- Canada

- /

- Oil and Gas

- /

- TSXV:AXL

Arrow Exploration And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates through concerns of rising inflation and a softening labor market, investors are keenly observing potential opportunities amidst the volatility. Penny stocks, once considered relics of past market eras, continue to offer intriguing possibilities for those willing to explore smaller or newer companies with growth potential. By focusing on penny stocks with strong financial health and clear growth trajectories, investors can uncover valuable opportunities even in uncertain times.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.20 | CA$55.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.30 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.29 | CA$43.56M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.95 | CA$18.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.27 | CA$366.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.70 | CA$187.79M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$186.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.68 | CA$8.46M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

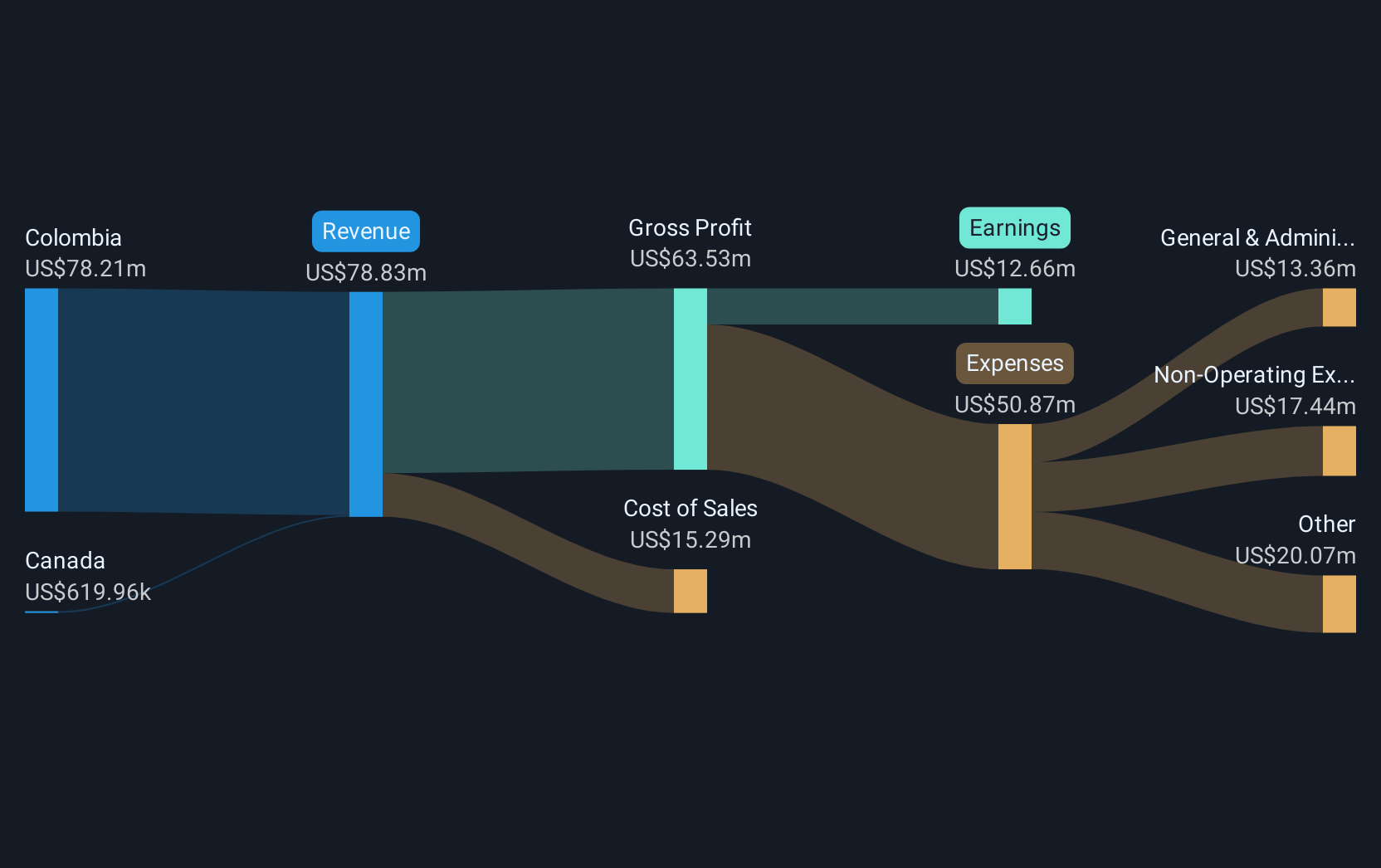

Overview: Arrow Exploration Corp. is a junior oil and gas company focused on acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$75.75 million.

Operations: The company's revenue is derived entirely from its oil and gas exploration and production activities, totaling $79.55 million.

Market Cap: CA$75.75M

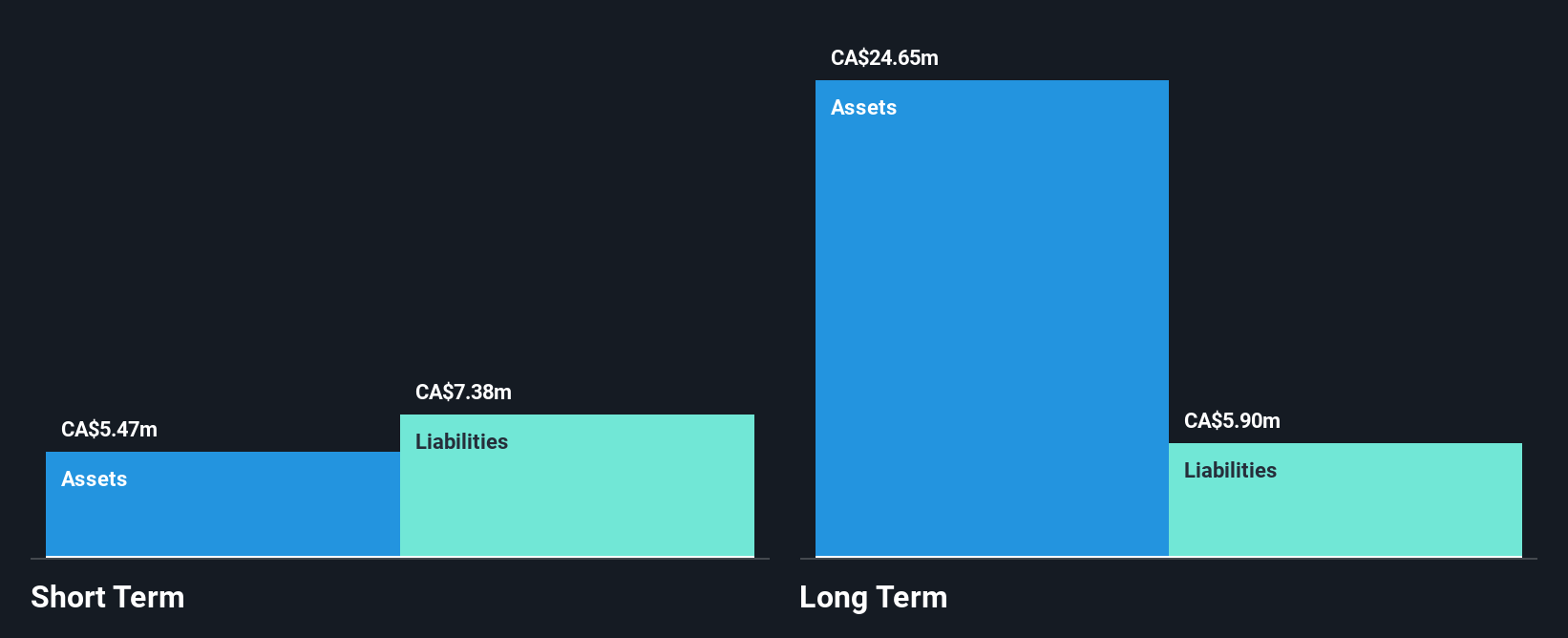

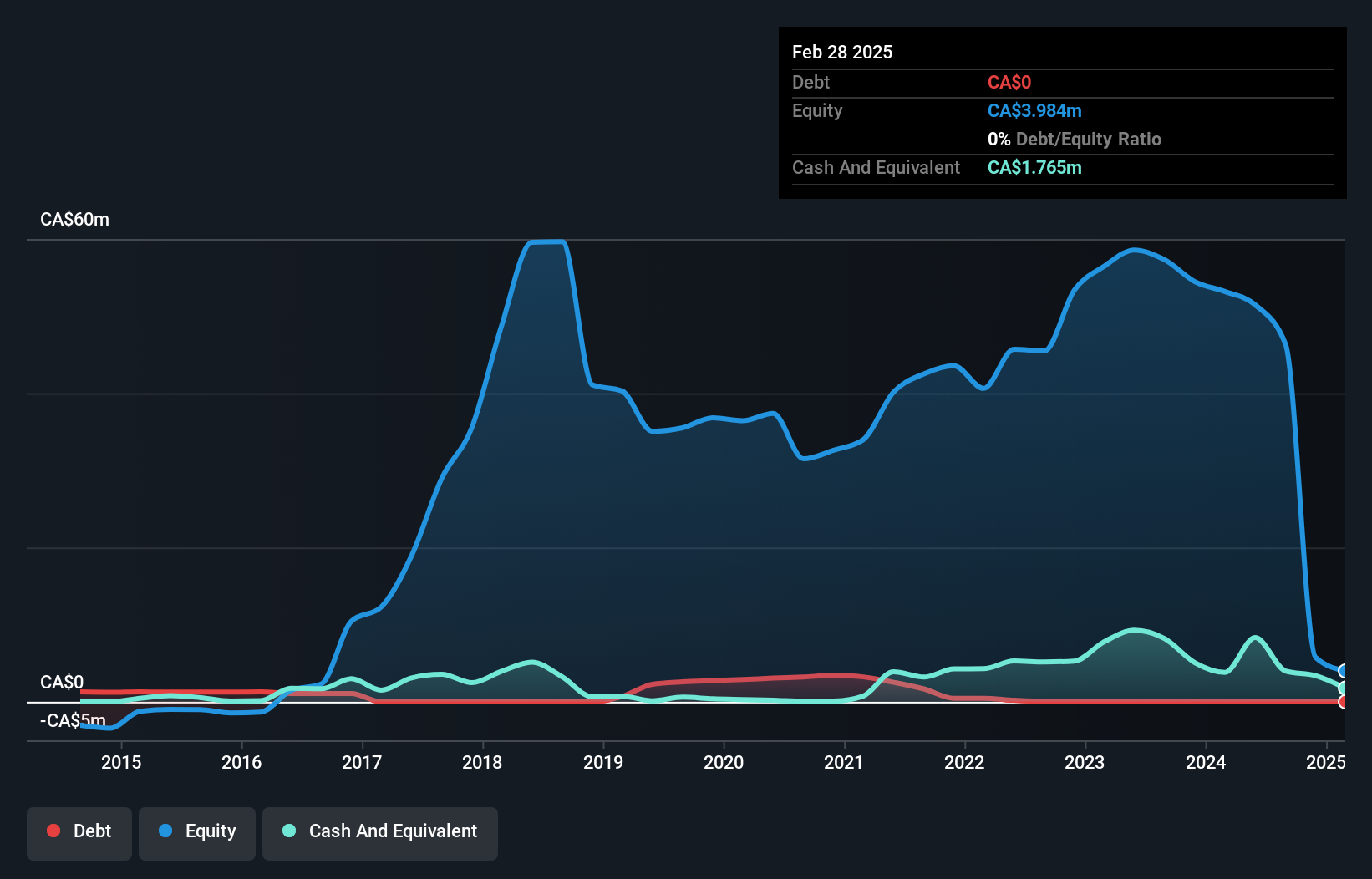

Arrow Exploration has shown significant earnings growth, with an 865.3% increase over the past year, surpassing industry averages. The company maintains a strong balance sheet with no debt and a cash balance of US$13.5 million as of July 2025, enabling flexibility in volatile markets. Despite recent operational challenges and being dropped from the S&P/TSX Venture Composite Index, Arrow continues its drilling program in Colombia's Llanos Basin and plans further exploration at Mateguafa Oeste. Its seasoned management team supports strategic decisions like share buybacks to enhance shareholder value while maintaining operational efficiency amidst fluctuating oil prices.

- Get an in-depth perspective on Arrow Exploration's performance by reading our balance sheet health report here.

- Gain insights into Arrow Exploration's outlook and expected performance with our report on the company's earnings estimates.

MCF Energy (TSXV:MCF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MCF Energy Ltd. is an upstream oil and gas company operating in Europe with a market cap of CA$19.88 million.

Operations: Currently, there are no reported revenue segments for MCF Energy Ltd.

Market Cap: CA$19.88M

MCF Energy Ltd., with a market cap of CA$19.88 million, is currently pre-revenue and has faced increasing losses, reporting a net loss of CA$8.98 million for the second quarter of 2025. The company recently completed a private placement, raising CA$1.1 million to support its operations, including ongoing drilling at the Kinsau-1A well in Germany. Despite having no debt and conducting promising operational updates on its exploration projects, MCF's short-term assets fall short of covering both short-term and long-term liabilities, posing financial challenges amidst its high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of MCF Energy.

- Examine MCF Energy's past performance report to understand how it has performed in prior years.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico with a market cap of CA$25.64 million.

Operations: Wealth Minerals Ltd. does not currently report any revenue segments.

Market Cap: CA$25.64M

Wealth Minerals Ltd., with a market cap of CA$25.64 million, remains pre-revenue and recently announced a private placement to raise up to CA$1 million, potentially extending its cash runway beyond the current 3-month estimate. The company has no debt and stable short-term assets exceeding liabilities, but its share price is highly volatile. Recent strategic moves include forming Kuska Minerals SpA in partnership with a local community for lithium development in Chile and an MOU with Voith Hydro for the Pabellon Lithium Project. Despite these efforts, Wealth Minerals continues to report losses, highlighting ongoing financial challenges.

- Unlock comprehensive insights into our analysis of Wealth Minerals stock in this financial health report.

- Understand Wealth Minerals' track record by examining our performance history report.

Seize The Opportunity

- Click this link to deep-dive into the 410 companies within our TSX Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AXL

Arrow Exploration

Operates a junior oil and gas company that engages in the acquisition, exploration, development, and production of oil and gas properties in Colombia and Western Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives