- Canada

- /

- Oil and Gas

- /

- TSX:TNZ

TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As trade tensions ease and central banks maintain accommodative monetary policies, the Canadian market continues to navigate a complex economic landscape characterized by mixed signals in the services sector and inflationary pressures. In this environment, growth companies with high insider ownership can be particularly appealing, as they often demonstrate strong alignment between management and shareholders, potentially positioning them well to capitalize on emerging opportunities.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 33% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Discovery Silver (TSX:DSV) | 17.5% | 47% |

| Almonty Industries (TSX:AII) | 11.6% | 49.8% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 40.4% |

| Aritzia (TSX:ATZ) | 17.5% | 22.4% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| SolarBank (NEOE:SUNN) | 17.2% | 178.3% |

| Tenaz Energy (TSX:TNZ) | 10.7% | 151.2% |

Let's explore several standout options from the results in the screener.

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for medical and adult use in the United States, with a market cap of approximately CA$1.83 billion.

Operations: Green Thumb Industries generates revenue through the production, distribution, and sale of cannabis products for both medical and adult-use markets in the United States.

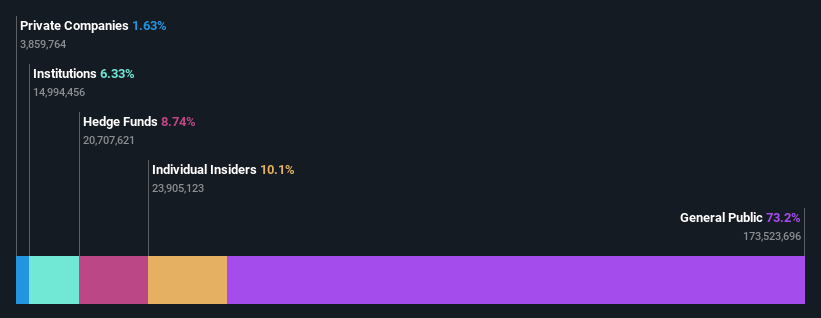

Insider Ownership: 10.1%

Earnings Growth Forecast: 31.8% p.a.

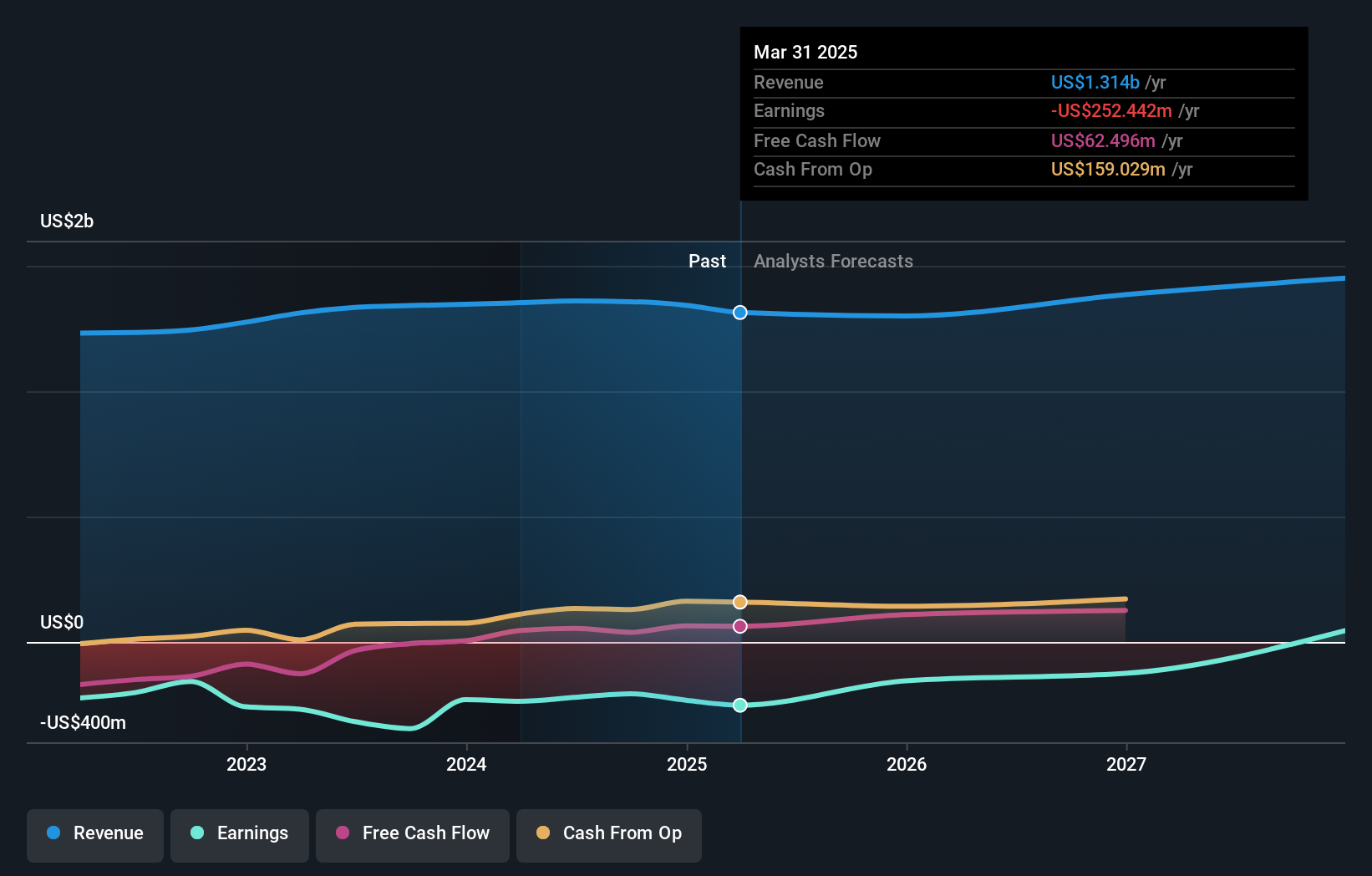

Green Thumb Industries, trading well below its estimated fair value, shows potential for growth with expected annual earnings growth of 31.8%, significantly outpacing the Canadian market. However, insider activity reveals significant selling in the past quarter. Recent expansions include new dispensaries in Ohio and Nevada, enhancing their market presence. Despite recent quarterly earnings showing a decline in net income to US$8.31 million compared to the previous year, strategic expansions may support future growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Green Thumb Industries.

- The valuation report we've compiled suggests that Green Thumb Industries' current price could be quite moderate.

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. is a company that produces and distributes cannabis products both in the United States and internationally, with a market cap of approximately CA$863.42 million.

Operations: Curaleaf Holdings generates its revenue through the production and distribution of cannabis products across domestic and international markets.

Insider Ownership: 19.6%

Earnings Growth Forecast: 60.9% p.a.

Curaleaf Holdings is trading significantly below its estimated fair value, indicating potential for growth despite recent financial challenges. The company reported a net loss of US$61.06 million in Q1 2025, with revenue declining to US$310.01 million compared to last year. Although insider activity shows substantial selling recently, Curaleaf's strategic brand expansion with Anthem could enhance its market position as it aims for profitability within three years, outpacing average market growth expectations.

- Navigate through the intricacies of Curaleaf Holdings with our comprehensive analyst estimates report here.

- Our valuation report here indicates Curaleaf Holdings may be undervalued.

Tenaz Energy (TSX:TNZ)

Simply Wall St Growth Rating: ★★★★★☆

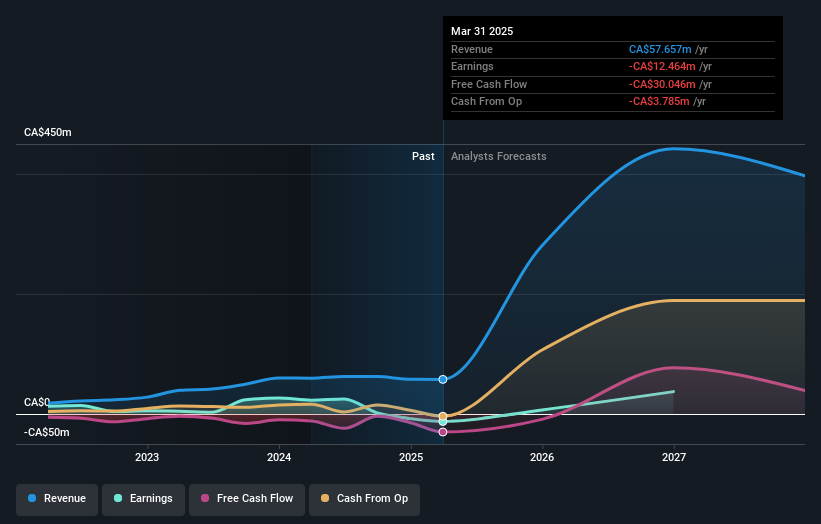

Overview: Tenaz Energy Corp. is an energy company focused on acquiring and developing oil and gas properties in Canada and the Netherlands, with a market cap of CA$398.99 million.

Operations: The company's revenue is primarily derived from its operations in the oil and gas sectors located in Canada and the Netherlands.

Insider Ownership: 10.7%

Earnings Growth Forecast: 151.2% p.a.

Tenaz Energy is trading at a significant discount to its estimated fair value, suggesting growth potential despite recent financial setbacks. Analysts forecast revenue to grow 30% annually, surpassing the Canadian market's average. The company expects profitability within three years, indicating robust growth prospects. Recent earnings showed a net loss of CAD 5.31 million in Q1 2025, with revenue slightly down from last year. Production guidance anticipates lower output in Q2 due to maintenance activities but stabilizes thereafter.

- Unlock comprehensive insights into our analysis of Tenaz Energy stock in this growth report.

- Upon reviewing our latest valuation report, Tenaz Energy's share price might be too pessimistic.

Taking Advantage

- Embark on your investment journey to our 40 Fast Growing TSX Companies With High Insider Ownership selection here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tenaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TNZ

Tenaz Energy

An energy company, engages in the acquisition and development of oil and gas properties in Canada and the Netherlands.

Very undervalued with solid track record.

Market Insights

Community Narratives