GURU Organic Energy Corp.'s (TSE:GURU) Share Price Is Still Matching Investor Opinion Despite 25% Slump

The GURU Organic Energy Corp. (TSE:GURU) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

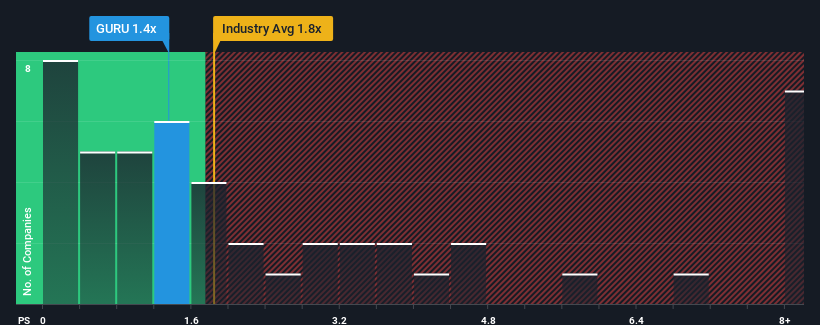

Even after such a large drop in price, it's still not a stretch to say that GURU Organic Energy's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Beverage industry in Canada, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for GURU Organic Energy

What Does GURU Organic Energy's Recent Performance Look Like?

Recent times haven't been great for GURU Organic Energy as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GURU Organic Energy.Is There Some Revenue Growth Forecasted For GURU Organic Energy?

The only time you'd be comfortable seeing a P/S like GURU Organic Energy's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. The solid recent performance means it was also able to grow revenue by 11% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 5.3% over the next year. That's shaping up to be similar to the 3.4% growth forecast for the broader industry.

With this information, we can see why GURU Organic Energy is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On GURU Organic Energy's P/S

With its share price dropping off a cliff, the P/S for GURU Organic Energy looks to be in line with the rest of the Beverage industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at GURU Organic Energy's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for GURU Organic Energy you should be aware of.

If you're unsure about the strength of GURU Organic Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GURU

GURU Organic Energy

A beverage company, produces, markets, and distributes natural, plant-based, and organic energy drinks in Canada and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives