W. Guest has been the CEO of Valeura Energy Inc. (TSE:VLE) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Valeura Energy pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Valeura Energy

Comparing Valeura Energy Inc.'s CEO Compensation With the industry

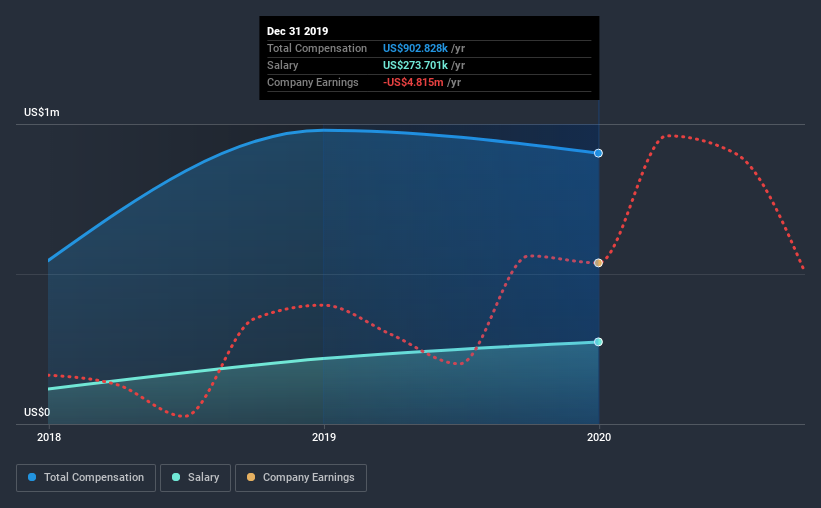

According to our data, Valeura Energy Inc. has a market capitalization of CA$40m, and paid its CEO total annual compensation worth CA$903k over the year to December 2019. That's a slight decrease of 7.8% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$274k.

For comparison, other companies in the industry with market capitalizations below CA$261m, reported a median total CEO compensation of CA$307k. This suggests that W. Guest is paid more than the median for the industry. What's more, W. Guest holds CA$166k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$274k | CA$218k | 30% |

| Other | CA$629k | CA$761k | 70% |

| Total Compensation | CA$903k | CA$979k | 100% |

Speaking on an industry level, nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. In Valeura Energy's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Valeura Energy Inc.'s Growth

Over the past three years, Valeura Energy Inc. has seen its earnings per share (EPS) grow by 34% per year. It saw its revenue drop 13% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Valeura Energy Inc. Been A Good Investment?

Given the total shareholder loss of 68% over three years, many shareholders in Valeura Energy Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, Valeura Energy pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, the EPS growth is certainly impressive, but it's disappointing to see negative shareholder returns over the same period. Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Valeura Energy that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Valeura Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:VLE

Valeura Energy

Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives