- Canada

- /

- Energy Services

- /

- TSX:SHLE

Source Energy Services Ltd.'s (TSE:SHLE) Shares Leap 25% Yet They're Still Not Telling The Full Story

Source Energy Services Ltd. (TSE:SHLE) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

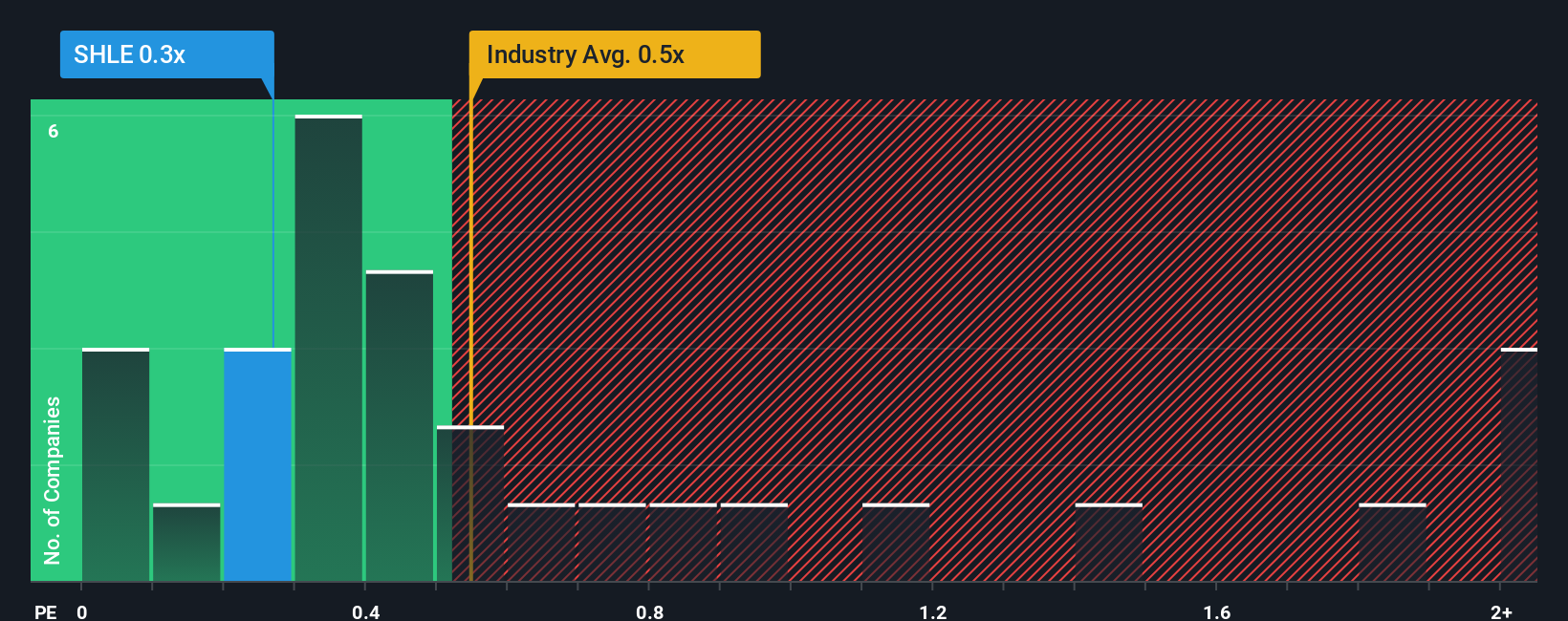

In spite of the firm bounce in price, it's still not a stretch to say that Source Energy Services' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Canada, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Source Energy Services

How Has Source Energy Services Performed Recently?

The revenue growth achieved at Source Energy Services over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Source Energy Services will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Source Energy Services?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Source Energy Services' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 113% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Source Energy Services is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Source Energy Services' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Source Energy Services' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Source Energy Services has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Source Energy Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SHLE

Source Energy Services

Engages in the production and distribution of frac sand used primarily in oil and gas exploration and production in Canada and the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives