- Canada

- /

- Oil and Gas

- /

- TSX:SU

Can Suncor’s Gains Continue After Recent Environmental Policy News?

Reviewed by Bailey Pemberton

- Wondering if Suncor Energy could be an undervalued gem hiding in plain sight? You’re not alone; many investors are eyeing its potential right now.

- The stock has climbed 7.2% year-to-date and is sitting on a strong 9.2% gain over the past year, with its 5-year return soaring to an impressive 261.6%.

- Recently, Suncor Energy has been in the news with headlines centered around energy sector shifts and major developments related to environmental policy. These news items have played into changing investor sentiment and may help explain some of the recent price movement.

- Right now, Suncor Energy scores a 5 out of 6 on our valuation checks, suggesting it offers intriguing value. To really understand how fair the current price is, we’ll look at multiple valuation approaches and share a more holistic way to assess fair value by the end of this article.

Find out why Suncor Energy's 9.2% return over the last year is lagging behind its peers.

Approach 1: Suncor Energy Discounted Cash Flow (DCF) Analysis

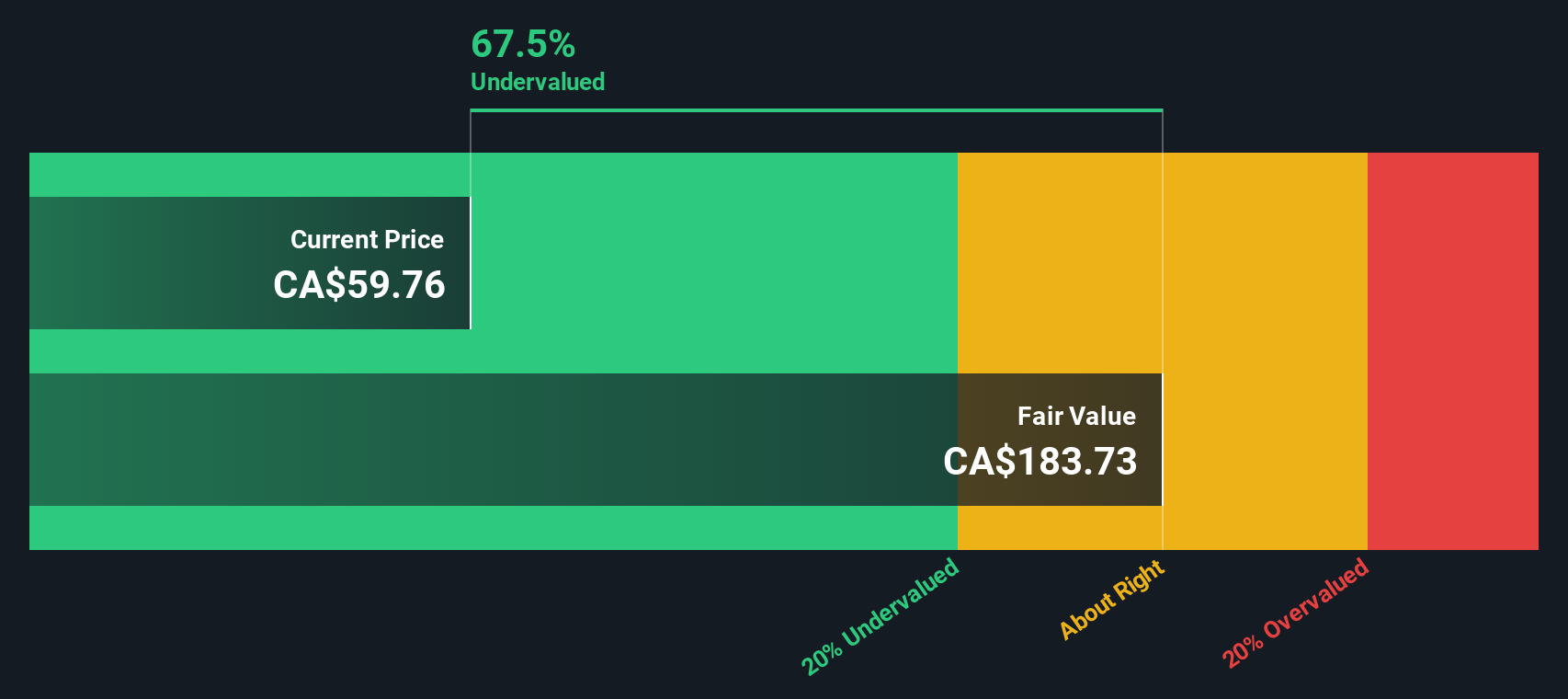

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those amounts back to today's dollars. This approach helps investors look beyond short-term market movements to assess the real, underlying worth of a business like Suncor Energy.

Currently, Suncor Energy boasts trailing twelve month free cash flow of CA$8.56 billion. Analysts expect these annual cash flows to moderate over time, with projections suggesting free cash flow of around CA$4.29 billion by 2035. While analyst estimates typically extend only about five years, Simply Wall St extends these projections out to ten years by extrapolating from available data.

After calculating and discounting these future cash flows to present value, the DCF model estimates Suncor's intrinsic value at CA$88.72 per share. This implies the stock is trading at a substantial 37.3% discount to its intrinsic value right now, which may indicate an attractive opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Suncor Energy is undervalued by 37.3%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

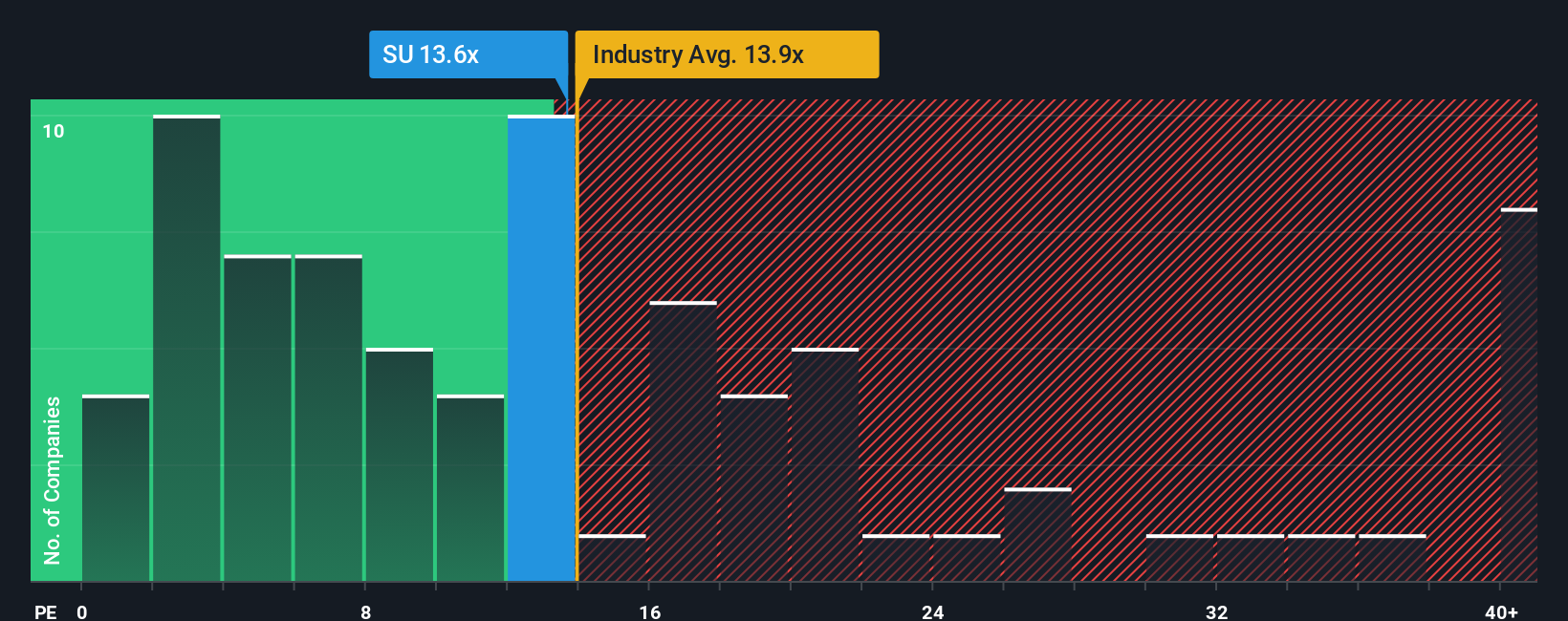

Approach 2: Suncor Energy Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Suncor Energy because it links a company's stock price to its bottom-line performance. This makes it a straightforward way to compare companies of similar profitability. Investors often look to the PE ratio for insights into how the market values a firm's current earnings and its future growth prospects.

It is important to note that the "right" PE ratio can vary significantly depending on factors such as expected earnings growth and the perceived riskiness of the business. Companies with strong growth prospects or lower risk are typically assigned higher PE ratios by the market, while those facing challenges or uncertainty may trade at lower multiples.

At present, Suncor’s PE ratio stands at 11.93x. This is below the Oil and Gas industry average of 12.16x and also below the average of its peers, which sits at 14.23x. However, simply comparing PE ratios with the industry and peers only tells part of the story.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Suncor is 14.01x, derived from a model that takes into account not just the company’s growth and profit margins but also industry dynamics, market capitalization, and company-specific risks. By going beyond standard averages, this Fair Ratio aims to give a more tailored view of what a reasonable PE multiple should be for Suncor right now.

Because Suncor’s current PE of 11.93x is meaningfully lower than its Fair Ratio of 14.01x, the stock appears undervalued on this key measure and could be offering investors a relative bargain based on its earnings profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Suncor Energy Narrative

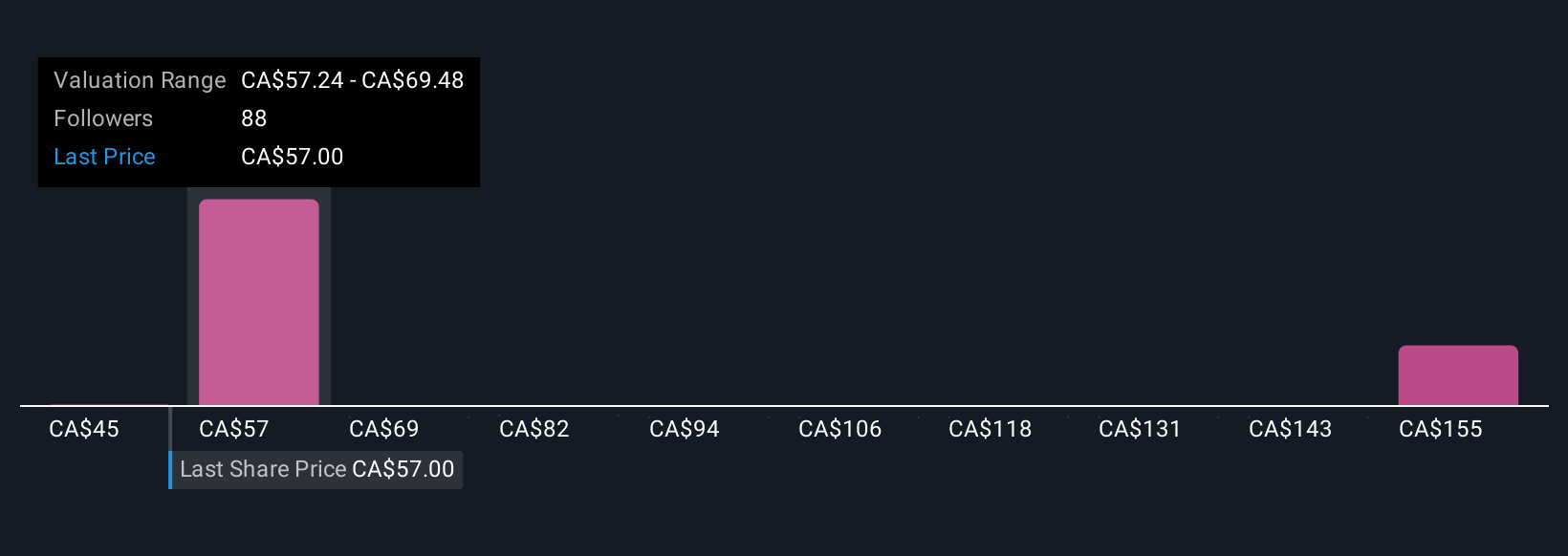

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a new, intuitive way to invest that combine your personal view of Suncor Energy’s story—what you believe about its future performance, risks, and opportunities—with the hard numbers like projected revenues, earnings, and profit margins, all to create a financial forecast and a unique fair value.

Instead of just crunching numbers, Narratives help you link the “why” behind your investment conviction with the “what” of the company’s expected results. This makes it simple to connect a company’s real-world developments to financial outcomes. Accessible to everyone on Simply Wall St’s Community page, Narratives allow millions of investors to express their perspectives, quickly compare fair value to the current market price, and decide whether to buy or sell, all in one place.

Best of all, Narratives update automatically as new information, such as news headlines or earnings releases, becomes available. This keeps your view relevant without extra effort. For example, some investors might believe Suncor’s drive for efficiency and shareholder returns will propel it towards a fair value of CA$66. Others, more cautious about energy transition risks, may see it closer to CA$52. Narratives make it easy to explore, challenge, and refine these views whenever market conditions change.

Do you think there's more to the story for Suncor Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives