- Canada

- /

- Oil and Gas

- /

- TSX:TAL

Will PetroTal's (TSX:TAL) Dividend Pause Mark a New Phase in Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- PetroTal Corp. recently announced third-quarter 2025 results, reporting revenue of US$63.91 million and net income of US$3.6 million, alongside a decision to suspend its regular quarterly dividend indefinitely.

- The suspension highlights the company’s shift toward prioritizing cash reserves and development investment after previously returning almost US$155 million to shareholders since 2023.

- We'll examine how the dividend suspension and focus on maintaining a US$60 million cash buffer influence PetroTal's investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is PetroTal's Investment Narrative?

For investors considering PetroTal, a key driver has been its ability to generate sizeable cash returns via dividends backed by steady production growth from its core assets such as the Bretana Field. With the newly announced indefinite dividend suspension and a sharpened focus on shoring up a US$60 million cash buffer, the immediate investment case is shifting. While the company assures a continued commitment to capital returns down the track, in the short term the main catalyst shifts from the dividend yield to execution on production expansion and effective capital allocation. The share price’s steep 40 percent slide in the past month underscores rising market unease about softer revenues, lower profits and tightening cash flows, now that distributions are on hold. The biggest risk has become whether operational momentum and commodity prices can sufficiently support PetroTal’s next phase without routine shareholder payouts.

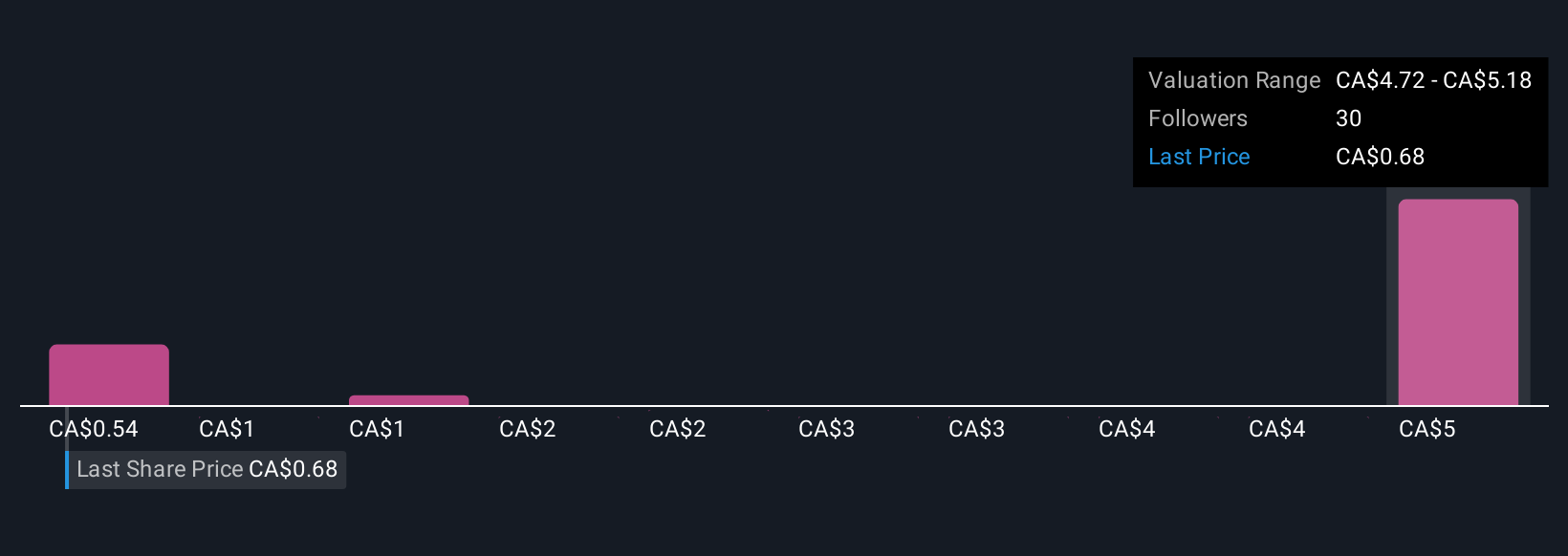

Yet, should commodity volatility persist and production costs rise, the path to reinstating payouts might take longer than some expect. Despite retreating, PetroTal's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 15 other fair value estimates on PetroTal - why the stock might be worth just CA$0.54!

Build Your Own PetroTal Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PetroTal research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PetroTal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PetroTal's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives