Stock Analysis

As the first half of 2024 concludes, the Canadian market has shown resilience with a solid performance, particularly benefiting from sectors like utilities and gold while maintaining lower volatility. This positive trajectory, coupled with favorable economic indicators and potential central bank rate cuts, sets an optimistic backdrop for investors. In this context, dividend stocks remain appealing due to their potential for steady income and relative stability amidst fluctuating markets.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.77% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.17% | ★★★★★★ |

| Enghouse Systems (TSX:ENGH) | 3.40% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.46% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.29% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.86% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.53% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.26% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.07% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Enghouse Systems (TSX:ENGH)

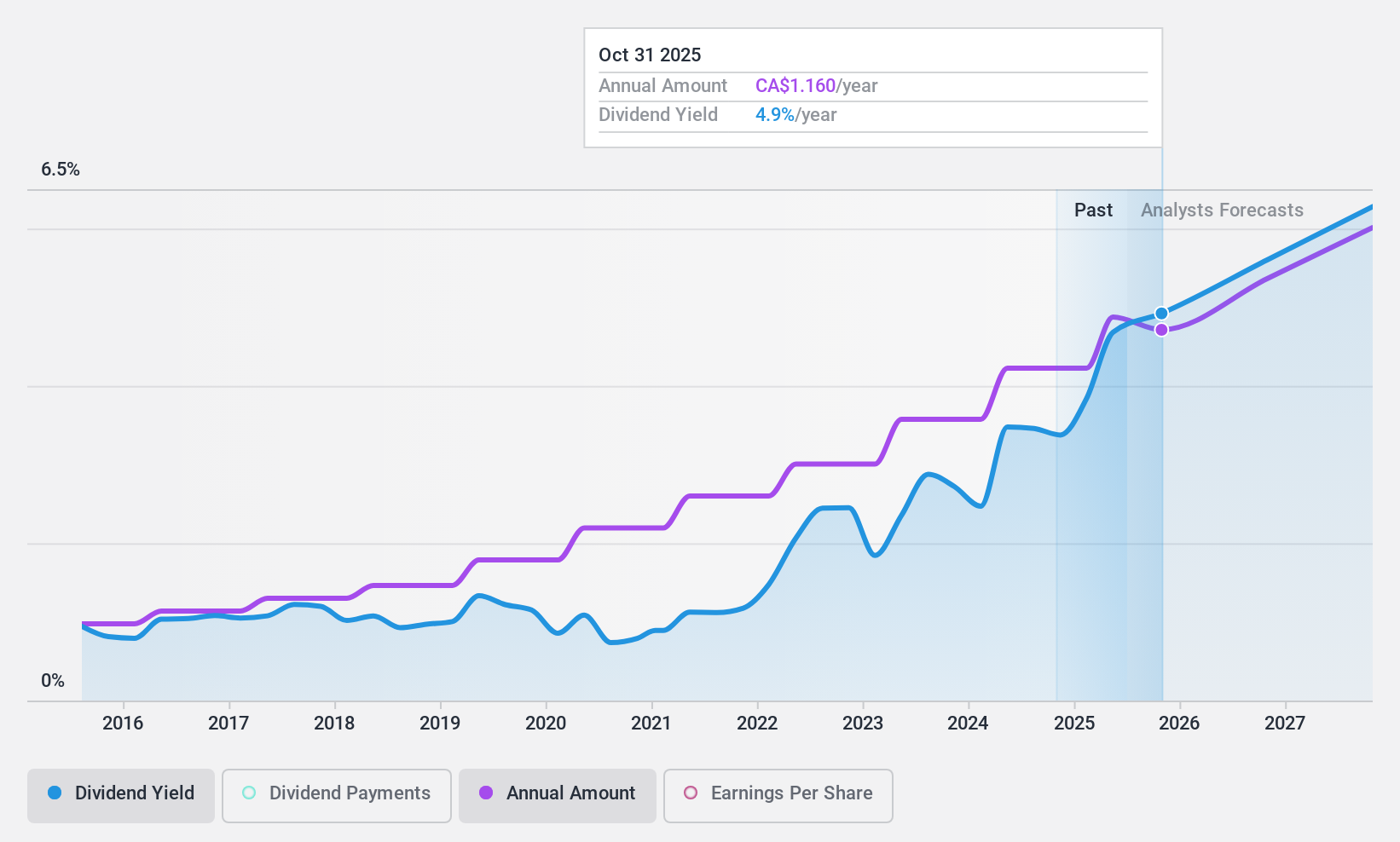

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited is a global provider of enterprise software solutions with a market capitalization of approximately CA$1.67 billion.

Operations: Enghouse Systems Limited generates revenue through two main segments: the Asset Management Group, which brought in CA$180.88 million, and the Interactive Management Group, with revenues of CA$299.55 million.

Dividend Yield: 3.4%

Enghouse Systems Limited has shown a solid financial performance with a notable increase in both revenue and net income as of the second quarter of 2024, with revenues rising to CAD 125.81 million from CAD 113.46 million year-over-year. The company maintains a sustainable dividend, evidenced by a cash payout ratio of 45.8% and an earnings coverage ratio of 65.7%. Despite this, its dividend yield stands at 3.4%, which is lower than the top quartile of Canadian dividend payers at 6.62%. Additionally, Enghouse's commitment to returning value to shareholders is demonstrated through its recent share buyback activities and consistent dividend payments over the past decade.

- Unlock comprehensive insights into our analysis of Enghouse Systems stock in this dividend report.

- According our valuation report, there's an indication that Enghouse Systems' share price might be on the cheaper side.

High Liner Foods (TSX:HLF)

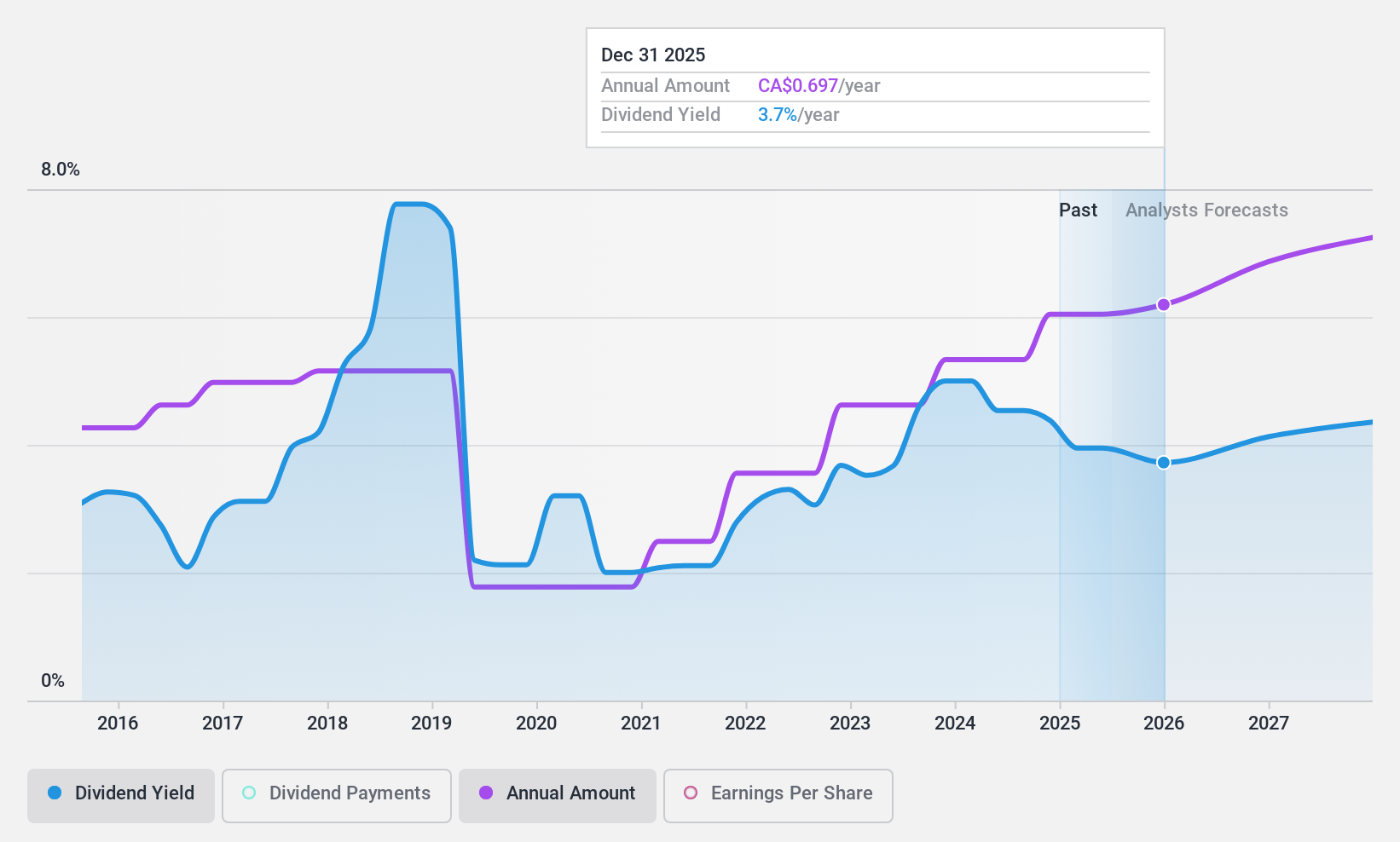

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated, with a market capitalization of CA$407.29 million, specializes in processing and marketing frozen seafood products across North America.

Operations: High Liner Foods generates CA$1.03 billion from its core activity of producing and selling prepared and packaged frozen seafood.

Dividend Yield: 4.5%

High Liner Foods has recently announced a share repurchase program and appointed Darryl Bergman as CFO, indicating management's confidence and strategic planning for growth. Despite a 13% decrease in sales volume Q1 2024, the firm maintained its quarterly dividend at CAD 0.15 per share. Financially, High Liner shows stability with dividends well-covered by earnings (payout ratio: 41.5%) and cash flows (cash payout ratio: 8%). However, its dividend yield of 4.45% is below the top Canadian payers' average, reflecting potential concerns about its attractiveness to dividend-focused investors amidst an unstable dividend track record over the past decade.

- Take a closer look at High Liner Foods' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that High Liner Foods is priced lower than what may be justified by its financials.

Richards Packaging Income Fund (TSX:RPI.UN)

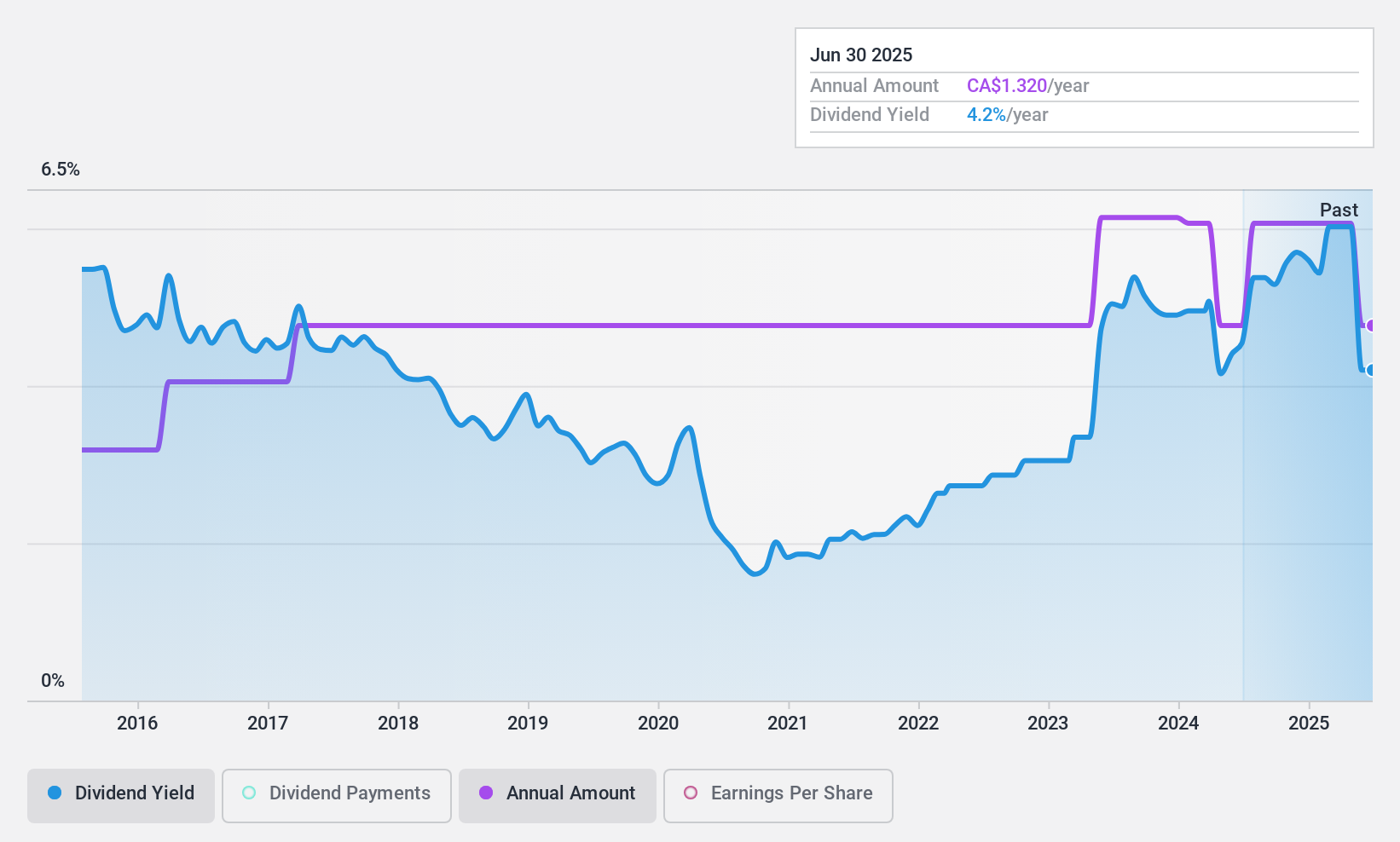

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, operating in North America, specializes in the design, manufacture, and distribution of packaging containers and healthcare supplies, with a market capitalization of CA$318.24 million.

Operations: Richards Packaging Income Fund generates CA$416.97 million in revenue from its wholesale miscellaneous segment.

Dividend Yield: 4.5%

Richards Packaging Income Fund has consistently paid monthly dividends, recently affirming a CAD 0.11 distribution, reflecting its commitment to shareholder returns despite a slight dip in Q1 2024 earnings with sales dropping from CAD 106.83 million to CAD 97.88 million and net income decreasing to CAD 8.49 million from CAD 9.8 million year-over-year. The company's dividend yield stands at 4.55%, lower than the top Canadian dividend payers, but it boasts a stable and reliable dividend history over the past decade, supported by a low payout ratio of 38.5% and cash payout ratio of 19.4%, ensuring sustainability even amid fluctuating earnings.

- Navigate through the intricacies of Richards Packaging Income Fund with our comprehensive dividend report here.

- Our valuation report here indicates Richards Packaging Income Fund may be undervalued.

Make It Happen

- Delve into our full catalog of 33 Top TSX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether High Liner Foods is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HLF

High Liner Foods

Processes and markets frozen seafood products in North America.

Good value with adequate balance sheet and pays a dividend.