- Canada

- /

- Oil and Gas

- /

- TSX:TAL

A Look at PetroTal (TSX:TAL) Valuation Following Dividend Suspension and Lower Q3 Results

Reviewed by Simply Wall St

PetroTal (TSX:TAL) shares are in focus after the company announced the suspension of its regular quarterly dividend. This decision follows a third quarter marked by lower revenue and net income compared to last year. Investors are watching closely as PetroTal prioritizes maintaining a solid cash balance to fund development projects and address ongoing market uncertainty.

See our latest analysis for PetroTal.

PetroTal’s 1-year share price return has slumped by more than 35%, with recent volatility picking up after the latest dividend suspension and a tough quarterly report. While short-term momentum is fading, the company’s five-year total shareholder return of 244% shows that long-term investors have seen significant gains through previous cycles.

If the recent shift at PetroTal has you thinking bigger, this is the perfect opportunity to broaden your outlook and discover fast growing stocks with high insider ownership

But does this pullback mean PetroTal shares are now undervalued, or have investors already accounted for the company’s development plans and future risks in the current price? Is there real upside, or are expectations already set?

Price-to-Earnings of 3.4x: Is it justified?

PetroTal is trading at a price-to-earnings ratio of just 3.4x, far below both sector and peer averages. With a last close price of CA$0.39, the stock stands out as a potential value pick relative to its earnings power.

The price-to-earnings ratio represents how much investors are currently willing to pay for a dollar of PetroTal’s annual earnings. Lower ratios often suggest the market is skeptical about the company’s future growth prospects, stability of profits, or other risk factors. In PetroTal’s case, its multiple is heavily discounted versus peers.

Compared to the Canadian Oil and Gas industry average of 14.7x and a fair value estimate of 10.2x, PetroTal’s 3.4x multiple is strikingly low. If investor sentiment or the company’s earnings outlook improve, there is significant room for the market to re-rate the shares toward those higher benchmarks.

Explore the SWS fair ratio for PetroTal

Result: Price-to-Earnings of 3.4x (UNDERVALUED)

However, PetroTal faces ongoing revenue challenges and elevated share price volatility, which could undermine the case for a sustained valuation rebound.

Find out about the key risks to this PetroTal narrative.

Another Perspective: What Does the SWS DCF Model Suggest?

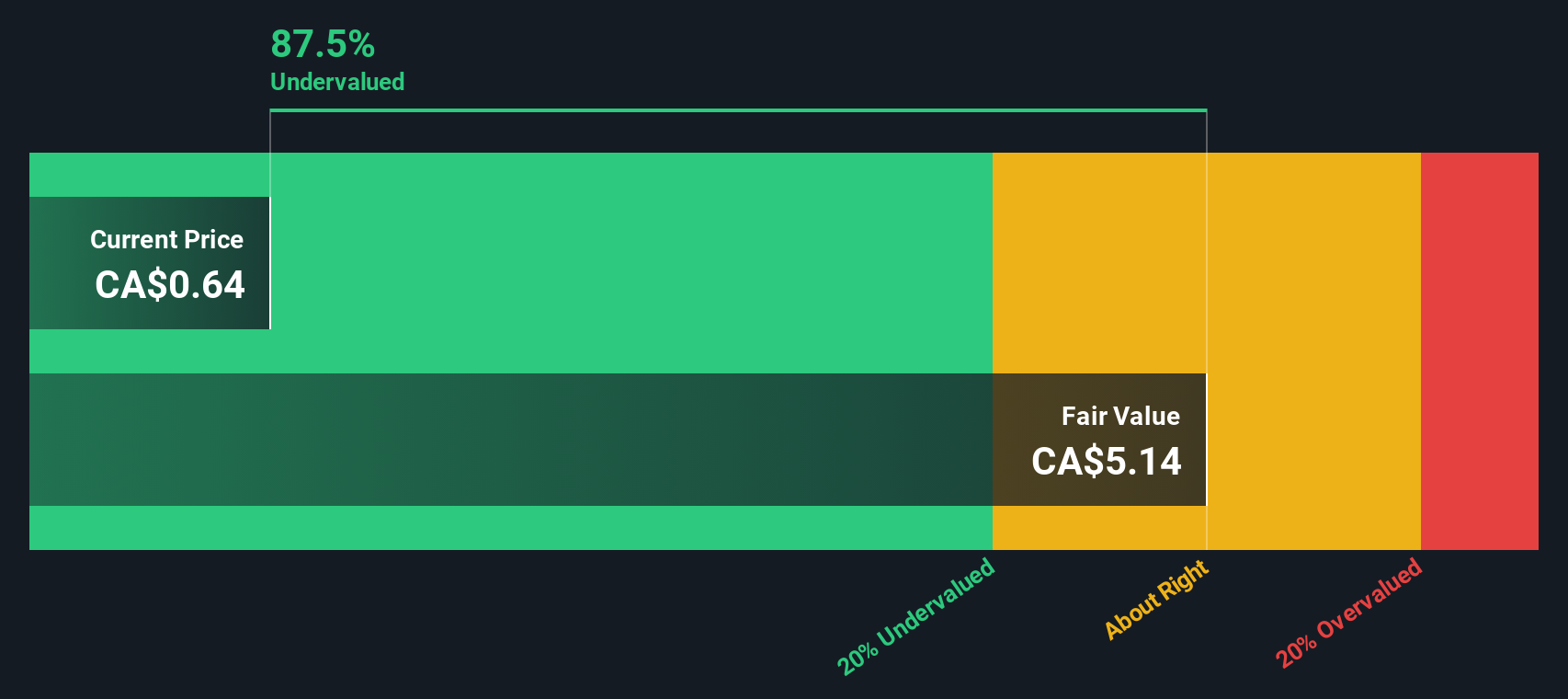

While the market is undervaluing PetroTal based on its earnings, the SWS DCF model tells a similar story. At CA$0.39, shares are trading well below our estimated fair value of CA$5.03. This suggests a significant disconnect between the company's fundamentals and its stock price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PetroTal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PetroTal Narrative

If you want a different perspective or would rather dive into the numbers yourself, crafting your own narrative only takes a few minutes. Do it your way

A great starting point for your PetroTal research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities go far beyond PetroTal, and the right stock picker can stay ahead of the pack. Uncover other fast-moving possibilities with these curated investment avenues and do not let today’s winners pass you by.

- Seize major upside by harnessing momentum from leaders featured among these 924 undervalued stocks based on cash flows, shaping tomorrow's market with proven value.

- Capitalize on high-yield potential through these 14 dividend stocks with yields > 3%, focusing on companies providing income and stability in any market cycle.

- Get ahead of the next tech surge by watching the innovators behind these 26 AI penny stocks, as artificial intelligence transforms industries right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success