Lassonde Industries (TSX:LAS.A): What Recent Gains Reveal About Valuation and Investor Opportunity

Reviewed by Simply Wall St

Lassonde Industries (TSX:LAS.A) stock has seen some interesting moves this month, catching the eye of investors tracking performance in the Canadian food and beverage sector. Its returns over the past year invite a closer look at current valuation trends.

See our latest analysis for Lassonde Industries.

Lassonde’s share price has steadily advanced this year, with a year-to-date gain of 15.6%. Its 1-year total shareholder return of 15% suggests momentum is building following a period of strong three-year growth near 100%.

If you’re curious where opportunities like this could lead, broaden your perspective and discover fast growing stocks with high insider ownership.

With the share price trending higher and strong financial growth in recent years, the big question remains: is Lassonde Industries still trading below its true value, or is the market already factoring in all the upside?

Most Popular Narrative: 15% Undervalued

With Lassonde Industries’ last close at CA$215 and the narrative’s fair value implied at CA$254, this latest analysis suggests the current price could be lagging improving fundamentals. That premium tells a story of expected business transformation and lasting market advantages if the profit trajectory holds.

The company's investment in local production capacity, such as in-house juice box production in North Carolina and planned expansion in New Jersey, aligns with growing consumer preference for sustainable and locally-sourced products. This also enables operational efficiencies that can enhance net margins in the U.S. market.

What is driving this optimism? There are bold projections about margins and profitability that not many investors have priced in. Curious which levers, from U.S. expansion to new packaging technology, are seen as transforming future earnings and long-term valuation? The outlook behind this narrative is full of unexpected details. Unlock the full story to see how these specific growth bets translate into that premium fair value.

Result: Fair Value of $254 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, juice market contraction and ongoing commodity cost volatility could challenge Lassonde’s growth story if these trends persist or if margin pressures increase.

Find out about the key risks to this Lassonde Industries narrative.

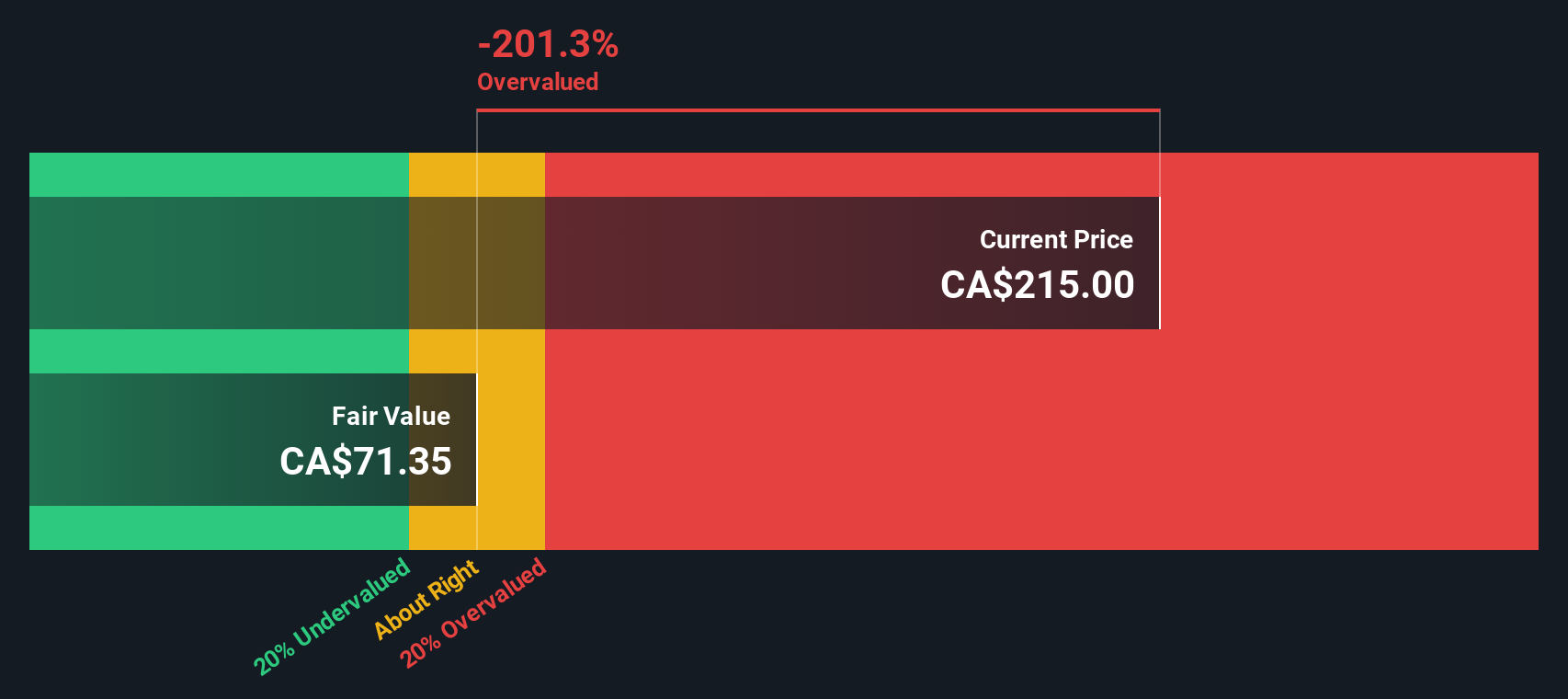

Another View: Discounted Cash Flow Tells a Different Story

While the market’s valuation looks attractive compared to industry averages, our DCF model paints a less optimistic picture. Based on estimated future cash flows, Lassonde shares appear overvalued at current levels. Which method offers a more accurate perspective on where the price is headed next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lassonde Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lassonde Industries Narrative

If you'd like to dig into the numbers your own way or test different valuation assumptions, you can craft a personal view in just minutes using our tools. Do it your way

A great starting point for your Lassonde Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make sure you give yourself every advantage by checking out stocks that are gaining momentum in other fast-moving sectors. Don’t let exceptional opportunities pass you by in today’s markets. Smart moves start with live data and fresh insights.

- Unlock the potential of rapidly growing industries by checking out these 25 AI penny stocks where artificial intelligence is fueling tomorrow’s leaders.

- Boost your portfolio’s income stream by seeing which companies are paying out attractive yields with these 16 dividend stocks with yields > 3% right now.

- Capitalize on pricing inefficiencies before others do by reviewing these 874 undervalued stocks based on cash flows for fundamentally strong stocks trading below their worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAS.A

Lassonde Industries

Develops, manufactures, and markets a range of ready-to-drink beverages, fruit-based snacks, frozen juice concentrates, and specialty food products in Canada, the United States, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives