- Canada

- /

- Energy Services

- /

- TSX:TVK

Will TerraVest Industries’ (TSX:TVK) CFO Change Influence Its Evolving Financial Strategy?

Reviewed by Sasha Jovanovic

- TerraVest Industries Inc. recently announced the appointment of Guillaume Cloutier as Chief Financial Officer, succeeding Marilyn Boucher, with Cloutier bringing significant experience in finance, strategy, and business transformation across the North American manufacturing sector.

- This leadership transition could signal fresh perspectives for TerraVest’s financial management and operational priorities at a pivotal moment in the company’s development.

- We’ll explore how Guillaume Cloutier’s finance background shapes the current investment narrative for TerraVest Industries.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TerraVest Industries' Investment Narrative?

To be optimistic about TerraVest Industries as a shareholder, you need to have confidence in the company’s ability to expand its operations while managing risks around falling margins and a premium valuation. The recent appointment of Guillaume Cloutier as CFO introduces new financial expertise, which could influence how short-term catalysts like revenue growth, dividend stability, and buyback programs are executed. While the overall outlook for continued revenue gains remains, the CFO transition may help address concerns about declining profit margins and low return on equity, especially given TerraVest’s rapid expansion. However, the impact of this leadership change is unlikely to dramatically alter the most immediate drivers or risks; the company’s heavy reliance on efficient operations and consistently strong cash flow remains. Investors should pay attention to how quickly Cloutier can address cost containment and margin improvement as these remain critical issues.

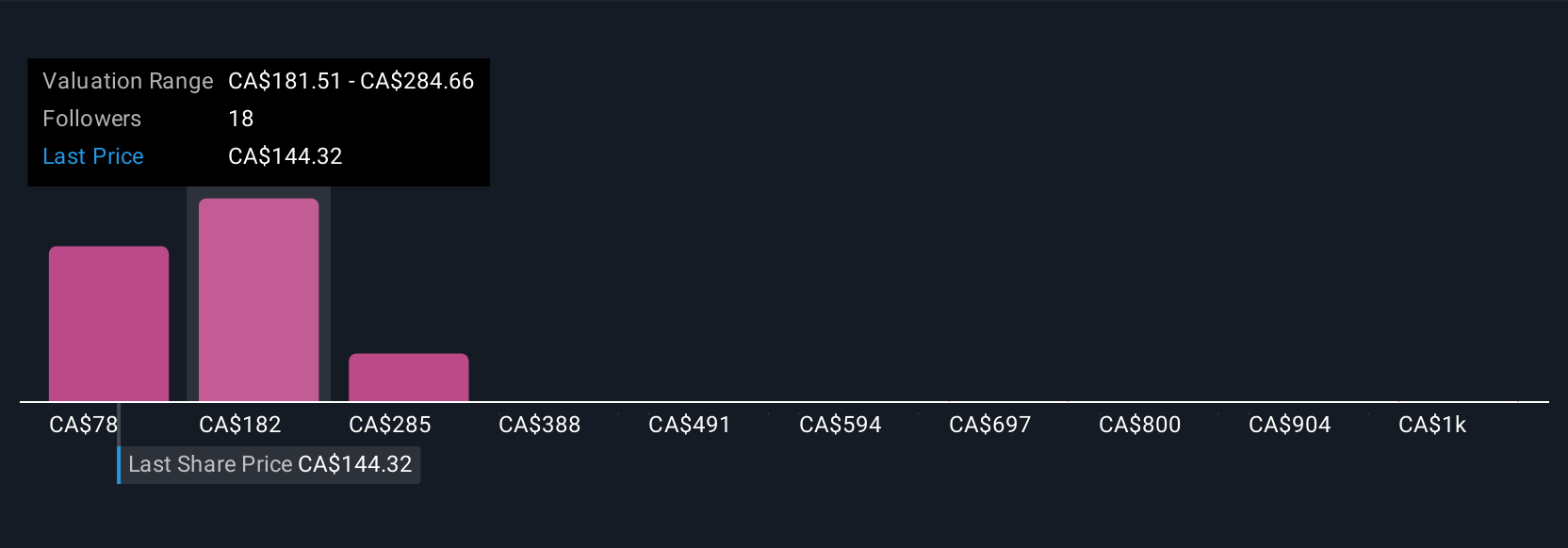

But there’s more investors should monitor, especially the recent dip in profit margins. Despite retreating, TerraVest Industries' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on TerraVest Industries - why the stock might be worth 38% less than the current price!

Build Your Own TerraVest Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TerraVest Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TerraVest Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TerraVest Industries' overall financial health at a glance.

No Opportunity In TerraVest Industries?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives