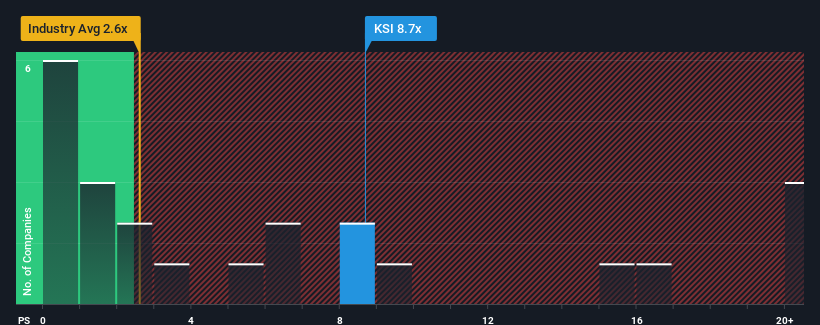

There wouldn't be many who think kneat.com, inc.'s (TSE:KSI) price-to-sales (or "P/S") ratio of 8.7x is worth a mention when the median P/S for the Healthcare Services industry in Canada is similar at about 7.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for kneat.com

What Does kneat.com's Recent Performance Look Like?

kneat.com could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think kneat.com's future stacks up against the industry? In that case, our free report is a great place to start.How Is kneat.com's Revenue Growth Trending?

In order to justify its P/S ratio, kneat.com would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 40% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 18% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that kneat.com's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does kneat.com's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, kneat.com's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for kneat.com (of which 2 are a bit concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KSI

kneat.com

Designs, develops, and supplies software for data and document management within regulated environments in North America, Europe, and the Asia Pacific.

Good value with adequate balance sheet.

Market Insights

Community Narratives