Definity Financial (TSX:DFY) Is Up 7.6% After Q3 Earnings Beat and Dividend Hike Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Definity Financial reported its third-quarter 2025 earnings, revealing net income of C$193.1 million and basic earnings per share of C$1.61, both up significantly from a year prior, while also increasing revenue to C$1.18 billion and declaring a dividend of C$0.1875 per share payable in December.

- The earnings report notably beat analyst expectations for both profit and revenue, highlighting ongoing momentum in Definity Financial's performance and operational improvements.

- With quarterly earnings outperforming estimates, we'll examine how Definity's strong operational performance supports its evolving investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Definity Financial Investment Narrative Recap

To hold Definity Financial stock, investors need confidence in the company’s ability to unlock scale and efficiency gains from its operational initiatives, while navigating challenges in insurance regulation and industry competition. The recent Q3 results reinforce the short-term catalyst of improved digital platforms and stronger operating metrics, but do not materially change the most prominent risk: exposure to unpredictable, climate-related catastrophe losses, which can affect claims volatility and margin stability in the near term.

Among recent announcements, the Q3 earnings results stand out, showing a clear improvement in net income and earnings per share, which supports positive sentiment around Definity’s ongoing investments in underwriting technology and digital transformation. This progress remains closely tied to the potential for enhanced growth and profitability, though risks from weather-related events and integration of new acquisitions remain relevant for shareholders considering near-term performance.

However, investors should be aware that even with strong core results, unexpected surges in weather-related claims could significantly pressure earnings and...

Read the full narrative on Definity Financial (it's free!)

Definity Financial is projected to reach CA$7.1 billion in revenue and CA$622.1 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 15.7% and an earnings increase of CA$233.6 million from current earnings of CA$388.5 million.

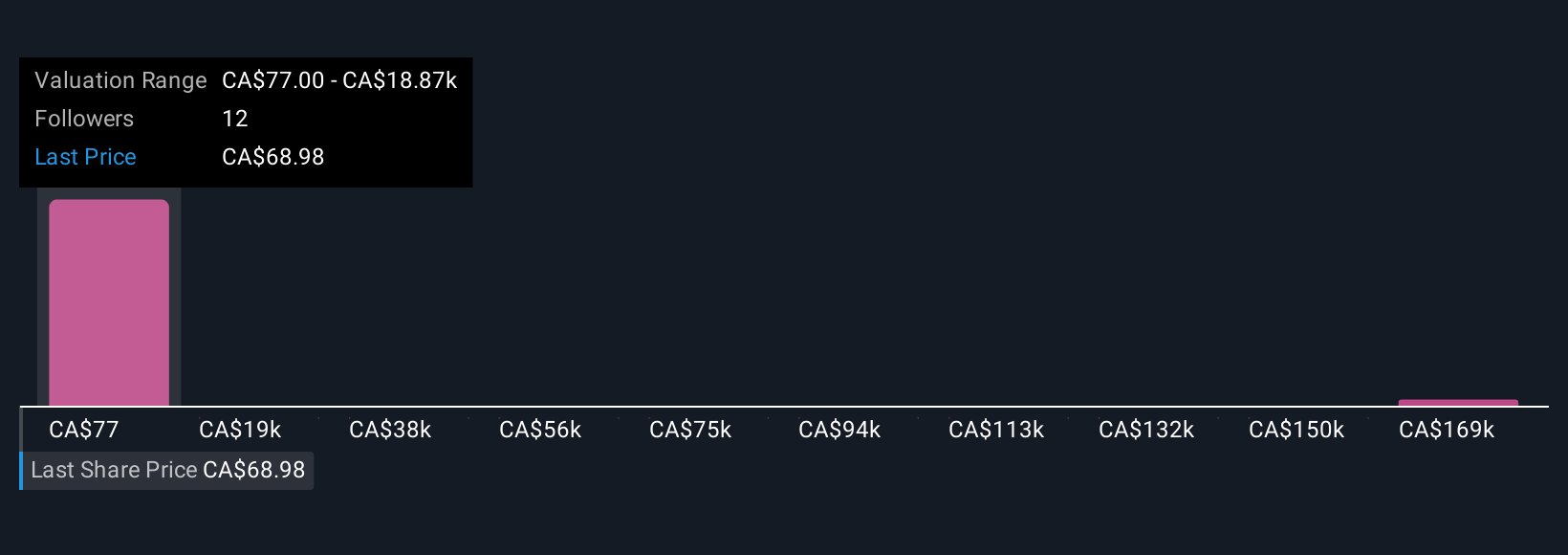

Uncover how Definity Financial's forecasts yield a CA$77.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three individual investors in the Simply Wall St Community estimated Definity’s fair value from C$77 to an outlier at nearly C$188,000 per share. While forecasts for operational improvement attract optimism, the risk from climate-driven insurance claims remains top of mind across viewpoints.

Explore 3 other fair value estimates on Definity Financial - why the stock might be a potential multi-bagger!

Build Your Own Definity Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Definity Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Definity Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Definity Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DFY

Definity Financial

Offers property and casualty insurance products in Canada.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives