Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Perpetual Energy Inc. (TSE:PMT) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Perpetual Energy

What Is Perpetual Energy's Debt?

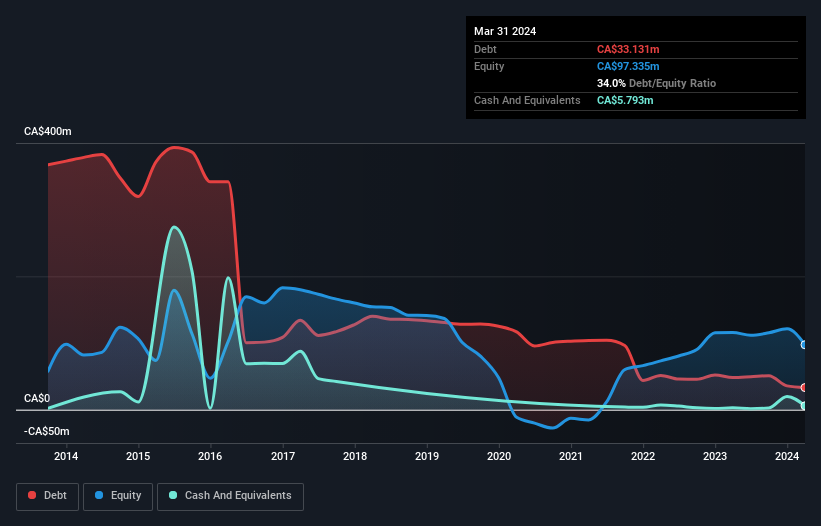

As you can see below, Perpetual Energy had CA$33.1m of debt at March 2024, down from CA$48.3m a year prior. However, it does have CA$5.79m in cash offsetting this, leading to net debt of about CA$27.3m.

How Healthy Is Perpetual Energy's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Perpetual Energy had liabilities of CA$37.1m due within 12 months and liabilities of CA$57.6m due beyond that. Offsetting this, it had CA$5.79m in cash and CA$10.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$78.2m.

The deficiency here weighs heavily on the CA$29.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Perpetual Energy would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 0.79 times EBITDA, it is initially surprising to see that Perpetual Energy's EBIT has low interest coverage of 2.4 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Shareholders should be aware that Perpetual Energy's EBIT was down 63% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Perpetual Energy's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, Perpetual Energy actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Perpetual Energy's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. After considering the datapoints discussed, we think Perpetual Energy has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Perpetual Energy you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMT

Perpetual Energy

Engages in the exploration, production, and marketing of oil and natural gas in Canada.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success