What Premium Brands Holdings' (TSX:PBH) Raised Revenue Guidance and Dividend Affirmation Mean for Shareholders

Reviewed by Sasha Jovanovic

- Premium Brands Holdings Corporation recently reported third quarter results, noting sales growth to C$1.99 billion, but a net loss of C$1.7 million compared to net income the year prior; the company also raised its full-year 2025 revenue guidance to a new range of C$7.4 billion–C$7.5 billion.

- This update was accompanied by the affirmation of a C$0.85 per share quarterly dividend, emphasizing the company’s ongoing commitment to shareholder returns even amid mixed profitability metrics this quarter.

- We will now examine how raised full-year revenue guidance could impact Premium Brands Holdings’ longer-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Premium Brands Holdings Investment Narrative Recap

To be a shareholder in Premium Brands Holdings, you need to believe in the company’s strategy of scaling premium food manufacturing and distribution, fueled by new facilities and acquisition-led growth. While the recent revenue guidance increase may support the short-term growth catalyst of facility ramp-ups, the third-quarter net loss keeps execution risk and earnings volatility in focus, making the impact of the news mixed as it does not resolve these core risks for now. Of the recent announcements, the updated full-year revenue guidance is most relevant. This forecasted improvement directly ties into the company’s expansion efforts but also places pressure on execution, integration of recent acquisitions, and facility utilization, all key components of Premium Brands’ ongoing growth story and critical to monitoring the durability of its results. However, it’s also important for investors to consider that if operational challenges persist and earnings remain irregular...

Read the full narrative on Premium Brands Holdings (it's free!)

Premium Brands Holdings' outlook forecasts CA$9.2 billion in revenue and CA$558.1 million in earnings by 2028. This scenario assumes a 10.0% annual revenue growth rate and a CA$464.9 million increase in earnings from the current CA$93.2 million.

Uncover how Premium Brands Holdings' forecasts yield a CA$116.00 fair value, a 26% upside to its current price.

Exploring Other Perspectives

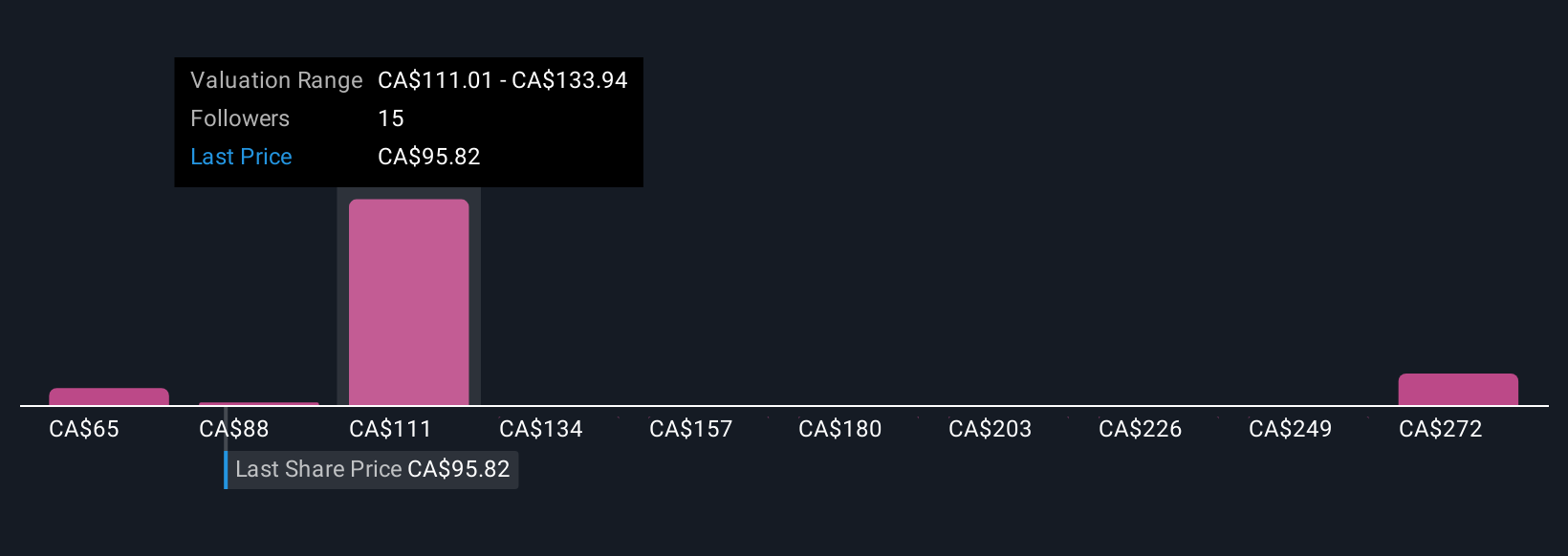

Seven Simply Wall St Community members published fair value estimates for Premium Brands Holdings, ranging widely from CA$65 to CA$404. Earnings volatility and unpredictable facility ramp-ups continue to be top concerns, so weigh these differences in your own analysis.

Explore 7 other fair value estimates on Premium Brands Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Premium Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Premium Brands Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Premium Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Premium Brands Holdings' overall financial health at a glance.

No Opportunity In Premium Brands Holdings?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PBH

Premium Brands Holdings

Manufactures and distributes food products under various brands in the United States, Canada, Asia, Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives