The board of Saputo Inc. (TSE:SAP) has announced that it will pay a dividend on the 16th of September, with investors receiving CA$0.18 per share. This means the dividend yield will be fairly typical at 2.1%.

See our latest analysis for Saputo

Saputo's Payment Has Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. At the time of the last dividend payment, Saputo was paying out a very large proportion of what it was earning and 147% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Over the next year, EPS is forecast to expand by 139.6%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 36% which would be quite comfortable going to take the dividend forward.

Saputo Has A Solid Track Record

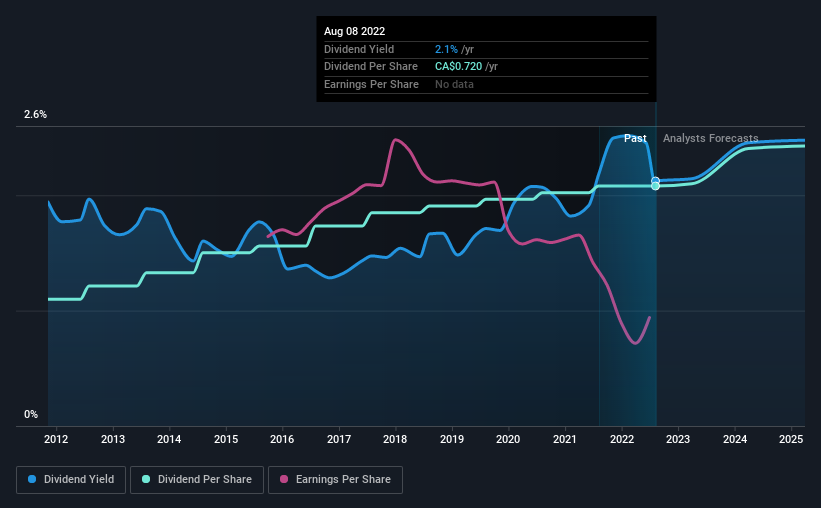

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of CA$0.38 in 2012 to the most recent total annual payment of CA$0.72. This implies that the company grew its distributions at a yearly rate of about 6.6% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Saputo's EPS has fallen by approximately 15% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Saputo's payments, as there could be some issues with sustaining them into the future. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for Saputo you should be aware of, and 1 of them is a bit unpleasant. Is Saputo not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.