- Canada

- /

- Oil and Gas

- /

- TSXV:EU

enCore Energy Corp.'s (CVE:EU) Stock Retreats 44% But Revenues Haven't Escaped The Attention Of Investors

enCore Energy Corp. (CVE:EU) shareholders that were waiting for something to happen have been dealt a blow with a 44% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

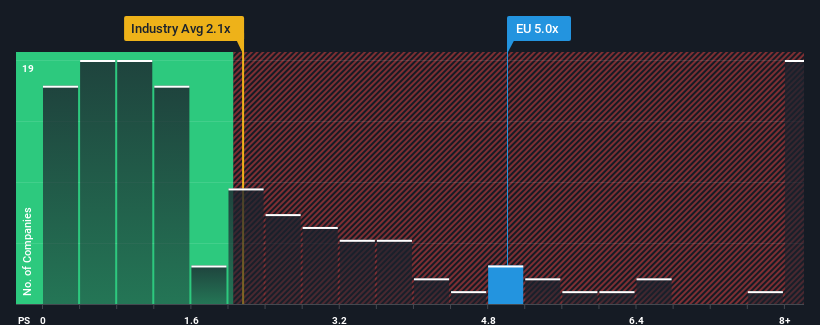

Even after such a large drop in price, you could still be forgiven for thinking enCore Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5x, considering almost half the companies in Canada's Oil and Gas industry have P/S ratios below 2.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for enCore Energy

What Does enCore Energy's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, enCore Energy has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think enCore Energy's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as enCore Energy's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 163%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 46% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 2.2% each year, which is noticeably less attractive.

In light of this, it's understandable that enCore Energy's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From enCore Energy's P/S?

enCore Energy's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into enCore Energy shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for enCore Energy that we have uncovered.

If you're unsure about the strength of enCore Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EU

enCore Energy

Engages in the acquisition, exploration, development, and extraction of uranium resource properties in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives