- Canada

- /

- Healthcare Services

- /

- TSX:WELL

A Piece Of The Puzzle Missing From WELL Health Technologies Corp.'s (TSE:WELL) 27% Share Price Climb

The WELL Health Technologies Corp. (TSE:WELL) share price has done very well over the last month, posting an excellent gain of 27%. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

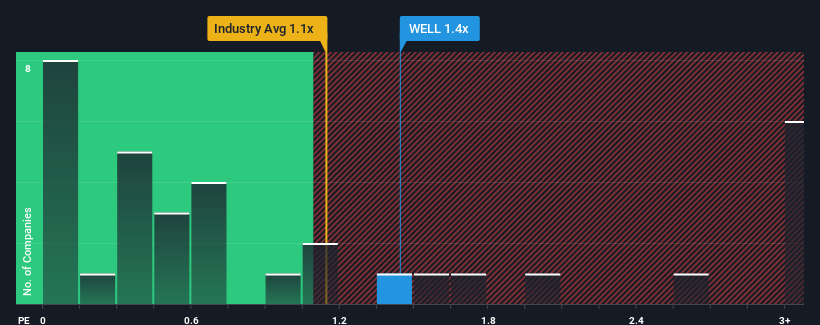

In spite of the firm bounce in price, there still wouldn't be many who think WELL Health Technologies' price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Canada's Healthcare industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for WELL Health Technologies

How WELL Health Technologies Has Been Performing

WELL Health Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on WELL Health Technologies will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For WELL Health Technologies?

WELL Health Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.5% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.2% per annum, which is noticeably less attractive.

With this information, we find it interesting that WELL Health Technologies is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does WELL Health Technologies' P/S Mean For Investors?

WELL Health Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at WELL Health Technologies' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 3 warning signs for WELL Health Technologies (1 is potentially serious!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives