- Canada

- /

- Personal Products

- /

- CNSX:AAWH.U

Further Upside For Ascend Wellness Holdings, Inc. (CSE:AAWH.U) Shares Could Introduce Price Risks After 30% Bounce

The Ascend Wellness Holdings, Inc. (CSE:AAWH.U) share price has done very well over the last month, posting an excellent gain of 30%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 64% share price drop in the last twelve months.

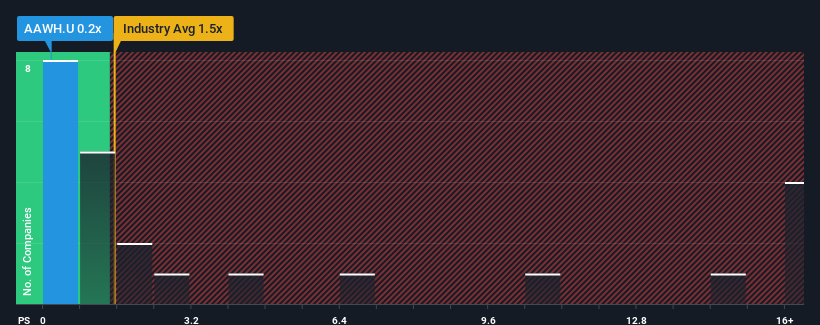

Although its price has surged higher, Ascend Wellness Holdings may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Personal Products industry in Canada have P/S ratios greater than 2.2x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

We've discovered 2 warning signs about Ascend Wellness Holdings. View them for free.View our latest analysis for Ascend Wellness Holdings

What Does Ascend Wellness Holdings' Recent Performance Look Like?

Recent times haven't been great for Ascend Wellness Holdings as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Ascend Wellness Holdings will help you uncover what's on the horizon.How Is Ascend Wellness Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Ascend Wellness Holdings would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. The latest three year period has also seen an excellent 69% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 2.5% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 3.0% per annum, which is not materially different.

With this in consideration, we find it intriguing that Ascend Wellness Holdings' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Ascend Wellness Holdings' P/S

Shares in Ascend Wellness Holdings have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ascend Wellness Holdings' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Ascend Wellness Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Ascend Wellness Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AAWH.U

Ascend Wellness Holdings

Engages in the cultivation, manufacture, and distribution of cannabis consumer packaged goods in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives