How Saputo’s (TSX:SAP) Major Share Buyback Has Changed Its Capital Allocation Story

Reviewed by Sasha Jovanovic

- On November 14, 2025, Saputo Inc. (TSX:SAP) announced a normal course issuer bid authorizing the repurchase of up to 20,498,278 shares, or 5% of its issued share capital, by November 18, 2026, paying cash at market prices.

- This major buyback forms part of Saputo’s broader capital allocation approach, signaling management’s confidence in the company's long-term strategy and financial position.

- We will examine how Saputo's substantial share repurchase plan intersects with its capital allocation priorities and forward-looking investment thesis.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Saputo Investment Narrative Recap

To be a Saputo shareholder today, you need to believe in the long-term global demand for higher-value dairy and the company’s ability to drive sustainable growth through operational efficiency and product innovation. The fresh share buyback signals management’s confidence but does not significantly alter the short-term catalyst, which remains earnings growth from margin expansion; nor does it materially lessen the main risk of shifting consumer preferences toward plant-based alternatives, which could weigh on future revenue growth.

Among recent headlines, the November dividend announcement stands out as most relevant to the buyback, given both reinforce Saputo’s ongoing commitment to returning capital to shareholders. Reliable dividends combined with share repurchases may support investor sentiment, but whether these measures offset long-term risks to traditional dairy demand remains a question.

In contrast, investors should also keep an eye on intensifying consumer demand for non-dairy alternatives, which...

Read the full narrative on Saputo (it's free!)

Saputo's outlook anticipates CA$20.7 billion in revenue and CA$853.8 million in earnings by 2028. This scenario assumes annual revenue growth of 2.7% and a CA$1,006.8 million increase in earnings from the current CA$-153.0 million.

Uncover how Saputo's forecasts yield a CA$37.86 fair value, a 3% downside to its current price.

Exploring Other Perspectives

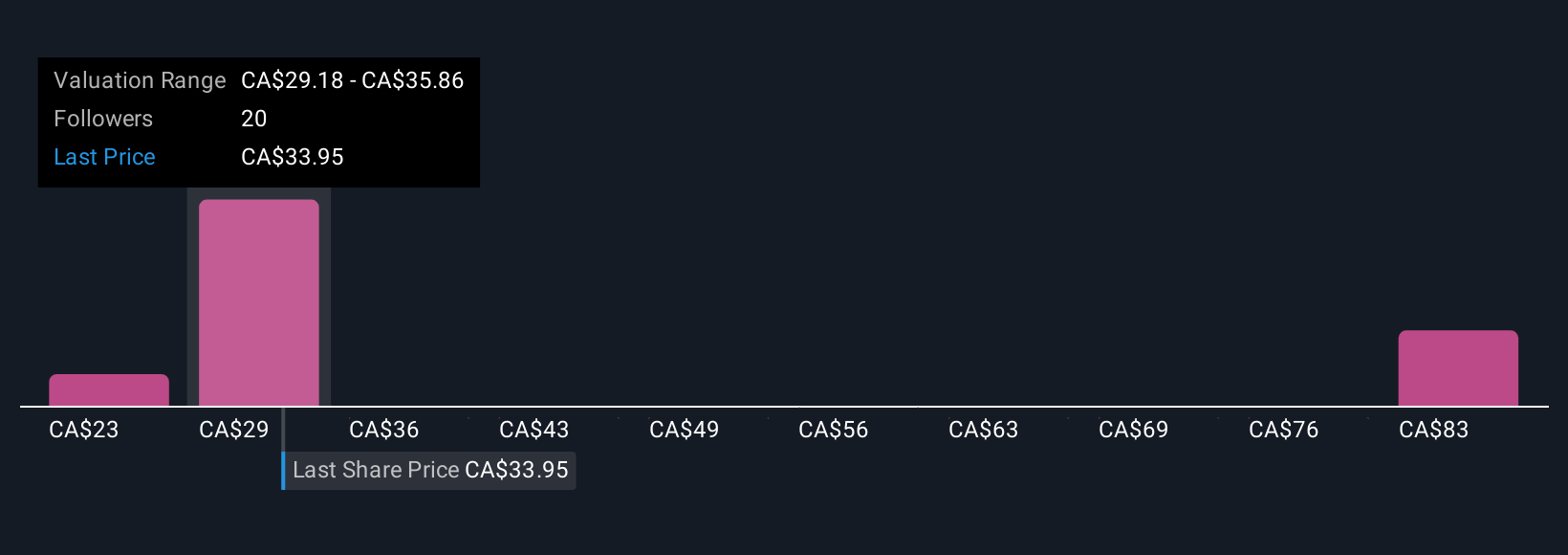

Seven different community fair value estimates for Saputo range widely from CA$22.50 to CA$79.43, reflecting sharp disagreement among Simply Wall St Community members. While some focus on expansion into premium dairy as a growth catalyst, many see the same risks to core dairy demand as central to future performance.

Explore 7 other fair value estimates on Saputo - why the stock might be worth 42% less than the current price!

Build Your Own Saputo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saputo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Saputo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saputo's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives