- Canada

- /

- Oil and Gas

- /

- TSX:TVE

How Tamarack Valley Energy’s Dividend Hike and Efficiency Moves Could Shape Returns for TSX:TVE Investors

Reviewed by Sasha Jovanovic

- Tamarack Valley Energy announced a 5% increase to its monthly dividend beginning in November 2025, alongside plans to transition to a quarterly dividend schedule in 2026 and a reaffirmation of its 2025 production guidance following strong operational results in the third quarter.

- Recent asset acquisitions and divestitures are expected to reduce net production expenses, reflecting the company’s focus on efficiency and shareholder returns amid executive leadership changes and the completion of a substantial share buyback program.

- We'll examine how Tamarack Valley Energy’s dividend hike and operational updates may reshape its investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tamarack Valley Energy Investment Narrative Recap

To be a Tamarack Valley Energy shareholder, you have to believe that cost management and operational efficiency can offset sector volatility and the company’s exposure to heavy oil markets in Western Canada. The latest dividend increase and production guidance reaffirmation signal management’s confidence, but the recent net loss in Q3 2025 draws attention to elevated financial leverage, which continues to be the most important risk, especially if oil prices remain unstable. These developments do little to substantially shift the near-term outlook, though efficiency gains may soften some headwinds. Among recent announcements, the completed buyback of nearly 40 million shares, representing almost 8% of Tamarack’s outstanding stock, stands out. While this move might reflect a commitment to shareholder returns and capital discipline, it sits alongside continued operating losses and debt obligations, providing a mixed backdrop for investor expectations and the sustainability of future distributions. In contrast, investors should be aware that despite rising dividends and buybacks, persistent net debt and commodity price volatility leave Tamarack exposed if...

Read the full narrative on Tamarack Valley Energy (it's free!)

Tamarack Valley Energy is projected to reach CA$1.7 billion in revenue and CA$80.5 million in earnings by 2028. This outlook assumes annual revenue growth of 4.8%, but a significant decline in earnings, down CA$178.7 million from the current CA$259.2 million.

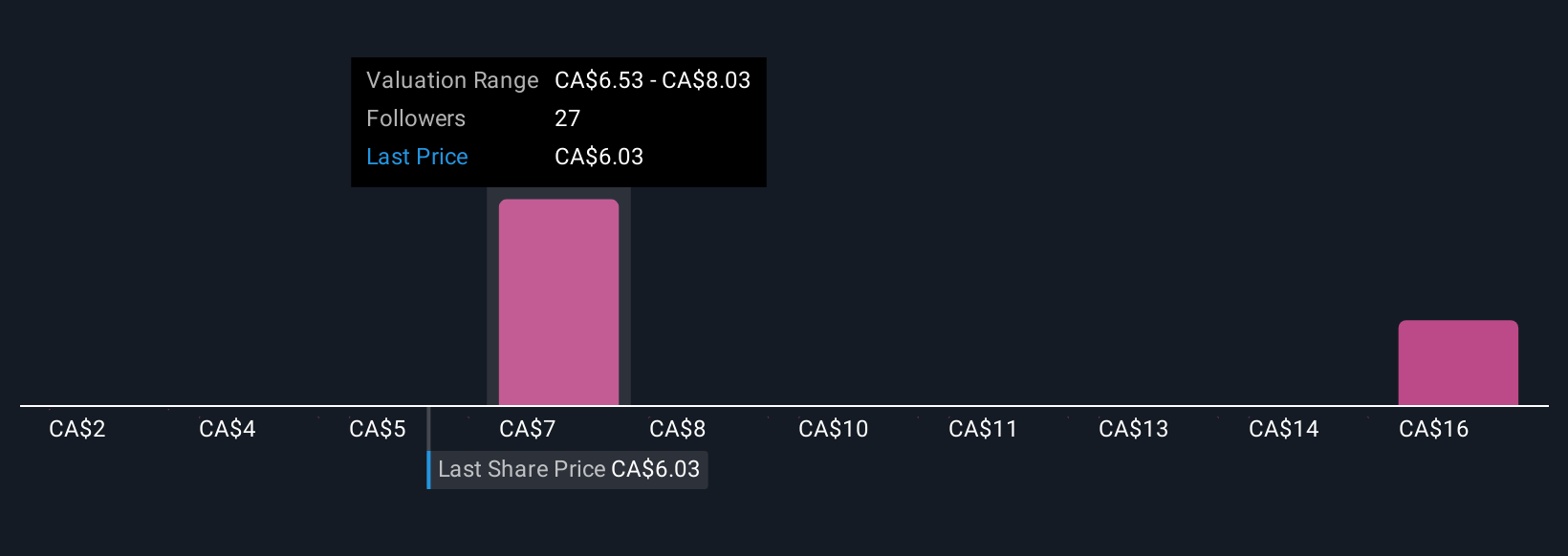

Uncover how Tamarack Valley Energy's forecasts yield a CA$7.38 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Tamarack Valley Energy shares between CA$7.38 and CA$26.67, using two distinct forecasts. With ongoing financial leverage and sector price risks in focus, comparing these viewpoints can offer broader insight into potential outcomes.

Explore 2 other fair value estimates on Tamarack Valley Energy - why the stock might be worth just CA$7.38!

Build Your Own Tamarack Valley Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tamarack Valley Energy research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Tamarack Valley Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tamarack Valley Energy's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives