Premium Brands Holdings (TSX:PBH) Valuation Spotlight After Upbeat Revenue Guidance and Mixed Quarterly Results

Reviewed by Simply Wall St

Premium Brands Holdings (TSX:PBH) just raised its full-year revenue guidance, giving investors a clearer picture of management’s optimism about ongoing sales growth, even though quarterly results showed a net loss.

See our latest analysis for Premium Brands Holdings.

The upbeat revenue guidance landed after a volatile stretch, with Premium Brands Holdings’ share price rallying 14.4% year-to-date and its one-year total shareholder return climbing to 20.2%. Recent quarterly news, such as raised sales targets and an affirmed dividend, have helped keep positive momentum intact, even as the company works through earnings challenges.

If the renewed guidance from Premium Brands has you thinking bigger, now’s a great moment to check out fast growing stocks with high insider ownership.

With shares rebounding this year and management projecting even higher sales ahead, the big question is whether Premium Brands Holdings is still undervalued or if investors have already priced in all of its future growth potential.

Most Popular Narrative: 20.8% Undervalued

The most widely followed narrative sees Premium Brands Holdings as trading at a substantial discount to its fair value, given where the last close sits relative to the $116 estimate. This gap is catching the market’s attention and hints at significant upside if narrative assumptions play out.

The ramp-up of several new production facilities and the launch of significant new programs, particularly in the U.S. market, is expected to drive strong organic growth over the next few quarters and years, leveraging rising demand for convenience and ready-to-eat foods. This will accelerate revenue growth and improve operating leverage, positively impacting both top-line and EBITDA.

What’s the math behind that optimism? This narrative’s fair value is built on ambitious growth forecasts, improved margins, and bold profit projections that set it apart from market norms. Want to know which surprise assumptions could power a price surge? Unlock the full story to see the details that make this valuation possible.

Result: Fair Value of $116 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost volatility and unpredictable timing of new facility ramp-ups remain potential hurdles that could disrupt Premium Brands Holdings' path to higher growth.

Find out about the key risks to this Premium Brands Holdings narrative.

Another View: Looking at Earnings Multiples

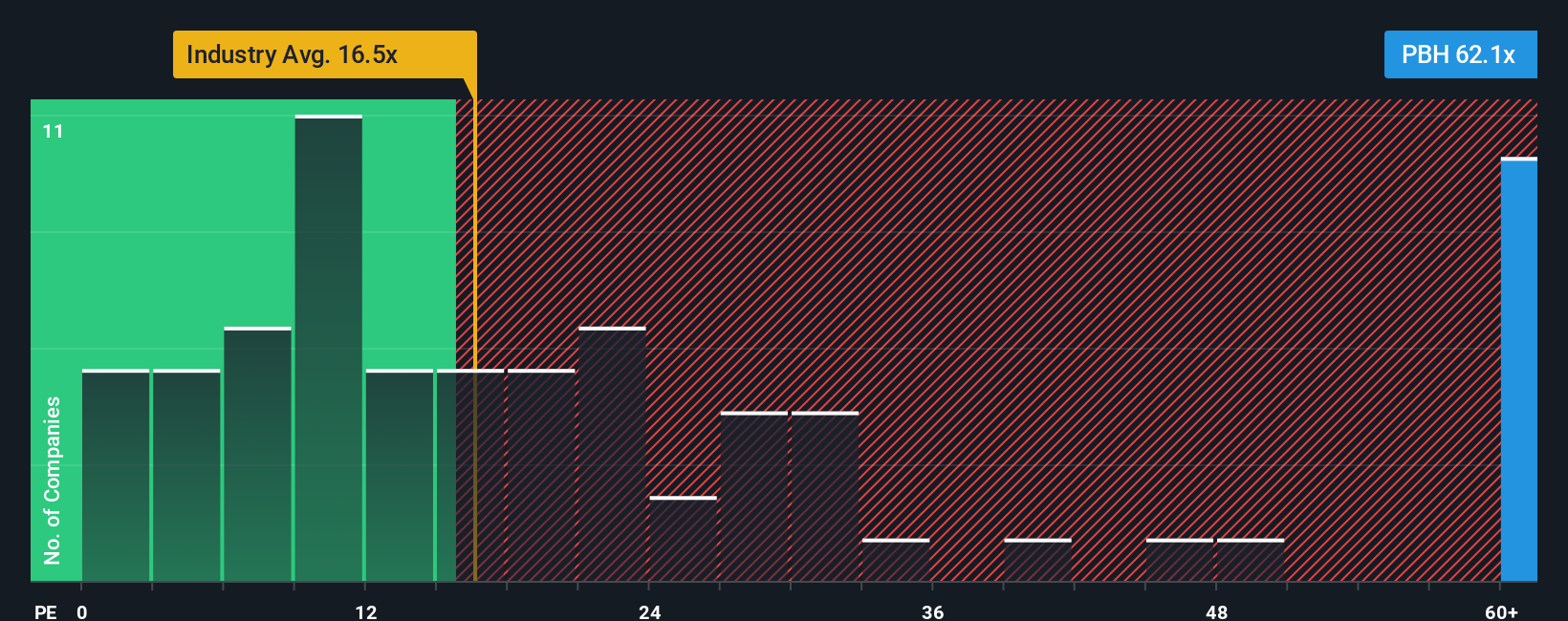

While analysts see Premium Brands Holdings as undervalued based on future earnings potential, a look at its price-to-earnings ratio tells a more cautious story. Shares currently trade at a multiple of 62.1x, which is considerably higher than both the North American food industry average of 16.5x and the peer average of just 11.1x. Even though the fair ratio is estimated to be 67.7x, such a large premium exposes the stock to valuation risk if growth does not meet lofty expectations. Could this high price tag limit future upside, or is it simply a case of paying a premium for quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Premium Brands Holdings Narrative

If you want to dig deeper, explore the numbers firsthand, and craft your own perspective on Premium Brands Holdings, you can get started and Do it your way in under three minutes.

A great starting point for your Premium Brands Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Why limit yourself? Now’s your chance to uncover fast-moving stocks and hidden gems before others catch on. Let Simply Wall Street’s powerful screener help you spot what others might miss.

- Take advantage of powerful trends in artificial intelligence and tap into future growth with these 26 AI penny stocks, which are shaping tomorrow’s breakthroughs today.

- Boost your income potential by checking out these 16 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3% for savvy investors who want steady returns.

- Get ahead of the market with these 926 undervalued stocks based on cash flows and pinpoint overlooked stocks trading below their true value for those seeking the next big win.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PBH

Premium Brands Holdings

Manufactures and distributes food products under various brands in the United States, Canada, Asia, Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives