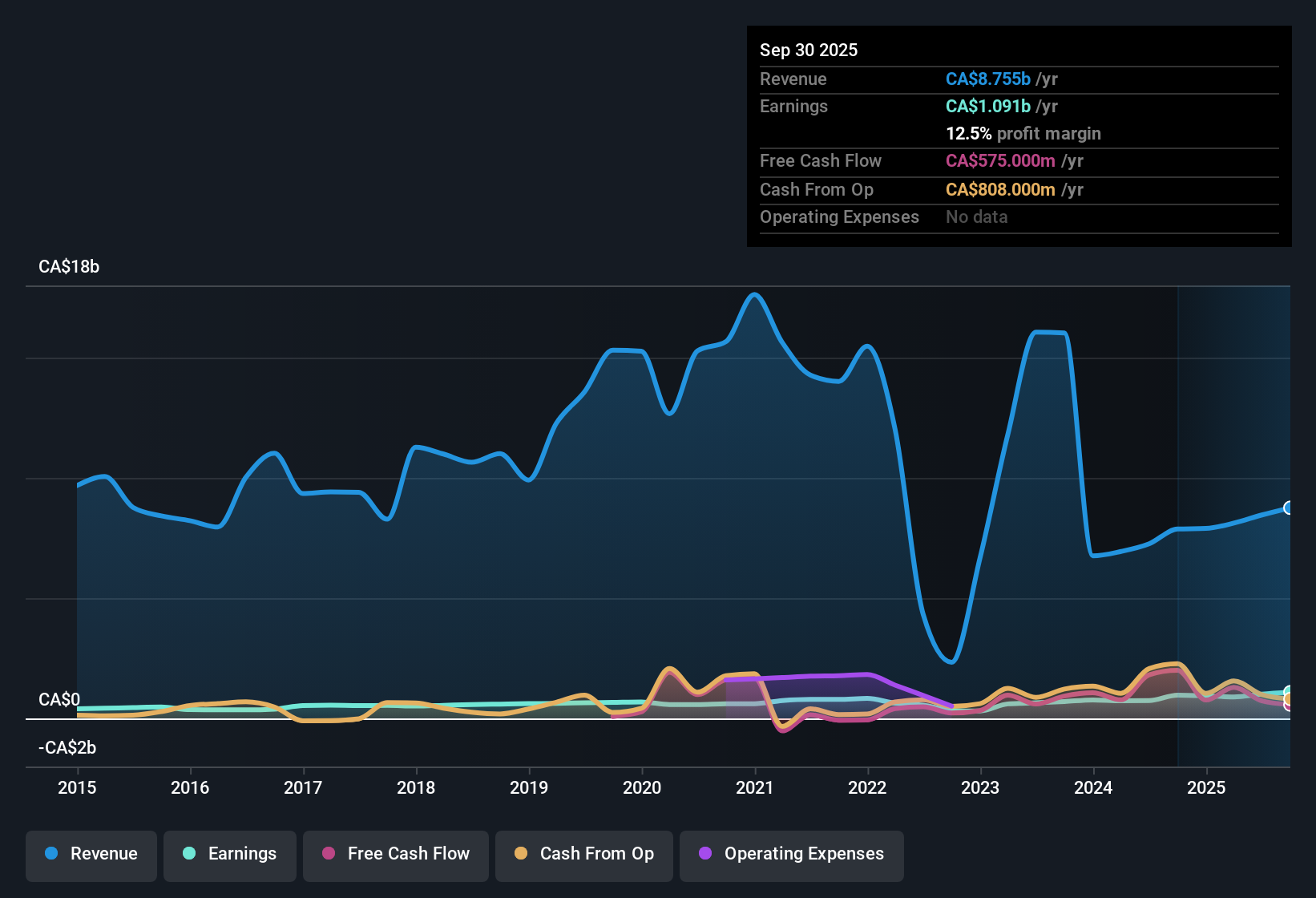

iA Financial (TSX:IAG) posted net profit margins of 11.9%, up from 10.2% a year ago, and delivered 36.1% earnings growth compared to its longer-term 8.1% average increase per year over the past five years. While high-quality earnings remain a draw for investors, the company’s projected annual earnings growth of 5.63% trails the broader Canadian market’s forecast of 12.1% per year. With shares trading at a level that is below estimated fair value by discounted cash flow but still expensive relative to the industry average, investor sentiment is likely to focus on IAG’s margin improvements and established track record of rewarding shareholders.

See our full analysis for iA Financial.Now, let us see how these headline numbers compare to the key narratives followed by the market. Some will fit, and others might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Outpace Peers

- With net profit margins reaching 11.9%, iA Financial is now ahead of the 10.2% posted last year, reflecting a notable efficiency improvement within its operations.

- This strongly supports the view that margin expansion is not just a result of industry trends but is linked to iA’s track record of high-quality earnings.

- The recent margin figure surpasses the company’s own five-year growth pace and stands as a positive marker when broader market earnings are growing faster. This indicates IAG is maintaining its position on profitability.

- Bulls note that this margin strength could support consistent dividends and sustained profit growth for shareholders, especially as the company remains in line with its peer group on other valuation metrics.

Earnings Growth Slows Versus Market

- Forecast annual earnings growth is 5.63% for iA Financial, which is well below the Canadian market’s 12.1% projected yearly growth rate.

- This challenges claims that iA’s impressive recent results alone guarantee continued momentum.

- The significant 36.1% growth rate seen most recently is a spike compared to its longer-term average of 8.1%, but expectations for more moderate acceleration ahead indicate the company faces a tougher growth runway than many competitors.

- This cooling growth projection puts more pressure on management to deliver additional catalysts to match sector expectations, as the market is rewarding faster-growing names.

Trading Below DCF Fair Value

- At a current share price of $162.85, iA Financial trades significantly below its DCF fair value estimate of $369.34, even while being considered expensive compared to the North American insurance industry’s average Price-To-Earnings Ratio.

- This creates tension for investors balancing valuation metrics against sector context.

- While a discount to DCF fair value may appeal to long-term investors, the peer-relative premium suggests the stock could have limited upside if sector sentiment shifts or if industry multiples contract.

- The company’s attractive dividends and consistent history of profit and revenue growth add to the appeal for those seeking stable returns, yet the relative valuation premium means monitoring for further earnings momentum is key.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on iA Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong recent margins, iA Financial’s slower forecast earnings growth compared to the market indicates that future momentum could lag behind faster-growing peers.

For investors focused on bigger gains, consider high growth potential stocks screener (51 results) to discover established companies with the high growth forecasts iA Financial currently lacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives