- Canada

- /

- Oil and Gas

- /

- TSXV:HAM

Market Participants Recognise Highwood Asset Management Ltd.'s (CVE:HAM) Revenues

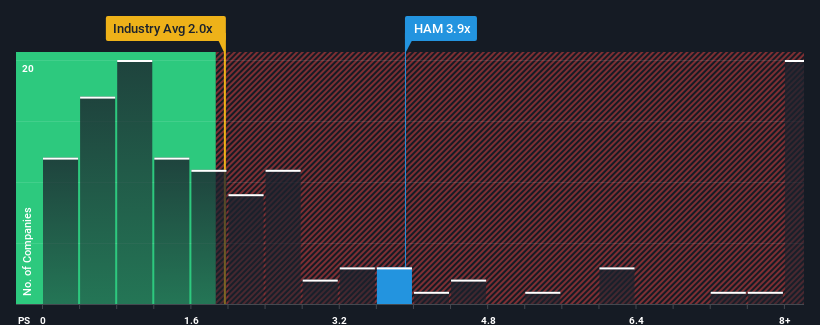

Highwood Asset Management Ltd.'s (CVE:HAM) price-to-sales (or "P/S") ratio of 3.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in Canada have P/S ratios below 2x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Highwood Asset Management

What Does Highwood Asset Management's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Highwood Asset Management has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Highwood Asset Management will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Highwood Asset Management would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 190%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 27% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 619% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 8.8%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Highwood Asset Management's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Highwood Asset Management maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Oil and Gas industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Highwood Asset Management is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Highwood Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:HAM

Highwood Asset Management

Together with its subsidiary, operates as an oil and gas exploration and production company in Canada.

Very undervalued with mediocre balance sheet.

Market Insights

Community Narratives