- Canada

- /

- Oil and Gas

- /

- TSX:SCR

Strathcona Resources (TSX:SCR): Assessing Valuation After Steady Share Price Gains and Strong 1-Year Return

Reviewed by Simply Wall St

See our latest analysis for Strathcona Resources.

Strathcona Resources’ 1-year total shareholder return of 40.7% stands out due to its steady climb this year. The recent 12.2% gain in the last 90 days suggests renewed optimism from investors. The combination of short-term momentum and a strong long-term record is driving new conversations about the company’s growth potential and valuation.

If you’re curious what else could catch a tailwind this quarter, it’s worth taking a look at fast growing stocks with high insider ownership.

But with shares reaching close to analyst targets, investors are now left wondering: Is Strathcona Resources truly undervalued, or is the market already factoring in all of its next wave of growth?

Most Popular Narrative: Fairly Valued

With Strathcona Resources closing at CA$37.00, this closely matches the narrative’s fair value estimate, signaling an uneasy consensus on the company’s prospects. The stage is set for debate, with nuanced details justifying why the current pricing might be right, provided that certain assumptions hold.

The company's growth projections, including ambitious organic expansion from 120,000 to 195,000 boe/d over 5 years, appear to price in consistently robust global oil demand and resilient commodity pricing, potentially overlooking growing risks associated with accelerated renewable energy adoption and long-term shifts away from fossil fuels. This could lead to investor overestimation of future revenue sustainability.

Can the market’s optimism survive big swings in energy policy and bold production targets? The real twist lies in future profit margins and growth rates that may be hidden behind that fair value.

Result: Fair Value of $37 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong production growth or successful capital returns could quickly challenge the current valuation, especially if operating efficiencies remain ahead of sector headwinds.

Find out about the key risks to this Strathcona Resources narrative.

Another View: Market Ratios Tell a Different Story

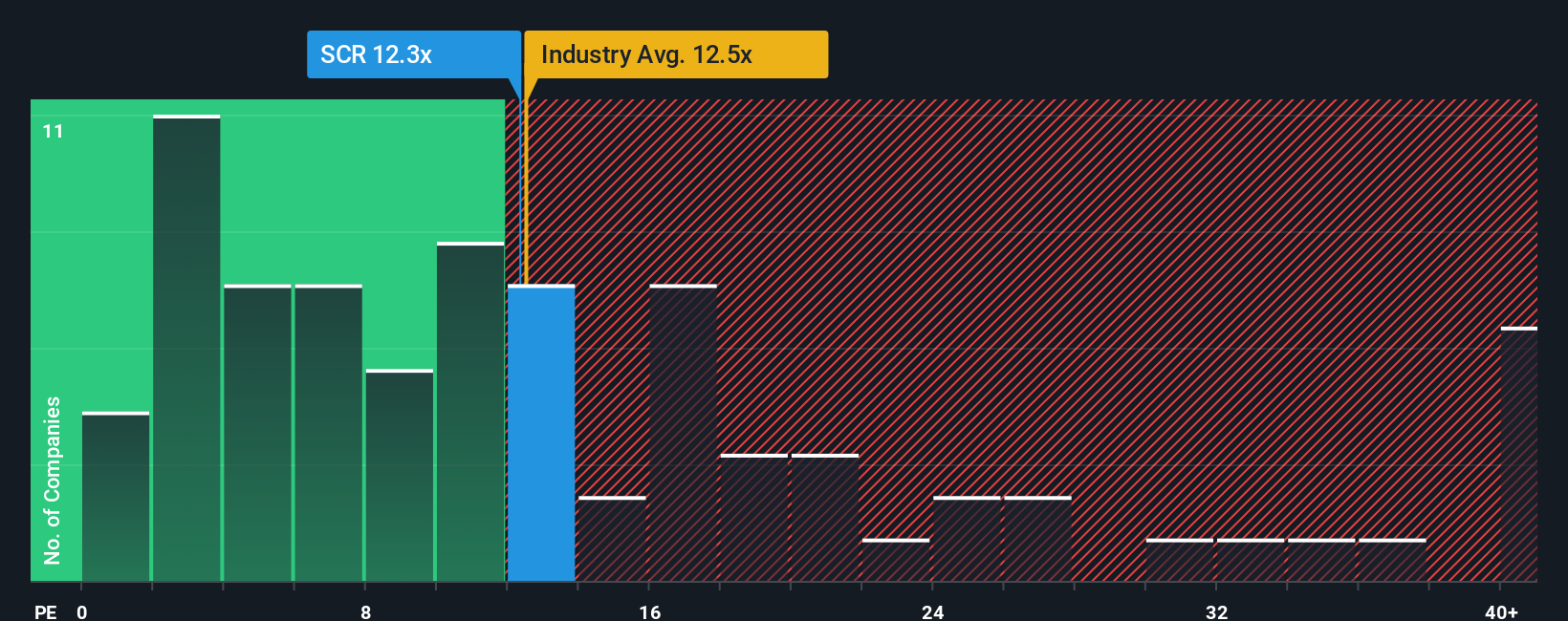

Looking through the lens of earnings-based ratios, Strathcona’s current price-to-earnings number sits at 12.4x. This matches the Canadian industry average and is noticeably lower than the market’s 16x. However, the fair ratio is just 9.8x, signaling room for the market to reprice should sentiment shift. Does this present an opportunity or a warning for investors willing to look past short-term momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Strathcona Resources Narrative

If you see the story differently, or want to dig into the numbers yourself, you can craft your own view in just minutes with Do it your way.

A great starting point for your Strathcona Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to a single opportunity. Make sure you don’t miss the next breakout by checking out these game-changing stock picks below.

- Tap into future medical innovation by reviewing these 33 healthcare AI stocks, which are pushing boundaries in health and AI integration.

- Ride the next wave of undervalued opportunities by uncovering strong companies within these 836 undervalued stocks based on cash flows, based on robust cash flow potential.

- Stay ahead in the race for smarter machines by sizing up these 27 AI penny stocks, which are poised to set trends in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SCR

Strathcona Resources

Acquires, explores, develops, and produces petroleum and natural gas reserves in Canada.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives