Andrew Peller (TSX:ADW.A) Returns to Profitability, Challenging Bearish Growth Narratives

Reviewed by Simply Wall St

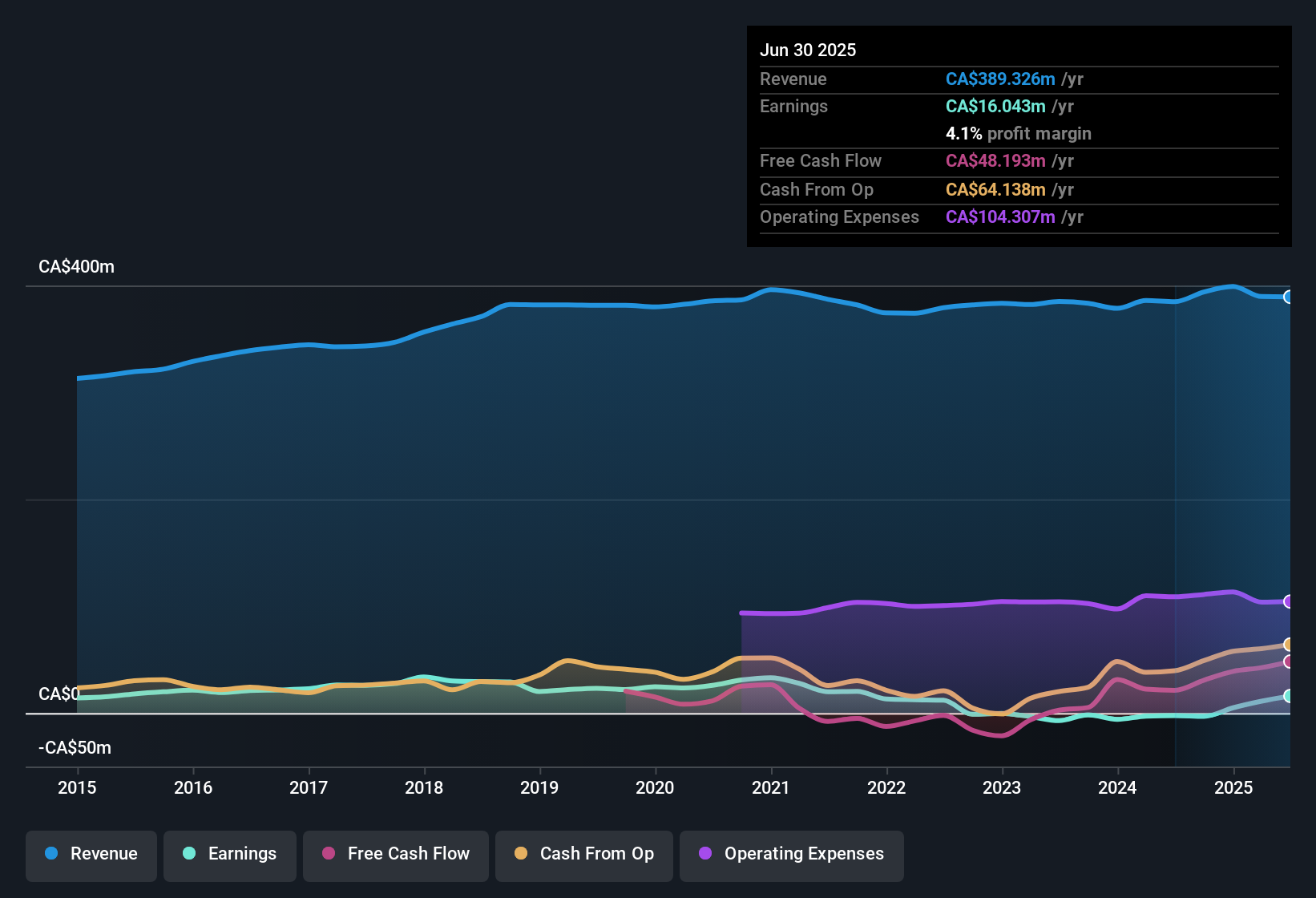

Andrew Peller (TSX:ADW.A) has posted a notable swing to profitability over the past year, delivering high-quality earnings after several years of trailing results. Despite returning to the black, the company’s earnings have fallen by 50% per year over the past five years, making direct year-over-year growth comparisons complicated. With a Price-To-Earnings ratio of 13.9x versus a peer average of 9.2x but below the global sector average, and a current share price of CA$5.14, well below the estimated fair value of CA$21.34, investors are left weighing the positives of improved profit margins and perceived value against clear signals of weak growth and financial position risk.

See our full analysis for Andrew Peller.Next, we’ll see how these headline numbers match up to the most prominent narratives debated by the market and Simply Wall St’s community. Expect some consensus, and maybe even a few surprises.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Swing Positive

- Andrew Peller became profitable this year, shifting from previous years of net losses to a positive net profit margin. This marks a significant turn in operational performance compared to its long-term annual earnings decline of 50% per year.

- Recent profitability directly tests the idea that the company’s fundamentals remain sound despite sector headwinds.

- This run of profit supports the argument that Andrew Peller can still generate quality earnings. This challenges fears that sector and company pressures would prevent a return to profitability.

- However, ongoing margin pressures and the challenging beverage sector make it unclear if this positive margin is durable without further evidence of cost control or revenue growth.

Dividend Stays Attractive Amid Weak Growth

- While neither revenue nor earnings are expected to grow in coming periods according to the filing, Andrew Peller continues to offer an attractive dividend. This may offset concerns about stagnating performance.

- The steady dividend payment is central to debates about the company’s risk versus reward.

- Bulls see the dividend as a reason to hold through tough cycles, arguing the payout creates a cushion even as top-line growth is limited.

- Bears point to the absence of earnings or revenue growth as an elevated risk, stating that a dividend alone may not be enough if profitability falters again.

Valuation Stands Out Versus Peers

- The company trades at a Price-To-Earnings ratio of 13.9x, above the peer average of 9.2x but well below the global beverage sector average of 17.6x. The current share price of CA$5.14 represents a sharp discount to its DCF fair value of CA$21.34.

- This valuation gap sharpens debate on whether the market is underrating Andrew Peller or rightly discounting growth risk.

- The significant gulf between market price and intrinsic value may be compelling for investors who believe margin recovery is sustainable.

- But critics highlight that, relative to direct peers, Andrew Peller is more expensive. This can be hard to justify if top-line or margin improvements do not materialize further.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Andrew Peller's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a recent return to profitability, Andrew Peller’s declining earnings and lack of growth raise questions about the reliability of its financial foundation.

If you’re seeking companies with stronger balance sheets and less financial risk, check out solid balance sheet and fundamentals stocks screener (1979 results) for investment ideas built on healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ADW.A

Andrew Peller

Produces and markets wines and craft beverage alcohol products in Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives