- Canada

- /

- Oil and Gas

- /

- TSX:SES

What SECURE Waste Infrastructure (TSX:SES)'s $300 Million Debt Refinancing Means for Shareholders

Reviewed by Sasha Jovanovic

- SECURE Waste Infrastructure Corp. recently completed a CA$300 million fixed-income offering by issuing 5.75% senior unsecured notes due November 2032, with proceeds allocated to repaying existing debt and general corporate purposes.

- The transaction, underwritten by a syndicate of major banks and issued under Rule 144A and Regulation S exemptions, may enhance the company's financial flexibility through refinancing.

- With this substantial debt refinancing now in place, we'll explore how stronger capital flexibility could influence the company's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SECURE Waste Infrastructure Investment Narrative Recap

To invest in SECURE Waste Infrastructure, you must have conviction in the company’s ability to maintain cash flow and profitability as it pivots through industry headwinds and energy transition risks. The recent CA$300 million debt refinancing strengthens near-term capital flexibility, but does not materially shift exposure to its core risks: concentrated oil and gas end markets and regulatory challenges remain front and center for near-term performance. The main catalyst, commissioning new long-term contracted water disposal facilities, remains intact, while the greatest pressure comes from macro trends weighing on revenue stability.

Among the highlights, the Q3 buyback of 1.7 million shares for CA$27 million stands out, reinforcing a commitment to capital returns even during operational volatility. This loyalty to shareholder distributions must be weighed against softer earnings, since margin pressure from energy sector reliance could affect both free cash flow and future buyback pace. Contrast this with recent balance sheet moves, and the broader question is how well stronger financial positioning can offset ongoing sector risks.

Yet, as capital flexibility improves, the ongoing risk that could impact long-term shareholder value stems from concentrated sector exposure if...

Read the full narrative on SECURE Waste Infrastructure (it's free!)

SECURE Waste Infrastructure is projected to reach CA$262.9 million in revenue and CA$254.0 million in earnings by 2028. This outlook assumes a 70.6% annual decline in revenue and a CA$57 million increase in earnings from the current level of CA$197.0 million.

Uncover how SECURE Waste Infrastructure's forecasts yield a CA$19.92 fair value, a 9% upside to its current price.

Exploring Other Perspectives

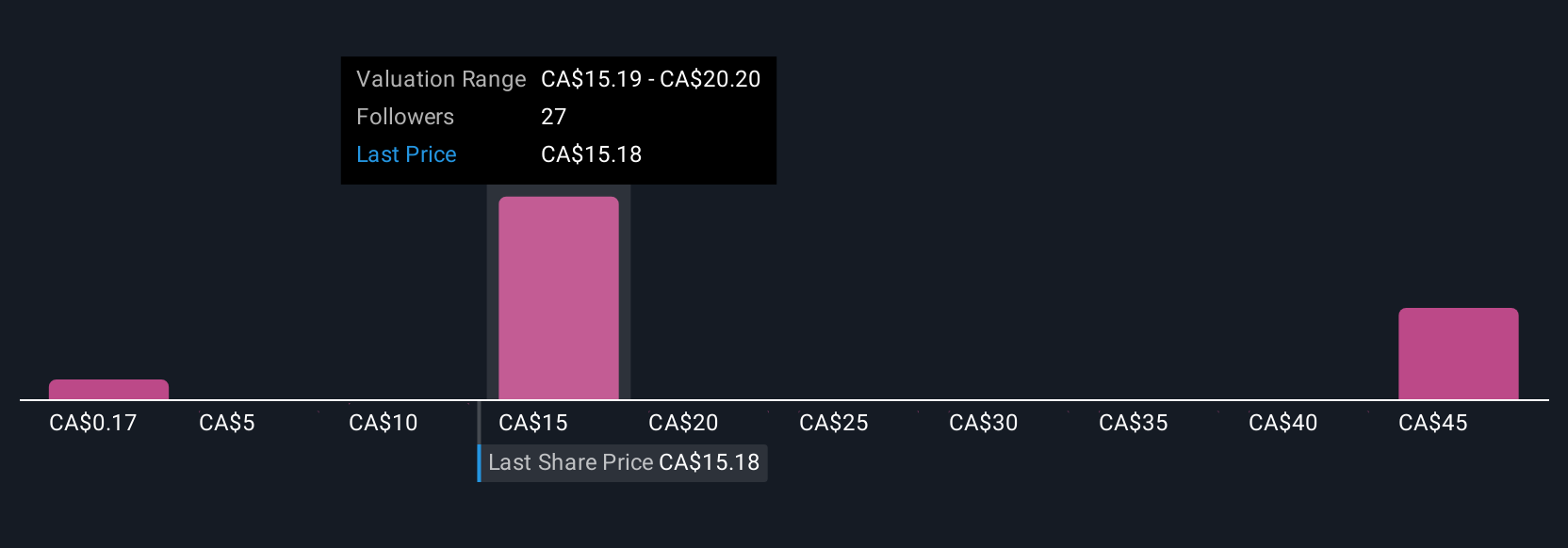

Ten members of the Simply Wall St Community placed fair value estimates between CA$0.17 and CA$47.03, revealing unusually broad opinion on the company’s prospects. With new debt issued and sector risks unsolved, the diversity of views reflects substantial uncertainty, explore how differing expectations for regulatory developments and recurring revenue could shape the future for SECURE Waste Infrastructure.

Explore 10 other fair value estimates on SECURE Waste Infrastructure - why the stock might be worth over 2x more than the current price!

Build Your Own SECURE Waste Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SECURE Waste Infrastructure research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SECURE Waste Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SECURE Waste Infrastructure's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SES

SECURE Waste Infrastructure

Engages in the waste management and energy infrastructure businesses primarily in Canada and the United States.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives