- Canada

- /

- Oil and Gas

- /

- TSX:SOBO

What South Bow (TSX:SOBO)'s Profits Rising Amid Lower Sales Means for Shareholders

Reviewed by Sasha Jovanovic

- South Bow Corporation recently reported third quarter 2025 results, posting net income of US$93 million and basic earnings per share of US$0.45, despite a decline in sales to US$461 million, while also affirming a quarterly dividend of US$0.50 per share.

- The company’s ability to improve profitability in the face of lower sales highlights potential improvements in cost management or operational efficiencies.

- With earnings rising despite a drop in revenue, we’ll explore how this improved profitability shapes South Bow’s investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is South Bow's Investment Narrative?

To be a South Bow shareholder right now, you likely need to believe in the company's ability to maintain profitability and consistent dividend payments even as revenues fluctuate. The recent third quarter results added an interesting wrinkle: net income and earnings per share rose sharply, despite sales dropping for a second straight quarter and throughput levels remaining steady but slightly lower on the Gulf Coast segment. This surprise on the bottom line suggests management is managing costs or operations better than expected, which could ease concerns for those watching cash flow and dividend sustainability in the short term. However, big picture risks remain, including question marks around whether these efficiency gains are sustainable or just temporary, and if sales pressures could eventually cut into future earnings. The Q3 results may slightly delay these concerns, but they haven't erased them.

By contrast, the ability to keep raising profits even as sales slow is something investors should consider.

Exploring Other Perspectives

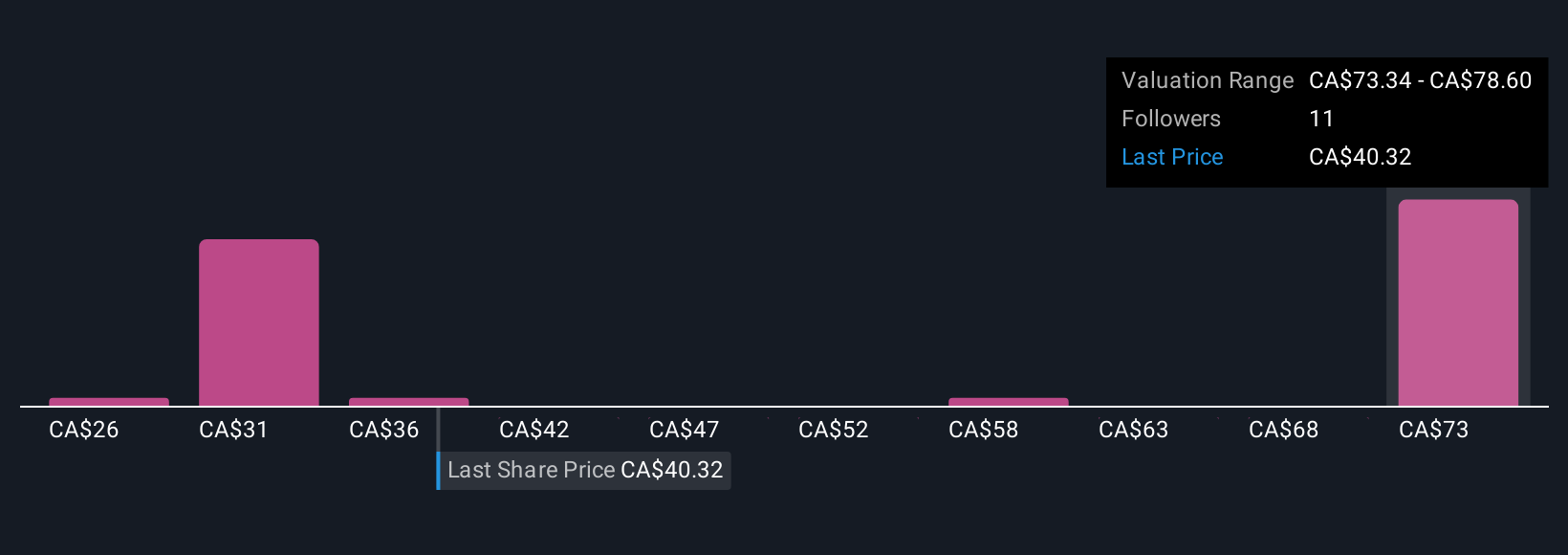

Explore 6 other fair value estimates on South Bow - why the stock might be worth over 3x more than the current price!

Build Your Own South Bow Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South Bow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South Bow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South Bow's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SOBO

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives