- Canada

- /

- Oil and Gas

- /

- TSX:TAL

3 Canadian Penny Stocks On The TSX With Market Caps Under CA$600M

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and potential interest rate cuts, investors are keenly observing how these factors might influence financial markets. Penny stocks, although considered niche, continue to offer intriguing opportunities for growth, especially when they exhibit strong financial health. In this article, we will explore three Canadian penny stocks on the TSX that stand out for their balance sheet strength and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.73M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$117.08M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$212.76M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$313.02M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.96 | CA$205.89M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$127.98M | ★★★★☆☆ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

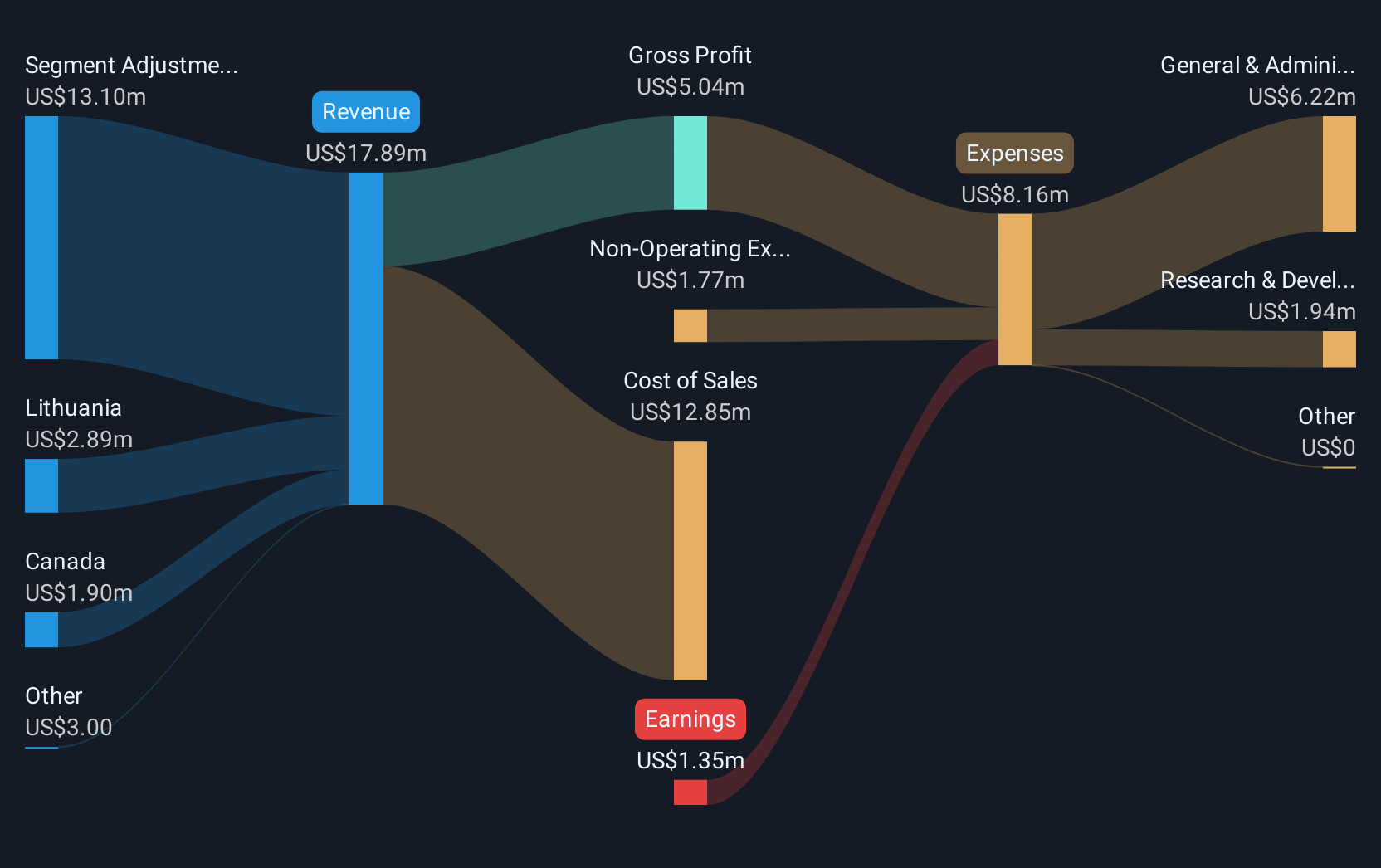

Red Light Holland (CNSX:TRIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Light Holland Corp. focuses on the production, growth, and sale of functional mushrooms and mushroom home grow kits for the recreational market in North America and Europe, with a market cap of CA$14.03 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, amounting to CA$5.11 million.

Market Cap: CA$14.03M

Red Light Holland Corp. has expanded its distribution network significantly with a new partnership with Costco Canada, now offering its Happy Caps Mushroom Home Grow Kits in 82 locations across the country. Despite having a market cap of CA$14.03 million and generating CA$5.11 million in revenue from its Pharmaceuticals segment, the company remains unprofitable with negative returns on equity and volatile stock performance. However, it maintains strong short-term financial health, as its short-term assets exceed liabilities and it holds more cash than debt, providing a stable cash runway for over three years based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Red Light Holland.

- Evaluate Red Light Holland's historical performance by accessing our past performance report.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies to replace synthetic, petrochemical-based adhesives and related products globally, with a market cap of CA$240.49 million.

Operations: EcoSynthetix Inc. has not reported specific revenue segments.

Market Cap: CA$240.49M

EcoSynthetix Inc. recently received a significant follow-on trial order for its product, SurfLock, from a global pulp manufacturer, representing approximately $400,000 in revenue. Despite being unprofitable with a negative return on equity of -4.4%, the company is debt-free and maintains strong financial health with short-term assets of $38.1M far exceeding liabilities of $2.7M. The management team is experienced with an average tenure of 16.6 years, and there has been no meaningful shareholder dilution over the past year, providing stability as it explores opportunities in its billion-dollar addressable market.

- Dive into the specifics of EcoSynthetix here with our thorough balance sheet health report.

- Examine EcoSynthetix's past performance report to understand how it has performed in prior years.

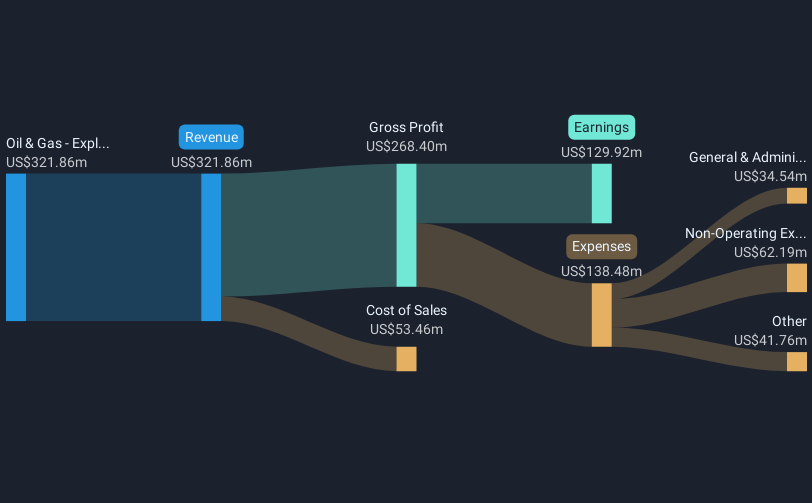

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetroTal Corp. is involved in the development and exploration of oil and natural gas in Peru, South America, with a market cap of CA$593.32 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated $321.86 million.

Market Cap: CA$593.32M

PetroTal Corp. has shown robust financial performance, with a market cap of CA$593.32 million and revenue of US$321.86 million from its oil and gas operations in Peru. The company is debt-free, which alleviates concerns over interest payments, and boasts a high return on equity at 25.5%. Despite recent production challenges due to drought conditions, PetroTal exceeded its production guidance for the year with an average output slightly above expectations. However, future earnings are forecasted to decline by an average of 6% annually over the next three years. Recent strategic moves include a significant stake acquisition by Blue Harbour Capital Securities Fund I and ongoing exploration efforts at the Bretaña field.

- Unlock comprehensive insights into our analysis of PetroTal stock in this financial health report.

- Learn about PetroTal's future growth trajectory here.

Turning Ideas Into Actions

- Take a closer look at our TSX Penny Stocks list of 964 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the development and exploration of oil and natural gas in Peru, South America.

Flawless balance sheet, undervalued and pays a dividend.