- Canada

- /

- Oil and Gas

- /

- TSX:TRP

How TC Energy’s Dividend Commitment and Project Pipeline Will Impact Investors (TSX:TRP)

Reviewed by Sasha Jovanovic

- TC Energy Corporation has declared a quarterly dividend of CA$0.85 per common share for the quarter ending December 31, 2025, with payouts scheduled for January 30, 2026, along with specified dividends on various series of cumulative first preferred shares.

- This continued focus on shareholder returns is paired with a newly extended financial outlook through 2028 and over CA$5 billion in new sanctioned projects, reinforcing confidence in the company's project execution and growth trajectory.

- We'll assess how TC Energy's reaffirmed dividend policy and project execution updates shape expectations for sustained earnings and sector resilience.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

TC Energy Investment Narrative Recap

To be a TC Energy shareholder, you need to believe that North American natural gas infrastructure will remain vital, supporting steady asset utilization and a predictable stream of earnings. The recently declared quarterly and preferred dividends reinforce management's commitment to shareholder returns, but do not materially shift the near-term focus: the most important catalyst remains reliable project execution, while the biggest risk is the potential for cost overruns or regulatory delays impacting margins and leverage.

Among recent developments, TC Energy’s extension of its financial outlook through 2028 is especially relevant, given over CA$5 billion in new, sanctioned projects announced. This outlook, underpinned by long-term contracts and timely project delivery, ties directly to the company’s ability to sustain dividend payments and support investor confidence in future earnings growth.

However, investors should also recognize that, despite these positive signals, growing project complexity and evolving climate regulations may mean...

Read the full narrative on TC Energy (it's free!)

TC Energy's outlook anticipates CA$17.2 billion in revenue and CA$4.0 billion in earnings by 2028. This assumes a 6.3% annual revenue growth rate but a decline in earnings by CA$0.2 billion from the current CA$4.2 billion.

Uncover how TC Energy's forecasts yield a CA$75.48 fair value, a 6% upside to its current price.

Exploring Other Perspectives

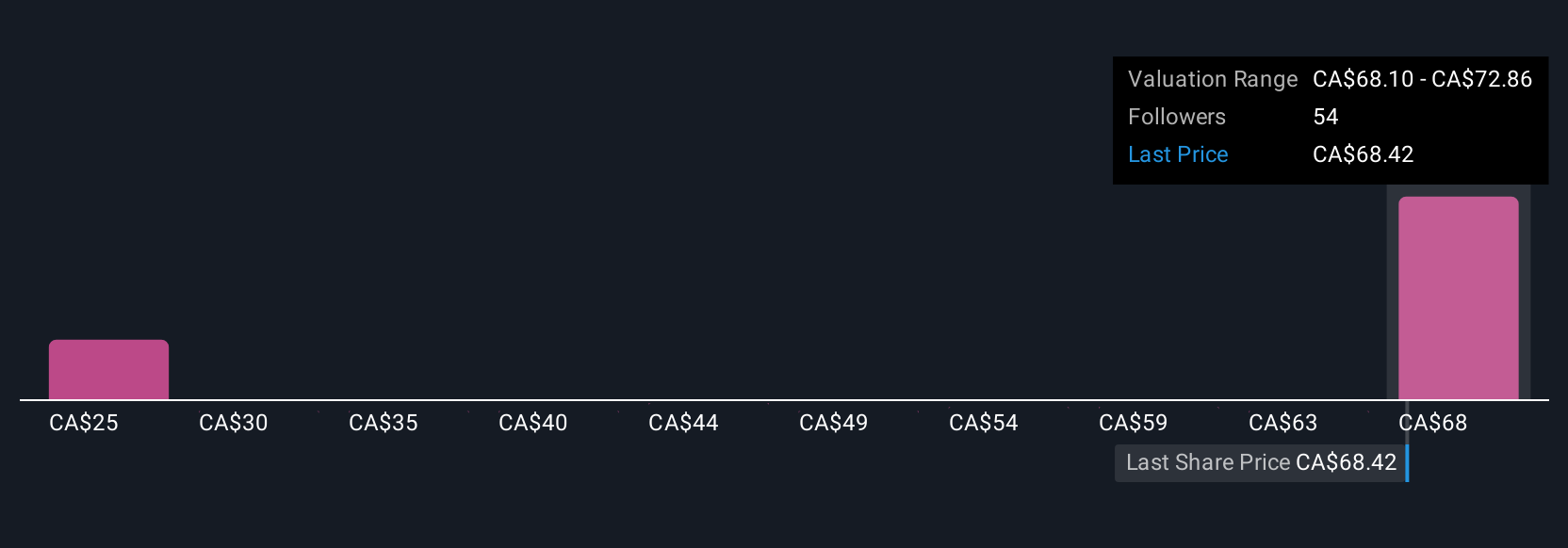

Five different Simply Wall St Community fair value estimates for TC Energy range from CA$35.21 to CA$75.48 per share. Given these contrasting views, keep in mind that while many expect continued contract stability, longer-term demand and capital return assumptions can be heavily shaped by emerging risks such as future carbon pricing or shifts in energy policy.

Explore 5 other fair value estimates on TC Energy - why the stock might be worth as much as 6% more than the current price!

Build Your Own TC Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TC Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TC Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TC Energy's overall financial health at a glance.

No Opportunity In TC Energy?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TC Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRP

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives