- Canada

- /

- Oil and Gas

- /

- TSX:PXT

With EPS Growth And More, Parex Resources (TSE:PXT) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Parex Resources (TSE:PXT), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Parex Resources with the means to add long-term value to shareholders.

See our latest analysis for Parex Resources

How Quickly Is Parex Resources Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Parex Resources has managed to grow EPS by 29% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Parex Resources is growing revenues, and EBIT margins improved by 10.8 percentage points to 61%, over the last year. That's great to see, on both counts.

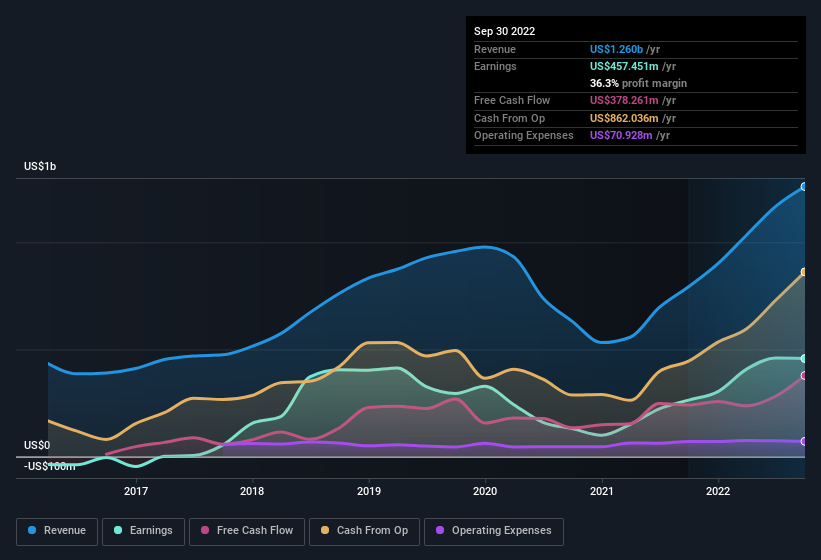

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Parex Resources' future EPS 100% free.

Are Parex Resources Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite US$444k worth of sales, Parex Resources insiders have overwhelmingly been buying the stock, spending US$940k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Chairman of the Board, Wayne Foo, who made the biggest single acquisition, paying CA$158k for shares at about CA$21.07 each.

Along with the insider buying, another encouraging sign for Parex Resources is that insiders, as a group, have a considerable shareholding. To be specific, they have US$50m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 2.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Parex Resources Deserve A Spot On Your Watchlist?

You can't deny that Parex Resources has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Even so, be aware that Parex Resources is showing 1 warning sign in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Parex Resources isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives