- Canada

- /

- Oil and Gas

- /

- TSX:VET

Vermilion Energy (TSX:VET): Earnings Growth Lags Market, Dividend Risks Center Stage

Reviewed by Simply Wall St

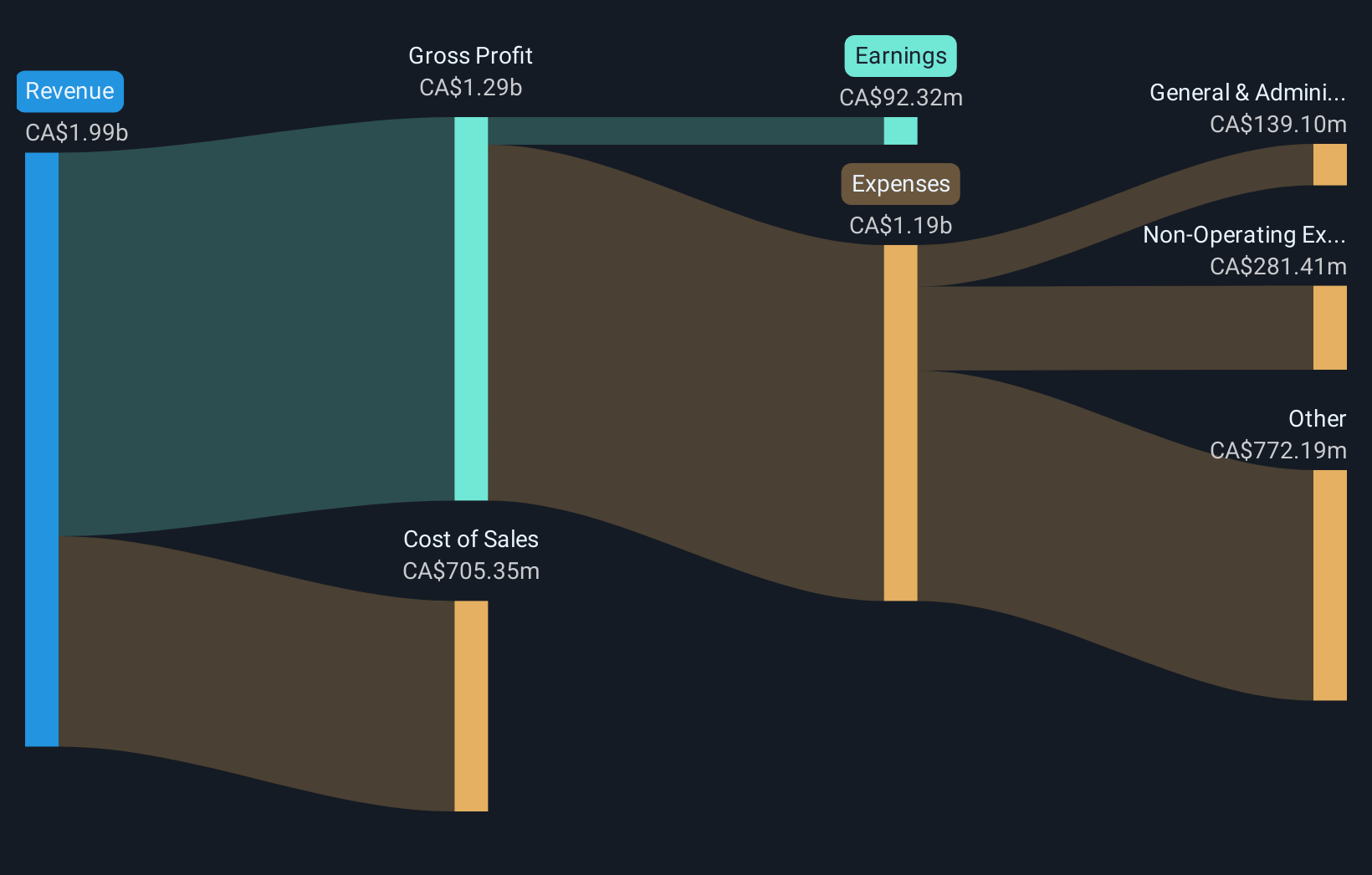

Vermilion Energy (TSX:VET) recently transitioned to profitability. However, its earnings are forecast to decline over the next three years, with expected annual profit growth trailing the Canadian market average. Revenue is projected to grow at 1.9% per year, while the five-year average earnings growth stands at -5.4% per year. This highlights challenges relative to peers whose average revenue growth is 4.9%.

See our full analysis for Vermilion Energy.Next up, we will see how these headline results compare to the most widely shared narratives from the market and investor community. Sometimes the numbers back up the story, and sometimes they turn it upside down.

See what the community is saying about Vermilion Energy

Margin Upside Hinges on Integration

- Profit margins are forecast to turn around from -1.8% currently to 0.9% in three years, reflecting a significant shift in operational profitability if targets are achieved.

- Analysts' consensus view highlights that the Westbrick acquisition and its integration could meaningfully improve cash flow and lower costs, provided operational execution stays on track.

- Catalysts like new drilling inventory from Westbrick are expected to underpin production stability and help margins, but high capital expenditures in early-stage projects could weigh on results if returns disappoint.

- Financial flexibility from asset disposals, such as those in noncore programs, is anticipated to support margin improvement. Yet, uncertainties remain around realizing forecasted synergies and maintaining margin growth amid industry cost pressures.

- For a deeper dive into the numbers behind these claims and to see how other investors are thinking about the path to better margins, check out the full consensus narrative for Vermilion Energy. 📊 Read the full Vermilion Energy Consensus Narrative.

Debt Load and Dividend Under Scrutiny

- Vermilion’s elevated net debt, coupled with concerns about the sustainability of its dividend, make its balance sheet a focal point for risk, especially if commodity prices fall.

- Consensus narrative points to deleveraging efforts and noncore asset sales as partial mitigants, but warns that financial risk will remain high until debt levels decline further.

- Even with steps to accelerate deleveraging, exposure to volatile global markets raises the stakes for consistent cash generation and dividend maintenance.

- The company’s ability to strengthen its balance sheet is closely tied to robust project execution and stable commodity pricing, a combination that may be difficult to maintain in a turbulent macro environment.

P/E Ratio Sits Between Peer and Sector Averages

- With a P/E of 18.7x, Vermilion is trading below its peer average (22.1x) but notably above the broader Canadian oil and gas industry average of 12.5x, revealing tension over whether the market is rewarding operational quality or penalizing slow growth.

- The consensus narrative notes that while Vermilion appears undervalued next to DCF fair value (CA$13.28) and the consensus analyst price target (CA$13.50), investors must weigh this discount against slower forecasted growth and the need for successful operational integration.

- The current share price of CA$11.22 stands about 20% below the consensus target, which could suggest upside if margin and growth projections are met.

- Still, the required future P/E of over 120x by 2028, based on consensus long-range earnings forecasts, signals that valuation upside is heavily contingent on hitting aggressive profitability milestones.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vermilion Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? In just a few minutes, you can shape your perspective into a narrative built from your analysis. Do it your way

A great starting point for your Vermilion Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite recent profitability, Vermilion's high debt, pressured margins, and questions around dividend stability present ongoing financial risks for investors.

If you'd prefer companies with more secure financial footing, check out solid balance sheet and fundamentals stocks screener (1974 results) to find those built to weather volatility without the same level of balance sheet strain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VET

Vermilion Energy

An oil and gas producer, focuses on the acquisition, exploration, development, and optimization of producing properties in North America, Europe, and Australia.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives