Extendicare Inc. (TSE:EXE) has announced that it will pay a dividend of CA$0.04 per share on the 15th of August. Based on this payment, the dividend yield on the company's stock will be 6.4%, which is an attractive boost to shareholder returns.

See our latest analysis for Extendicare

Extendicare's Dividend Is Well Covered By Earnings

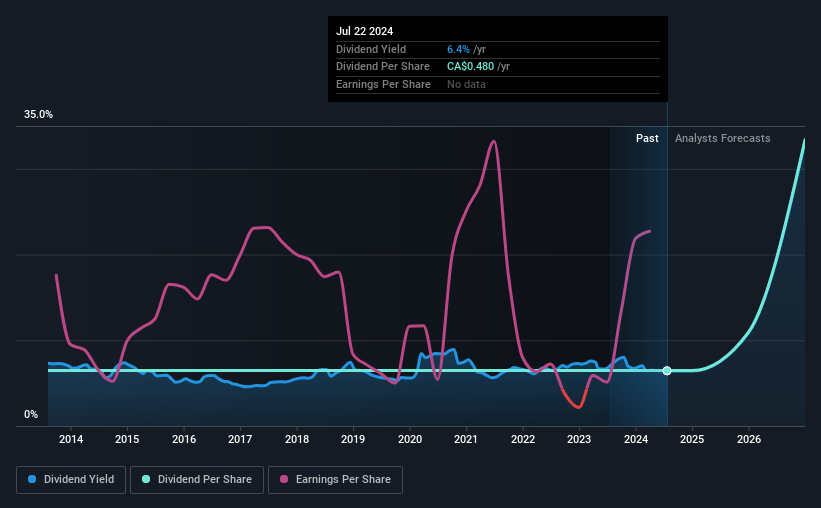

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, the dividend made up 114% of earnings, and the company was generating negative free cash flows. This high of a dividend payment could start to put pressure on the balance sheet in the future.

Over the next year, EPS could expand by 46.5% if the company continues along the path it has been on recently. If recent patterns in the dividend continue, the payout ratio in 12 months could be 76% which is a bit high but can definitely be sustainable.

Extendicare Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The most recent annual payment of CA$0.48 is about the same as the annual payment 10 years ago. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Extendicare Might Find It Hard To Grow Its Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Extendicare has impressed us by growing EPS at 47% per year over the past five years. Strong earnings is nice to see, but unless this can be sustained on minimal reinvestment of profits, we would question whether dividends will follow suit.

Extendicare's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Extendicare's payments, as there could be some issues with sustaining them into the future. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. To that end, Extendicare has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Extendicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EXE

Extendicare

Through its subsidiaries, provides care and services for seniors in Canada.

Solid track record established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success