- Canada

- /

- Energy Services

- /

- TSXV:DVG

Does Divergent Energy Services (CVE:DVG) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Divergent Energy Services (CVE:DVG). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Divergent Energy Services

How Fast Is Divergent Energy Services Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Divergent Energy Services to have grown EPS from US$0.0068 to US$0.022 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

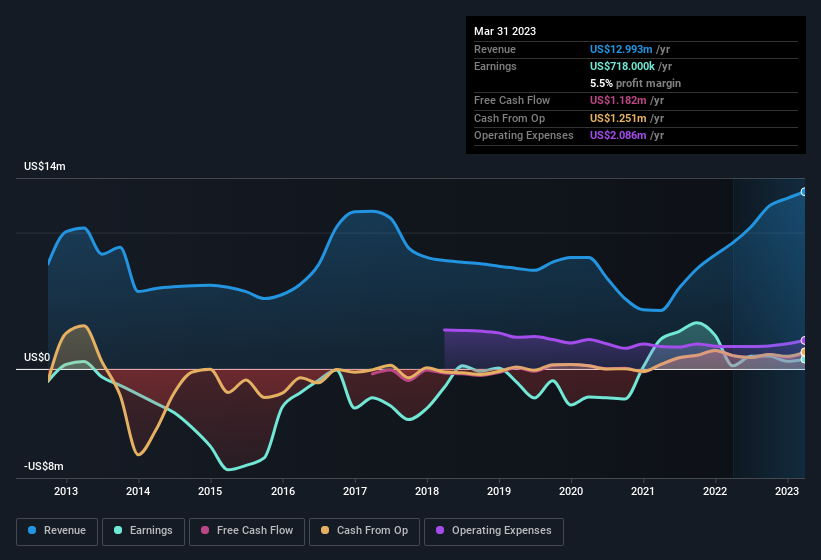

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Divergent Energy Services achieved similar EBIT margins to last year, revenue grew by a solid 40% to US$13m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Divergent Energy Services isn't a huge company, given its market capitalisation of CA$2.3m. That makes it extra important to check on its balance sheet strength.

Are Divergent Energy Services Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for Divergent Energy Services, is that company insiders spent US$31k acquiring shares in the last year. While this investment may be modest, it is great considering the lack of insider selling. We also note that it was the Independent Director, Geoffrey Bury, who made the biggest single acquisition, paying CA$8.3k for shares at about CA$0.075 each.

On top of the insider buying, we can also see that Divergent Energy Services insiders own a large chunk of the company. Actually, with 37% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Although, with Divergent Energy Services being valued at CA$2.3m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to US$857k. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Divergent Energy Services To Your Watchlist?

Divergent Energy Services' earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Divergent Energy Services deserves timely attention. You should always think about risks though. Case in point, we've spotted 3 warning signs for Divergent Energy Services you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Divergent Energy Services isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DVG

Divergent Energy Services

Provides artificial lift products and services to clients in the oil and gas industry in Canada and the United States.

Moderate and good value.

Market Insights

Community Narratives