Maple Leaf Foods (TSX:MFI) Surges 1,415% Earnings—Profit Jump Challenges Bearish Growth Narratives

Reviewed by Simply Wall St

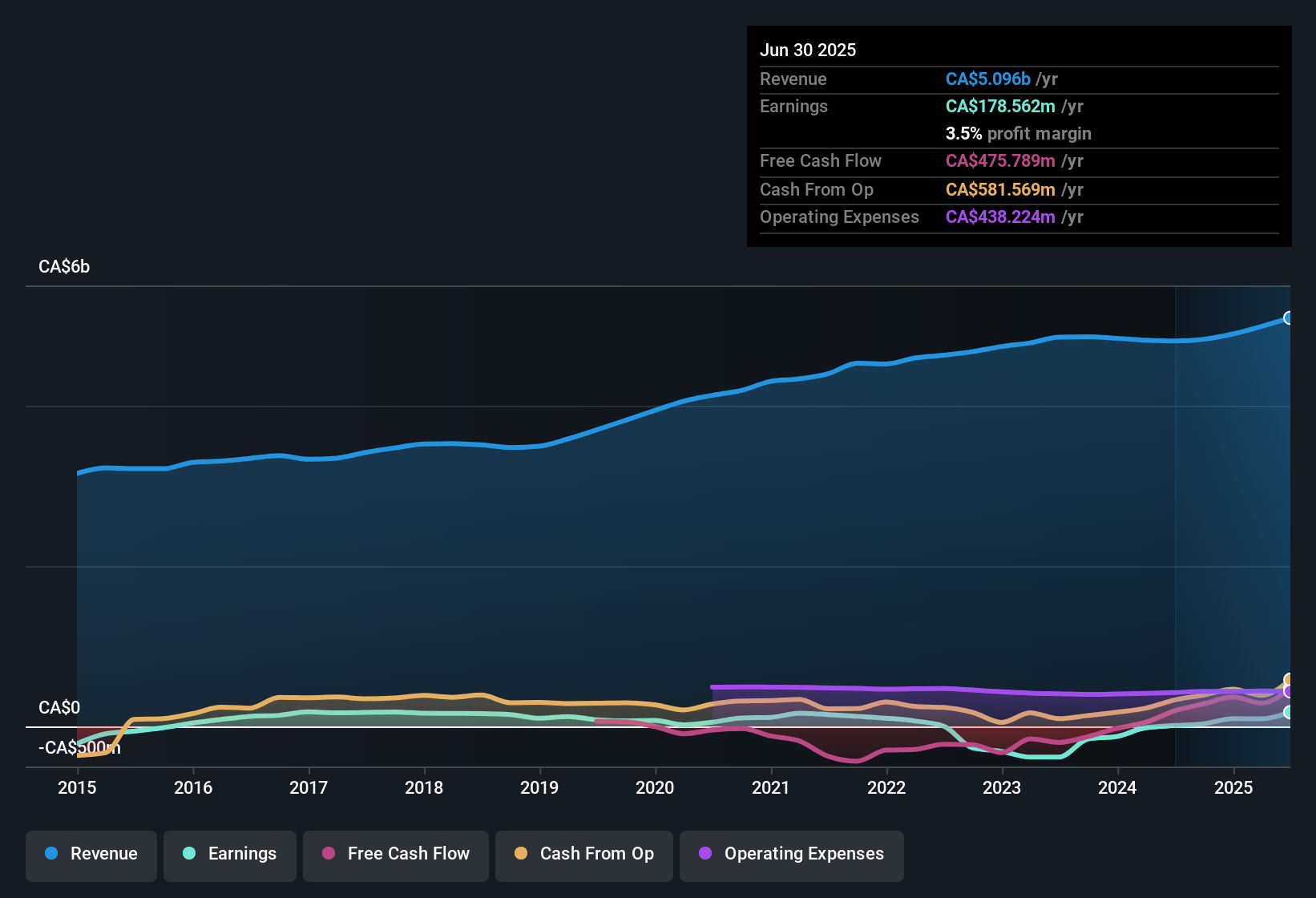

Maple Leaf Foods (TSX:MFI) delivered a remarkable 1,415.3% earnings growth over the past year, a dramatic turnaround from its five-year average annual decline of 13.2%. Net profit margin also improved sharply to 3.5%, up from just 0.2% a year ago, even as forecasted annual revenue growth of 3% lags behind the broader Canadian market’s 5.1% pace. With shares trading below both analyst-derived fair value estimates and average peer valuations, but carrying a P/E ratio of 17.4x, the results highlight robust profitability and attractive dividends, although there are ongoing concerns around the company’s financial position and growth outlook.

See our full analysis for Maple Leaf Foods.The next section breaks down how these numbers stack up against the most widely followed narratives, highlighting where sentiment matches reality and where surprises emerge.

See what the community is saying about Maple Leaf Foods

Margin Expansion Drives Upward Guidance

- Adjusted EBITDA margins are forecast to rise from 1.9% today to 8.3% by 2028, suggesting margin growth is poised to outpace top-line momentum over the next three years.

- Analysts' consensus view spotlights efficiency gains through automation and supply chain improvements, such as the Bacon Center of Excellence and the London Poultry facility, as main contributors.

- Ongoing investments and a strong innovation pipeline are projected to broaden the product mix and push Maple Leaf Foods further into value-added categories, supporting lasting margin enhancement.

- Consensus also notes that rising demand for high-protein and sustainable foods, plus double-digit growth in sustainable meats, provides a tailwind for pricing power and improved profitability.

- What’s notable is that despite margin gains, Maple Leaf’s profitability remains exposed to nonrecurring items and the normalization of pork market conditions.

- Consensus narrative notes one-time benefits and global protein trade volatility as elements that could disrupt the projected path to higher margins over time.

- Continued inflationary pressures and uncertain consumer response to price increases are cited as risks that could moderate these ambitious margin targets.

Strategic Spin-Off Unlocks Value Potential

- The planned spin-off of Canada Packers will separate Maple Leaf’s core business into two focused entities, each with tailored investment and operational priorities aimed at capital allocation and clearer growth pathways.

- Analysts' consensus view connects this restructuring to expected shareholder value creation.

- The new structure is seen as a catalyst for improved capital allocation and distinct earnings growth, although the lack of separate margin targets currently adds uncertainty to the narrative.

- Consensus highlights that this move is expected to provide operational agility, but also flags execution risk and the possibility of disrupted financial performance if value leakage occurs.

Discount to Target Despite Higher P/E

- Shares currently trade at $24.92, which is not only below the consensus price target of $36.56 but also below average peer valuations, despite a P/E ratio of 17.4x, slightly higher than the North American food industry average of 16.7x.

- According to analysts' consensus, this valuation setup frames Maple Leaf Foods as good value given its high quality earnings and attractive dividend.

- Yet, analysts caution that the company’s financial position and relatively slow forecasted revenue growth (3% annually versus the industry’s 5.1%) require vigilance, especially if anticipated margin and innovation gains do not fully materialize.

- The consensus emphasizes the importance of monitoring execution on upcoming initiatives, as failure to deliver on automation, innovation, or spin-off strategy could alter the current discount to target pricing.

- Ready to see how the full balanced narrative fits Maple Leaf’s latest performance? 📊 Read the full Maple Leaf Foods Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Maple Leaf Foods on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your perspective and shape your own investment narrative in just a few minutes. Do it your way

A great starting point for your Maple Leaf Foods research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite improving margins, Maple Leaf Foods remains vulnerable to balance sheet concerns and unpredictable financial performance if execution falters on planned initiatives.

If you want to focus on companies with healthier finances and less uncertainty, target those with stronger profiles by using our solid balance sheet and fundamentals stocks screener (1979 results) for greater peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives